German manufacturing: growth is on the way

German manufacturing: growth is on the way

German data is increasingly exceeding expectations, fuelling hopes for an improvement in the Eurozone economy.

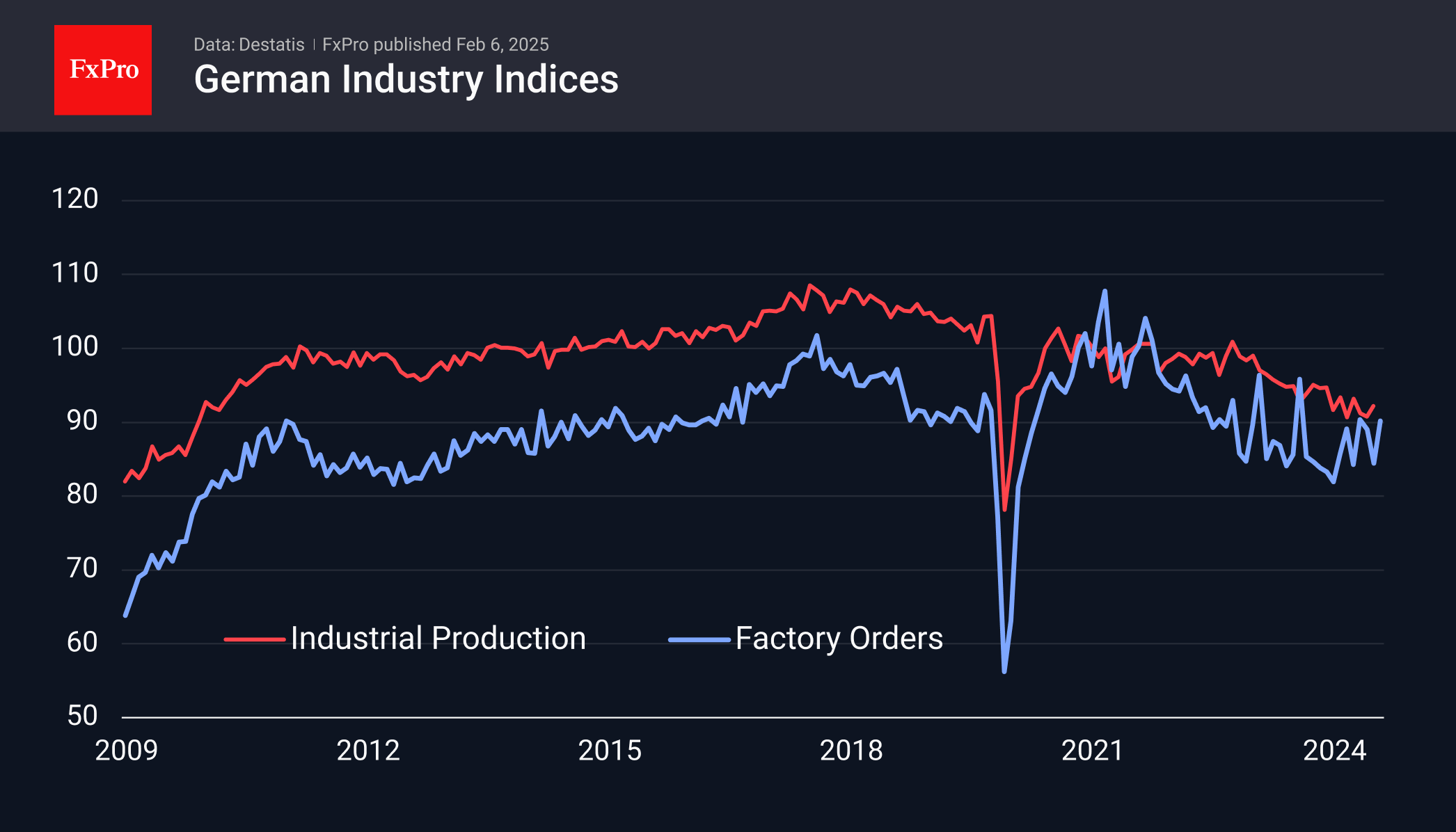

The industrial orders index increased by 6.9% in December, offsetting November's 5.2% decline. The year-on-year decline is 6.3% y/y. The low point of the current business cycle was reached in May last year, and since then, the orders index has risen by more than 10%, although it remains volatile.

Similarly, the industrial production index shows signs of reversal. It showed significant fluctuations at the end of last year but is now showing signs of stabilising.

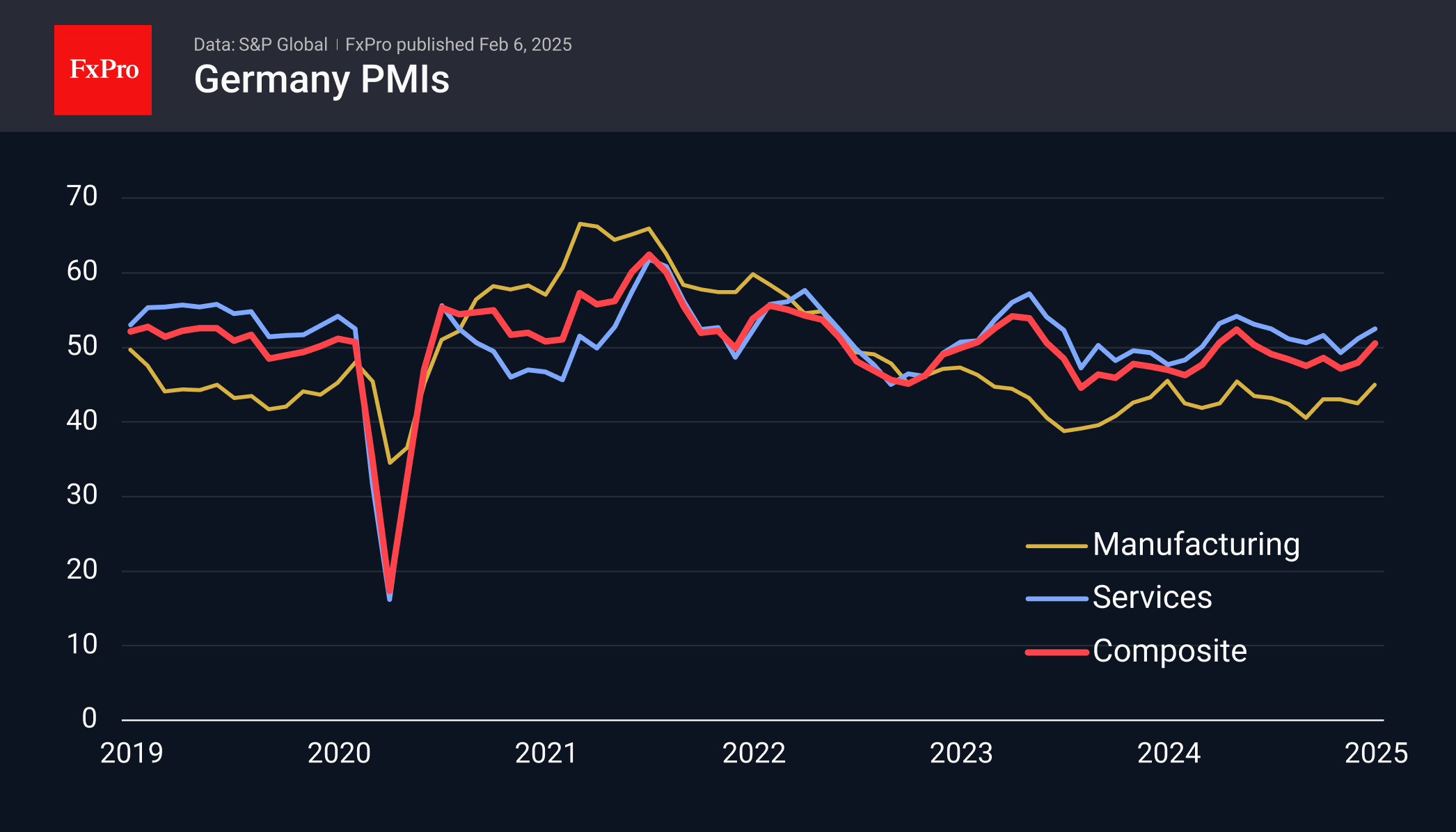

Earlier in the week, the PMI index also showed positive revisions. The manufacturing index has remained below 50 for the past 31 months, but the composite index, thanks to the services sector, has entered growth after six months below the waterline.

The German economy is undergoing a transformation accompanied by an increase in the unemployment rate. Nevertheless, there are signs of improvement as companies are becoming more optimistic and the economy is showing signs of recovery. This could prove to be an important supportive factor for the euro in the coming weeks.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)