Ethereum bolstered by hopes, Bitcoin waits for a signal

Market picture

The cryptocurrency market has lost almost 5% over the past seven days. It has not given up important support levels but also has no significant drivers to resume growth. Bitcoin lost 4.7% over the week, in unison with the market. Ethereum lost 3%, while the top altcoins' performance ranged between -7.7% (Solana) and +11.7% (Toncoin).

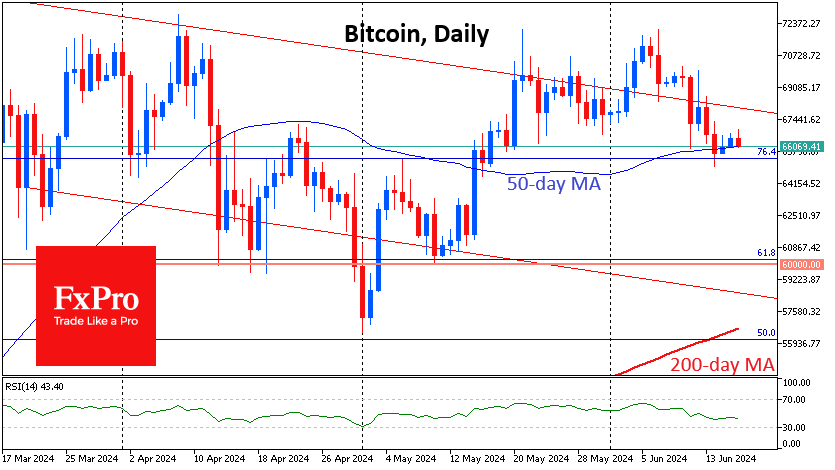

Bitcoin has been trading close to $66K since Friday, hovering around the 50-day moving average, testing the medium-term uptrend. The outcome of this test, as well as the market's direction in the short term, depends on risk appetite in global markets. It has waned due to fears over the French election and a series of weak data from the US and China in recent days.

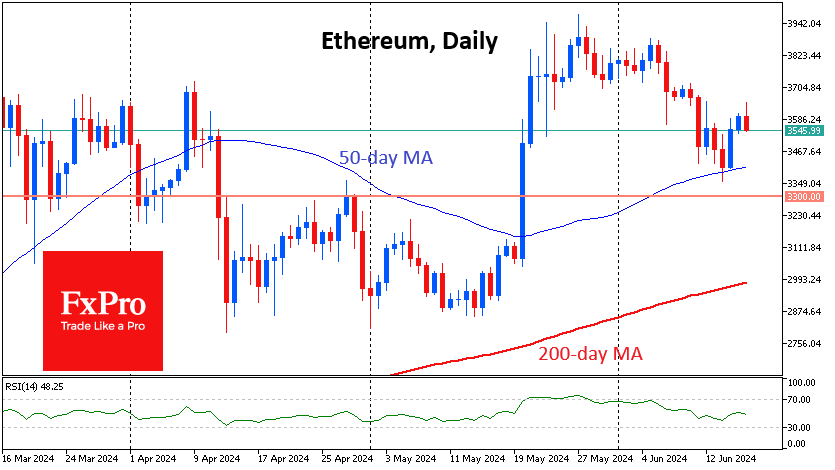

Ethereum, on optimistic expectations about the ETF, was able to add over 6% after briefly dipping under its 50-day MA on Friday. However, a loss of nearly 1.5% since the start of the day on Monday makes one wary of the near-term performance. The increased liquidity on weekdays will likely play into the hands of bears rather than bulls by increasing selling interest.

News background

Bernstein raised the target price of the first cryptocurrency by the end of 2025 from $150K to $200K. The forecast revision is due to expectations of "unprecedented demand from spot bitcoin-ETFs" managed by BlackRock, Fidelity, Franklin Templeton and others. Bernstein's baseline estimate is for BTC to reach $500K by the end of 2029 and $1 million by 2033.

Peter Brandt, Factor CEO, suggested that a massive sell-off of Bitcoins by mining companies could lead to a short-term drop in BTC to $60K and even $48K.

SEC head Gary Gensler said approval of Form S-1 for the Ethereum-ETF is possible "sometime by the end of this summer." According to him, "individual issuers are still going through the registration process. Everything is going smoothly."

According to CryptoQuant, Ethereum traders bought up 298,000 ETH (worth around $1.34B) after the Fed meeting, the second-highest daily number of coins in history.

Ripple Labs filed a letter demanding that the SEC reduce the fine it is requesting from $2B to $10M, using an agreement between the regulator and Terraform Labs as its argument.

El Salvador President Nayib Bukele proposed creating a private equity bank to "diversify the financing options offered to potential investors in dollars and bitcoin."

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)