EBC Markets Briefing | Yen regains safe-haven appeal

The yen rose to a seven-week high on Wednesday as the delays to tariffs on Canada and Mexico eased worries the Fed might be severely restricted in how far it could cut interest rates.

The yen withstood the dollar’s onslaught on Monday after Trump imposed new tariffs, suggesting that investors still see value in the Japanese currency as a haven in times of turmoil.

The yen’s course so far in 2025 stands in contrast to its weakening over the past four years. The so-called carry climbed has reached that of the Swiss franc for the first time in more than two years.

Some strategists say it is unclear whether the yen’s haven appeal will continue given a large trade surplus with the US. PM Shigeru Ishiba is set to meet with Trump later this week, local media reported.

BOJ policymakers discussed the likelihood of further rate hikes with some warning of upside inflation risks and the harm of a weak yen. The latest au Jibun Bank Japan PMI bears out the view.

Japan's factory activity fell at the fastest pace in 10 months on sluggish demand, with business confidence hitting a more than two-year low in a sign that the manufacturing sector is under heavy pressure.

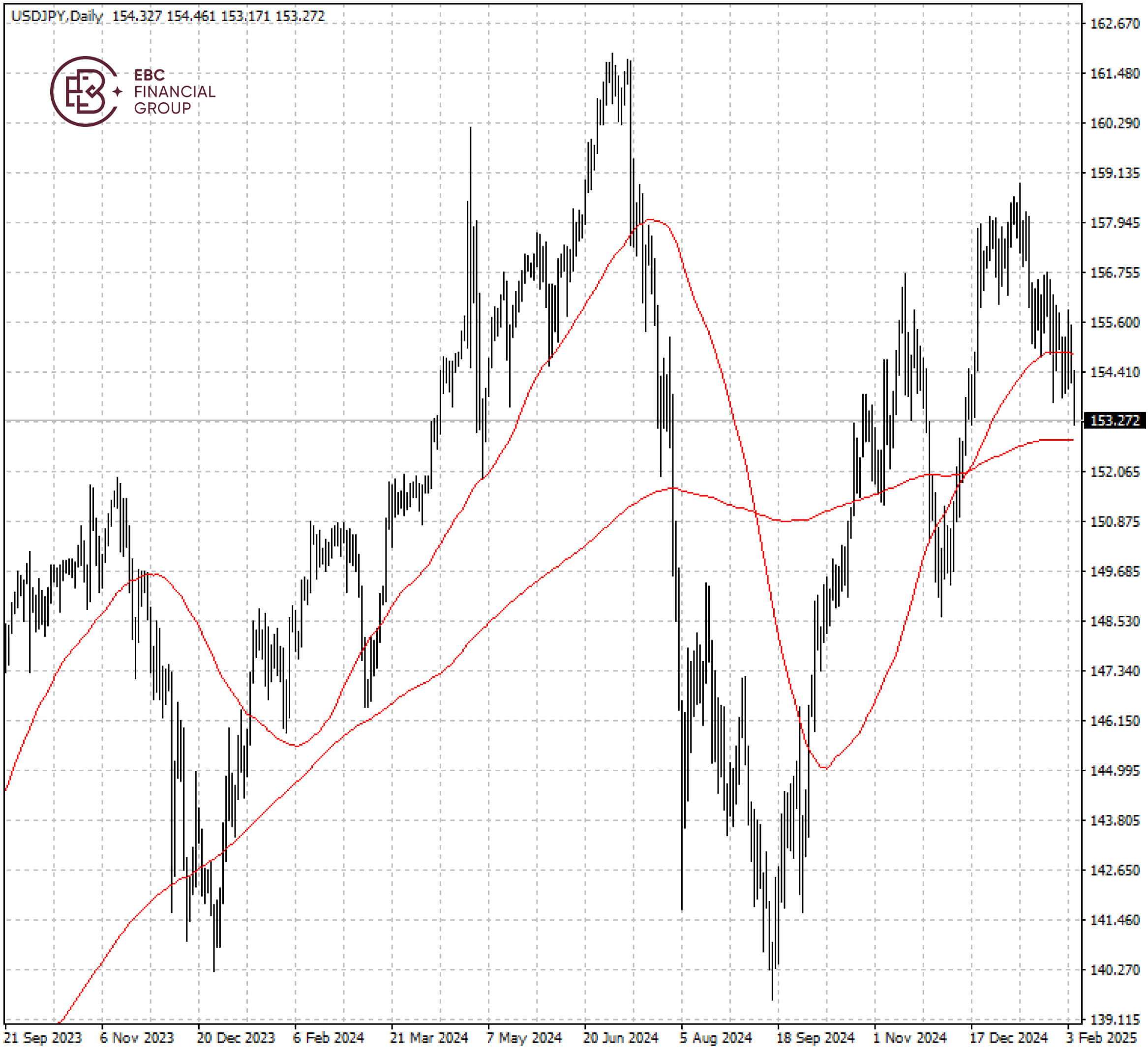

The yen has broken above 50 SMA and the path of least resistance is challenging 200 SMA. However, a push above 150 per dollar is uncertain.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.