Ethereum Touches Support Level, Bitcoin Yet to Follow

Market picture

The crypto market has climbed 2% in the last 24 hours to 1.04 trillion. It took a continuation of the Nasdaq rally and a dollar weakening by more than 1% from its intraday high to revive demand here. Demand also came after Tether's USD peg was restored, although the exchange rate was still 0.1% lower than 7 and 30 days ago. The cryptocurrency's fear and greed index rose from 41 to 47, back into neutral territory.

As expected, bitcoin found support on the dip below $25,000, leaning on external positivity and short-term oversold conditions. However, the move is still in a downtrend and will remain so until the price breaks above previous local highs - now at $27.3K. Targets for the current downtrend stay in the $23.6K area.

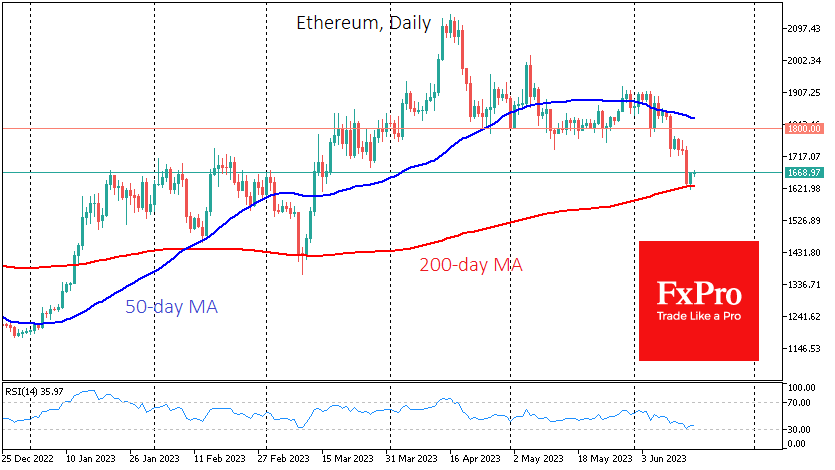

Ethereum has exhausted most of its corrective potential, as it has breached the 200-day moving average at $1630 and briefly touched oversold territory on the daily RSI.

Tether's USDT stablecoin has moved away from parity with the US dollar. The coin's weighted average exchange rate fell to 0.9958, according to CoinMarketCap. "The markets are nervous these days, so it's easy for attackers to take advantage of the general sentiment. We at Tether are as ready as ever," said Tether CTO Paolo Ardoino.

News background

Investment giant BlackRock is preparing to file for a Bitcoin ETF. The US Securities and Exchange Commission (SEC) has previously rejected almost all applications to register cryptocurrency ETFs.

Apple has rejected a new version of its non-custodial Zeus wallet app for the Lightning Network on the App Store.

Cryptocurrency broker Floating Point Group (FPG), which has $50 billion in assets under management, reported a hack and halted trading, deposits and withdrawals. Damage is tentatively estimated at $15-20 million.

The total number of subscribers to Reddit's leading cryptocurrency communities, r/Bitcoin and r/Ethereum, reached a new record high of 7 million users. More than 364 thousand people subscribed to the BTC section between 4 and 11 June. The SEC's litigation with two major cryptocurrency exchanges has likely piqued the community's interest.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)