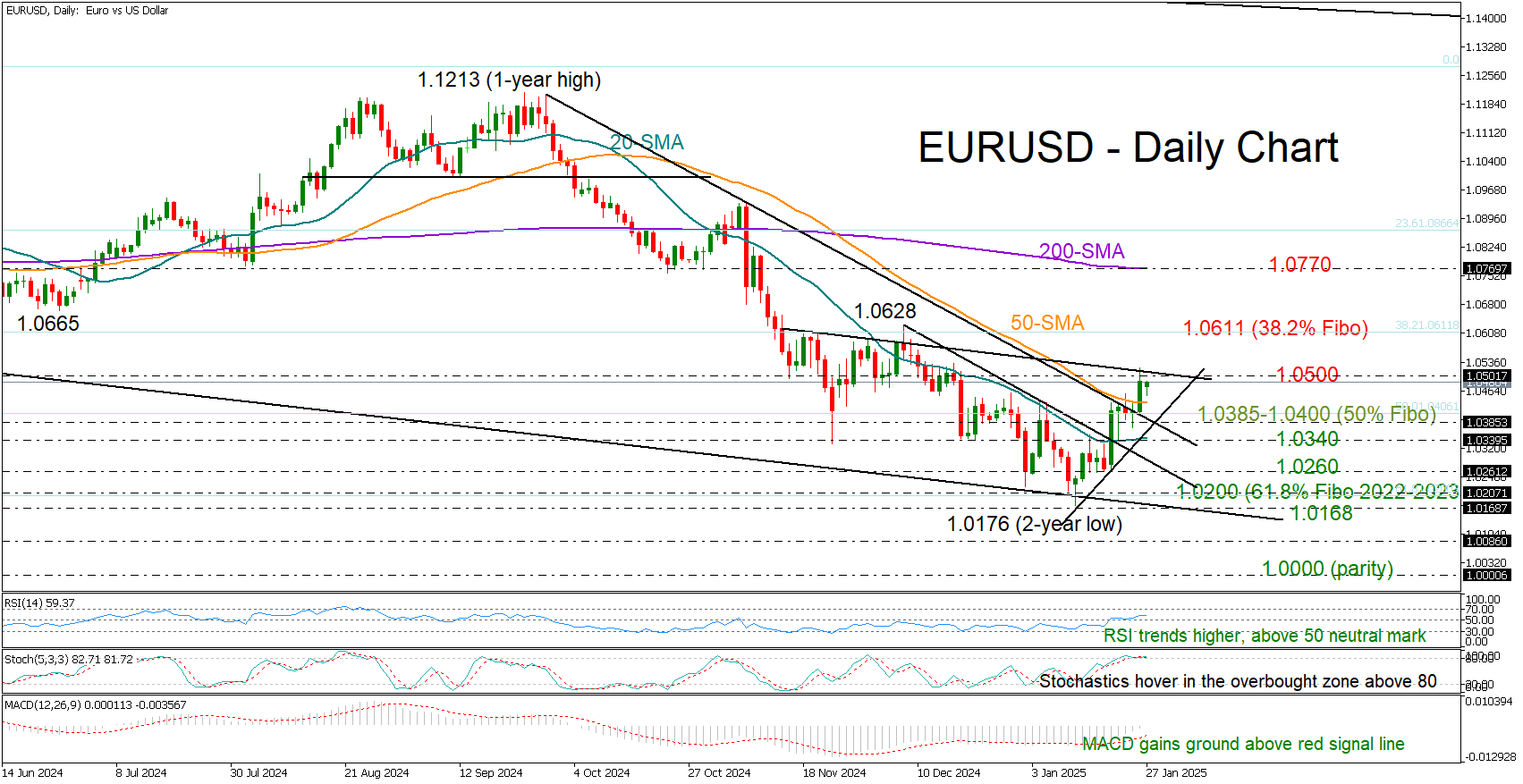

EUR/USD: Awaiting the green light above 50-SMA

EUR/USD opened the week with a slight gap lower at 1.0473 after running as high as 1.0520 on Friday. The pullback, however, could be temporary.

While a sustainable move above the 1.0500 level might be necessary for a continuation higher, Friday’s close above the 50-day simple moving average (SMA)– the first since October – is feeding hopes that the bulls could roar back. If the pair decisively holds above this line, there is potential for an extension towards the 38.2% Fibonacci retracement of the 2022-2023 uptrend at 1.0611. Then, the focus could turn to the 200-day simple moving average (SMA) currently seen near 1.0770.

The positive trajectory in the RSI and the MACD adds weight to the bullish scenario, though with the stochastic oscillator hovering within overbought zone, downside pressures cannot be ruled out, especially if the price dives below the support area of 1.0385-1.0400. If the bears breach this floor, the 20-day SMA may immediately come to the rescue near 1.0340. Otherwise, the price could tumble toward the 61.8% Fibonacci of 1.0260, and even slide into the 1.0168-1.0200 area, where the support line from February 2024 is sitting.

In summary, EUR/USD is maintaining a bullish stance in the short-term picture despite today’s minor pullback. A close above 1.0500 could provide the confirmation needed for a march higher. However, traders should keep an eye on downside risks if a dip below 1.0384-1.0400 takes place.

.jpg)