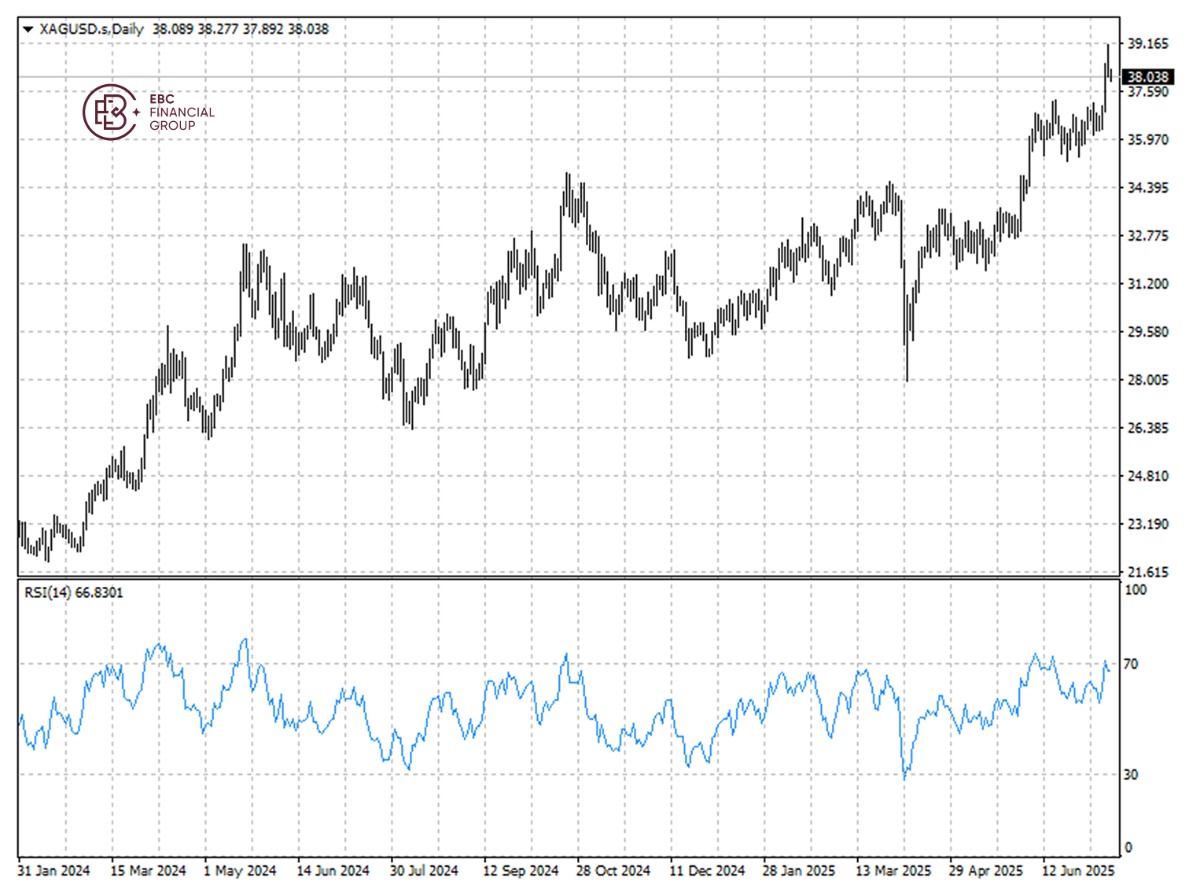

EBC Markets Briefing | Silver stabilises at over 10-year high

Silver was little changed on Tuesday after Trump escalated trade tensions on Mexico, the world's top producer of the white metal. It has gained around 32% so far.

silver climbed above $39 an ounce amid tightening physical supply last week. The implied annualized cost of borrowing the metal for one month has jumped to more than 6%.

Since February, the volume of silver-backed ETFs has expanded by some 2,570 tons, according data compiled by Bloomberg. The optimism was fueled by a weaker dollar and improving risk sentiment.

Silver's outperformance relative to gold means that the ratio between the two has dropped in recent months. Still the former remains relatively cheap historically, pointing to further gains.

The market is headed for a fifth year in deficit, according to the Silver Institute. Global silver demand is expected to remain broadly stable, with industrial applications and retail investment driving growth.

There is "a big gap" between the EU and US on tariffs ahead of an August deadline to strike a trade deal, the EU's lead negotiator has warned. The bloc is considering possible retaliatory measures.

Silver pulled back sharply from its 14-year high with RSI outside the overbought territory. The bearish bias remains intact in the short run, suggesting the price could be heading to $37.45 later this week.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.