EUR/USD makes slight retreat ahead of crucial week for the European economy

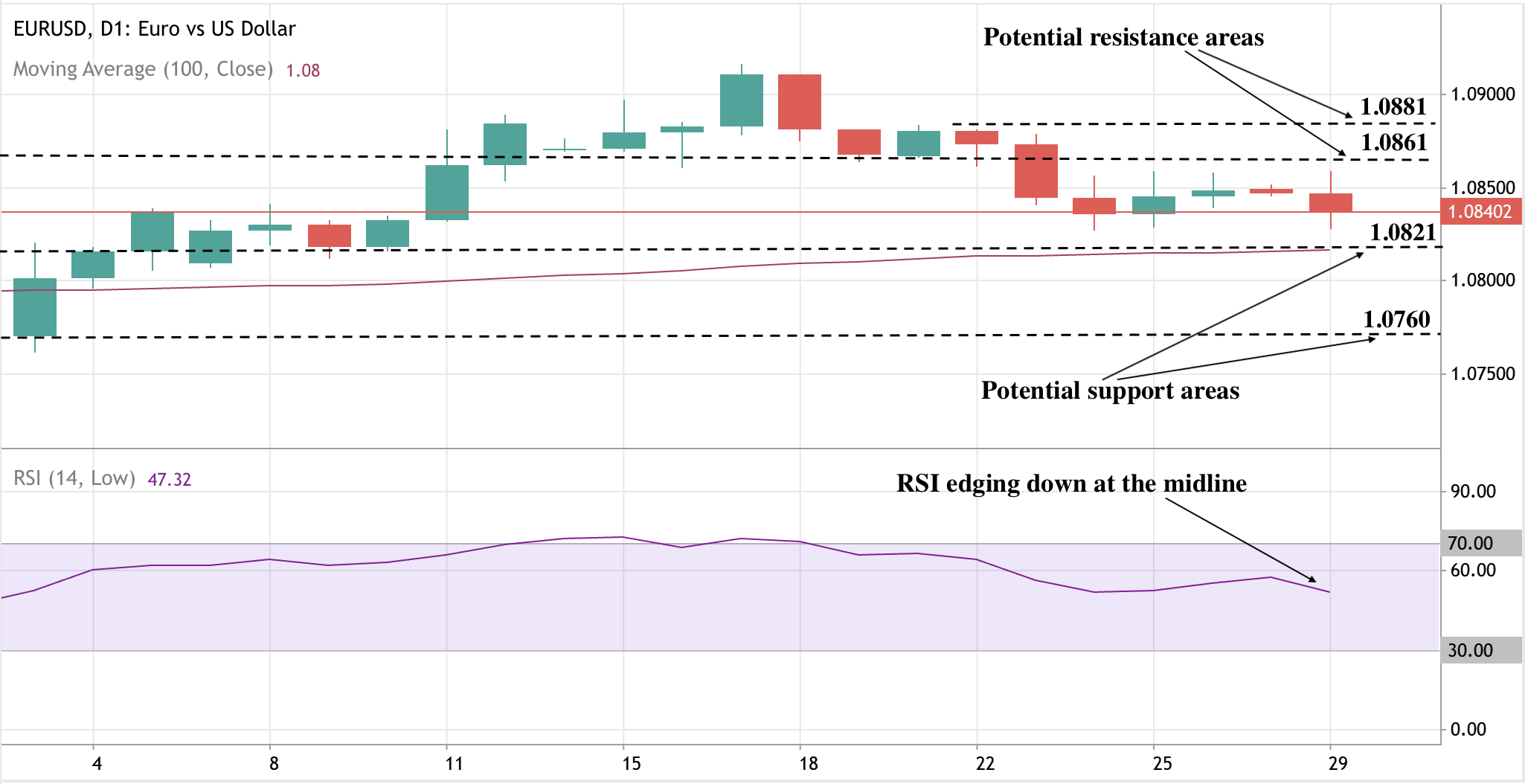

The EUR/USD pair is trading at around 1.0840 at the start of the London session, retreating from highs of 1.0860 in Monday’s early Asian session. The pair’s retreat comes as the European Central Bank (ECB) prepares for a significant week as various economic data points are expected to influence the decision on a potential interest rate cut in September. Financial markets currently predict a near 90% probability of this move, though ECB President Christine Lagarde has noted that the decision is still "wide open," emphasizing the importance of the upcoming data.

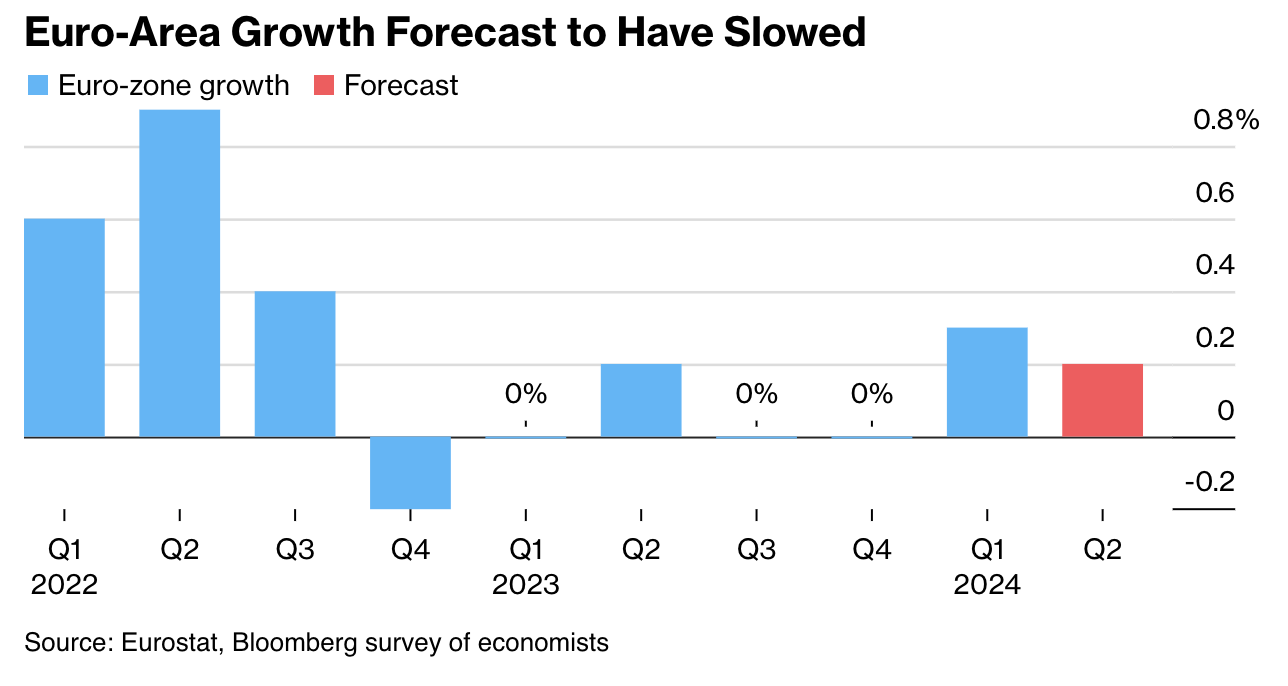

July inflation figures, due on Wednesday, are anticipated to drop to 2.4% from the previous month’s 2.5%. While this rate exceeds the ECB's target, a possible slowdown in core inflation (excluding energy and food) could provide a positive signal. Additionally, second-quarter GDP data, expected on Tuesday, is forecasted to show slower growth than initially projected, indicating a less robust economic recovery.

The ECB's main goal is to return inflation to its target 2% by the final quarter of 2025. If the data indicates lessening price pressures, especially in the service sector, the ECB may consider a rate cut as a measure to support the economy and manage inflation. Traders are also anticipating further rate cuts from the ECB, which could impact the Euro. Recent weaker-than-expected economic data from Germany, including the IFO survey results, have reinforced these expectations.

The preliminary GDP figures for the second quarter from Germany and the Eurozone will be closely monitored, as stronger-than-expected results could support the Euro against the US Dollar, potentially offsetting the expected rate cuts. Recent data has shown mixed signals about the euro-zone economy. Business surveys by S&P Global indicate that private-sector output likely stagnated in July, while the IFO survey pointed to declining sentiment among German companies. This combination of slow recovery and persistent price pressures presents a challenge for ECB officials.

The ECB's decision in September will depend on multiple factors. While market sentiment favours a rate cut, the detailed analysis of incoming data—including core inflation trends, economic growth figures, and wage growth patterns—will be essential. These elements, along with the potential impact of further ECB rate cuts on the Euro, will inform the ECB's decision, making this week important for the European economy.

EUR/USD’S technical outlookThe daily chart indicates some downward bias at the moment with the pair edging lower towards 1.0810. Sellers could encounter support around the 1.0821 level, with a further crash likely to be held at the 1.0760 mark. If the pair resumes its recent up move, on the other hand, buyers could face a barrier around the 1.0861 mark, with further buying likely to face resistance at the 1.0881 mark.

Indicators paint an overall bullish picture as the pair holds above the 100-day Exponential moving average. The RSI softly edging down at around the midline however, suggests that upside momentum may be waning.

Source: Deriv MT5

Disclaimer:

The information contained within this article is for educational purposes only and is not intended as financial or investment advice.

The performance figures quoted refer to the past, and past performance is not a guarantee of future performance or a reliable guide to future performance.

We recommend you do your own research before making any trading decisions.

No representation or warranty is given as to the accuracy or completeness of this information.

-28720251331.png)