Fed’s hawkish hold and Middle East flare up boost the dollar

Fed delivers hawkish hold

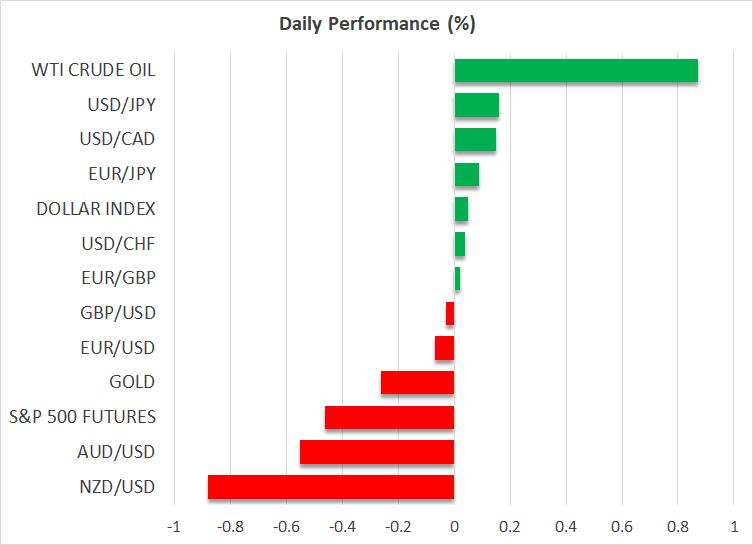

The US dollar finished the day mixed against its major counterparts yesterday. It traded virtually unchanged against the euro and the yen, while it was slightly higher versus the pound, the franc and the loonie. The greenback lost ground against the aussie and the kiwi. Nonetheless, it is gaining ground against all today.

The dollar was being sold ahead of the FOMC decision, but it was quick to rebound as soon as the market interpreted the outcome as a hawkish hold. Policymakers decided to keep interest rates unchanged as was widely anticipated and the new dot plot still pointed to two quarter-point reductions for this year.

However, this time around, there were more members voting for no reductions compared to March. Specifically, 7 members wanted interest rates to remain on hold until December, which is just one fewer member than those who kept the median projection for two more cuts. Back in March, only 4 policymakers voted for no rate cuts in 2025.

As for the economic projections, even though economic growth for this year and the next was revised lower, inflation was revised higher, with the headline PCE rate expected to be at 3.0% by the end of the year. At the press conference following the decision, Chair Powell highlighted the Committee’s concerns about inflation, noting that it could pick up during the summer as Trump’s tariffs start to impact consumers.

According to Fed funds futures, investors are penciling in 48bps worth of rate reductions by December, but the probability for the next cut being delivered in September was reduced from 75% to 70%.

Anxiety mounts, oil rallies, as Israel-Iran conflict escalates

What helped the dollar maintain its overnight gains and extend them today, was the escalation in the Israel-Iran conflict, with both nations exchanging new attacks and concerns about a potential US involvement growing.

Bloomberg reported that US officials were preparing and planning a potential strike against Iran in the coming days as Iranian Supreme Leader rejected Trump’s demand for unconditional surrender. However, although Trump said that his patience had run out, he did not explicitly indicate the US’s next move.

The dollar’s gains corroborate the notion that it has reclaimed its safe-haven status amid fears of heightened warfare, outshining other traditional safe harbors, like the franc, the yen, and even gold, which has been in a corrective phase since the beginning of the week.

Oil prices are on the rise again as the chaos in the Middle East is adding to worries about supply disruptions. The spillover effect if the oil rally persists may be higher inflation, which could force central banks to redirect their monetary policy strategies.

SNB takes interest rates to zero, BoE awaited

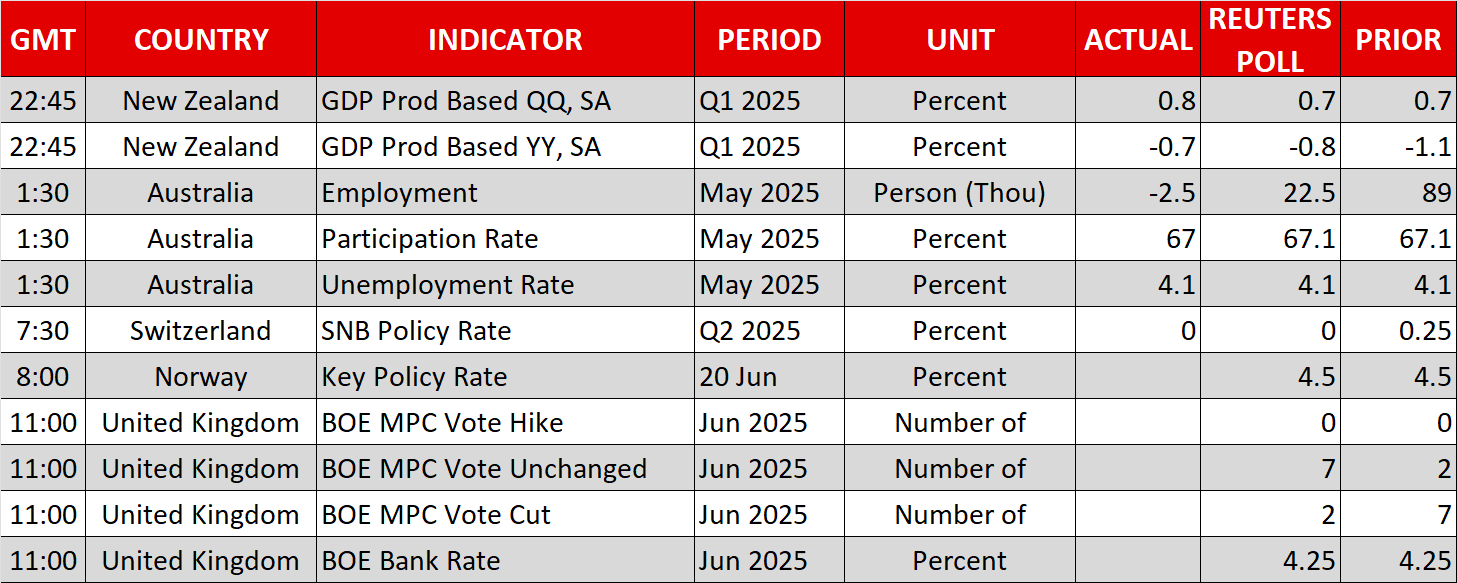

Speaking about monetary policy, the Swiss National Bank (SNB) decided to cut interest rates by 25bps to 0%, disappointing those expecting a bigger reduction into negative territory. The Swiss franc gained somewhat at the time of the announcement, although the Bank reiterated its readiness to intervene in the FX market if needed. Officials lowered their inflation projections for the whole forecast horizon, which combined with their willingess to adjust monetary policy further should be deemed necessary, keeps the door to negative interest rates wide open.

Later today, the central bank torch will be passed to the Bank of England. This Bank is widely anticipated to stand pat. However, the weak labor market report, the contraction in the monthly GDP for April, and slowdown in inflation in May, have prompted investors to pencil in around 50bps worth of rate cuts this year. As mentioned above, coincidentally this is the same amount of rates' reduction which is expected from the Fed in the US. A slightly more dovish message than the one delivered at the previous decision could corroborate investors’ view of more cuts to come and perhaps weigh on the pound.

.jpg)