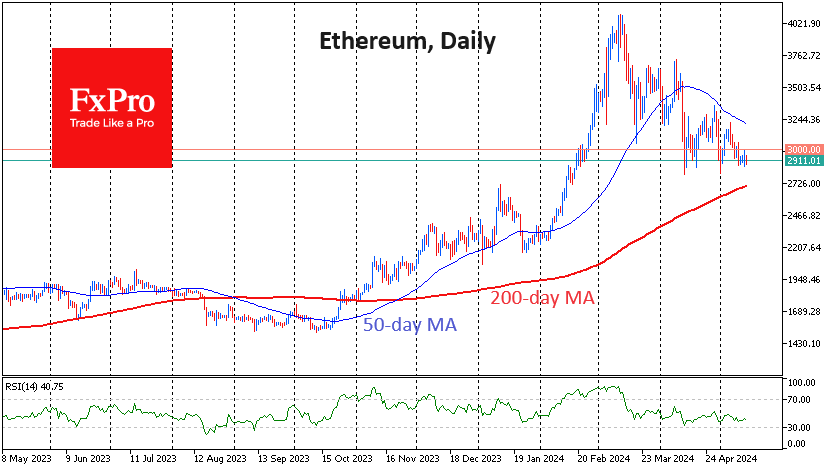

Ethereum knocking at support’s door

Crypto market capitalisation rose 0.8% over the past 24 hours to 2.2 trillion, but growth exceeded 2% for most of the period. However, it dipped at the start of active European trading, temporarily returning to levels of a day ago.

Bitcoin has added 0.9% over the past 24 hours, while Ethereum has increased by 0.15%. The top coins show dynamics from falling by 1% (BNB) and 0.8% (TON) to growth by 7.3% (DOGE) and 4.2% (SOL).

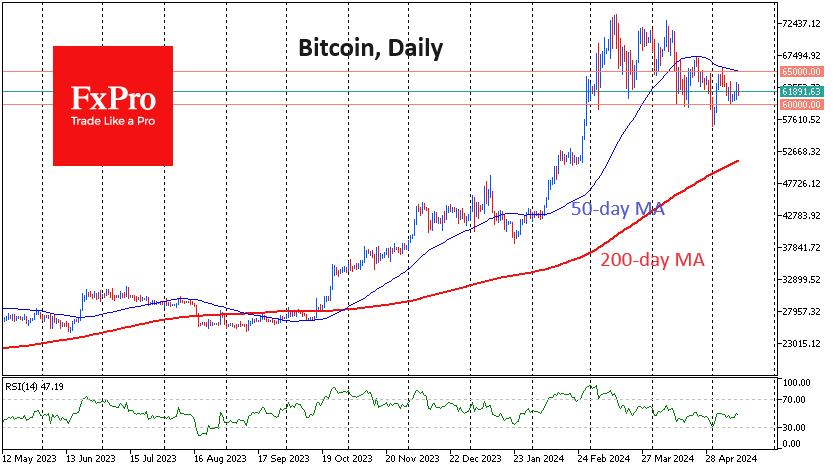

Bitcoin reversed on Monday on its approach to the $63.0K level, just below the pivot area on Friday, continuing a series of lower local highs. This time, it was at a significant distance from the 50-day moving average.

However, the pattern is even more negative in Ethereum, where the price has pulled back to the lower end of the range of the last three months, near $2900, drawing a bearish triangle. Technically, breaking this support opens the way to $1600-1500. This sounds like an overly negative scenario, and in our opinion, it is worth being prepared that Ethereum could attract enough buyers already on a dip into the $2500-2700 area.

News background

According to CoinShares, investments in crypto funds rose by $130 million last week after four weeks of outflows. Bitcoin investments increased by $144 million, Solana investments increased by $6 million, and Ethereum investments decreased by $14 million.

Trading volumes fell to $8bn last week, down from an average of $17bn in April. Low engagement by US regulators with issuers' applications for spot Ethereum-ETFs has increased speculation that ETF approval is not imminent, reflected in outflows from Ethereum, CoinShares noted.

The end of the consolidation is not far off. Traders have shown little interest in Bitcoin's latest pullback. In general, the lack of such faith from the crowd acts as a strong sign that prices are close to the bottom, suggests Santiment.

Bitcoin's bull cycle is just beginning, and BTC will be worth at least $117,000 in August 2025, Pantera Capital expects.

"Dormant" for more than ten years, 1,000 bitcoins have now started to move, Lookonchain pointed out. According to Chainalysis, 1.75 million Bitcoin wallets have been inactive for more than ten years. They hold 1.8 million BTC, which is 8.5 per cent of the total issuance.

The US government is going after Tether as potential regulatory action could have significant implications for the industry, Ripple CEO Brad Garlinghouse said. In response, Tether's CEO accused the head of Ripple of spreading damaging rumours.

Uniswap called the "all-out war" on cryptocurrencies waged by the SEC and Senator Elizabeth Warren a miscalculation by the Biden administration that could cause him to lose the upcoming US presidential election.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)