Fed minutes awaited as risk rally eases, dollar extends recovery

Dollar and yen advance amid fragile risk appetite

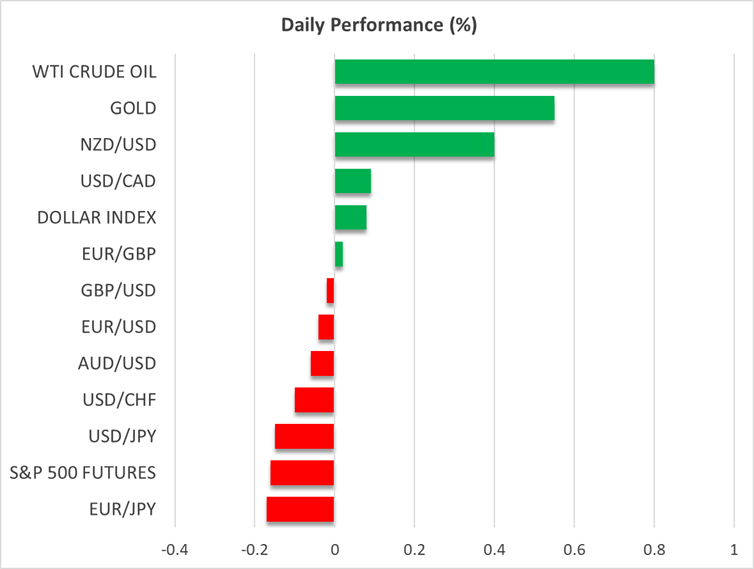

The US dollar is attempting to extend its recovery from Monday’s one-month low to a second day following the latest easing in trade tensions, while the Japanese yen is trading broadly firmer on Wednesday as long-dated Japanese yields creep higher again. The conflicting signals on the global economic outlook are keeping investors anxious, reining in risk appetite, with equity markets going in different directions today.

Last week’s passage of the House budget bill revived worries about the unsustainable rise in US debt, with the jitters spilling over to sovereign bond markets globally. Japanese bonds, in particular, have come under selling pressure as the Bank of Japan is scaling back its bond purchases at a time when there is heightened uncertainty about the world economy.

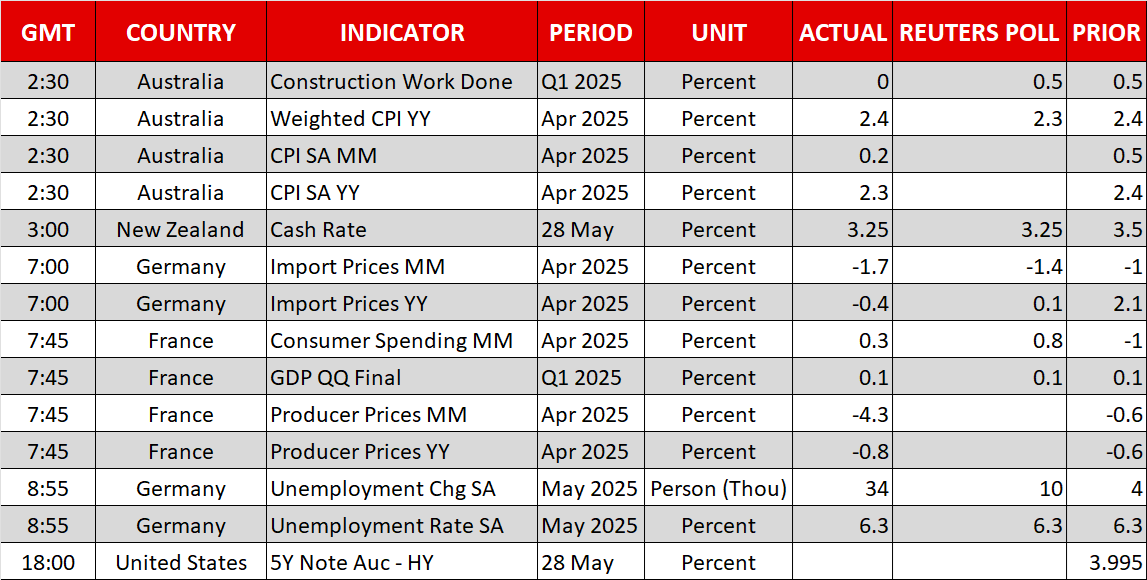

Japan’s 30-year yield rose to the highest since 1999 last week before pulling back on signs that the Japanese government is considering reducing the issuance of super-long bonds. However, long-term yields are edging up today, after an auction for 40-year bonds attracted the least demand since July 2024.

Concerns about excessive government borrowing are unlikely to go away unless the US Senate decides to cut spending or limit the scope of President Trump’s tax giveaways as it debates whether to accept the budget bill in its current form.

The dollar’s rebound is at risk of faltering if the Senate doesn’t act, but the yen is more likely to continue benefiting from higher yields if there’s a fresh rout in bond markets.

Kiwi jumps after hawkish RBNZ rate cut, aussie up too

Elsewhere in currency markets, the Australian dollar bounced back from an earlier dip after monthly CPI data out of Australia came in somewhat stronger than expected, suggesting that the RBA will have to tread carefully when considering further rate cuts.

But the best performer is the New Zealand dollar, which staged a modest rally after the Reserve Bank of New Zealand lowered rates by 25 bps but hinted at just one additional rate cut before pausing. Although the RBNZ is keeping the door wide open to further easing if the tariff war escalates, investors were surprised by the not-so-dovish tone of the meeting, pushing the kiwi higher.

Fed minutes on the agenda

In contrast, Fed officials have not budged from their wait-and-see stance and today’s FOMC minutes for the May meeting are unlikely to reveal much. If anything, a strong consensus among Fed officials to wait for some of the fog to clear before deciding on the next move could lead investors to slightly trim their rate-cut expectations, which may aid the dollar’s recovery.

However, the main focus is on Friday’s PCE inflation numbers, as any downside surprises would add pressure on the Fed to resume its rate cuts.

US economic indicators are so far showing little sign of damage from Trump’s trade war, supporting the Fed’s case for patience.

Wall Street futures slip after sharp gains, Nvidia eyed

Even consumer confidence is rebounding and this contributed to Wall Street’s strong rally yesterday, when both the S&P 500 and Nasdaq 100 notched up gains of more than 2%. Futures are lower today, while global equities are mixed, reflecting some caution.

Earnings by AI giant, Nvidia, will come into the spotlight soon after the closing bell on Wall Street later today. Any disappointment in earnings growth or warnings about the outlook could trigger a selloff in tech stocks.

Oil lifted by Venezuelan export curb, gold pares losses

The weakening in risk appetite was also evident in gold prices, as the precious metal recouped some of yesterday’s losses to climb back above $3,320.

Oil futures are also positive, boosted by the US government’s decision to ban Chevron from exporting Venezuelan oil. However, the boost may not last long as OPEC and non-OPEC countries may decide to increase output again. OPEC+ holds a full ministerial meeting today but an announcement on output may not come before Saturday when the monthly decision is due.

.jpg)