Gold and dollar edge up as markets bet on Trump win

Trump trade makes a return

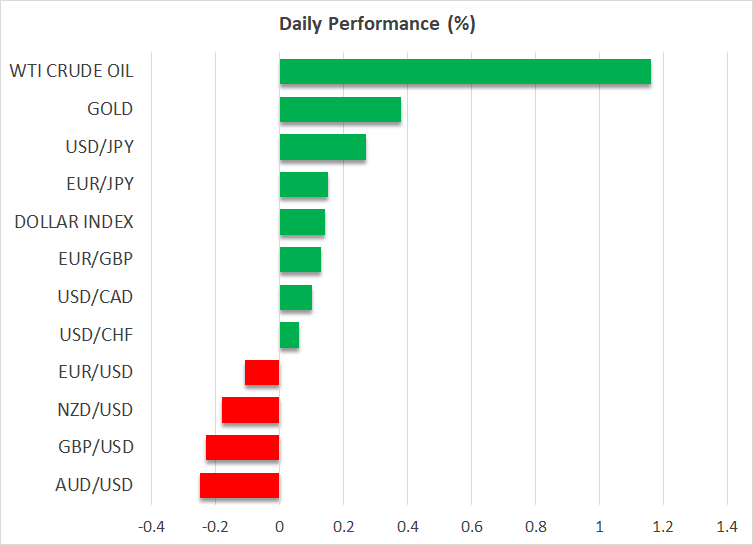

Gold extended its record streak at the start of the new trading week as investors increasingly bet on Donald Trump winning the US presidential election on November 5. The precious metal climbed to all-time highs above $2,730/oz amid the growing risk of Trump returning to the White House. The former president appears to be pulling ahead of Vice President Kamala Harris in most battleground states, while closing the gap in national polls.

Geopolitical risks are also contributing to gold’s bullish run as there seems to be no prospect of a ceasefire in the Middle East, with Israel only intensifying its assault on Hezbollah and Hamas. However, following Iran’s latest missile attack on Israel and an attempted drone strike on Israeli Prime Minister Netanyahu’s house on Saturday, markets are bracing themselves for a retaliation by Tel Aviv.

Dollar powers ahead

The US dollar has also been marching higher lately, with the increased election and geopolitical risks adding to the greenback’s appeal just as the Fed pushes back on aggressive rate cut expectations. Against a basket of currencies, the dollar rose to 10-week highs last Thursday before pulling back, but it is edging back up again on Monday.

The greenback’s persistent strength in the past few sessions is a little puzzling considering that the rebound in Treasury yields ran out of steam a week ago. But with opinion polls and betting markets moving in favour of Trump, there’s been a revival of the ‘Trump trade’ in recent days.

That includes a stronger dollar as Trump’s policies of higher tariffs, lower taxes and reduced migration are seen as being inflationary, which would translate to fewer rate cuts by the Fed and possibly even rate hikes.

Euro, pound and loonie slip ahead of key events

Bitcoin has also been benefiting from the Trump trade, hitting a three-month high of just under $69,500 earlier today before easing. The euro and pound were back in the red after a mild rebound at the end of last week. Both the ECB and Bank of England are seen as cutting rates faster than the Fed over the next 12 months amid diminishing inflationary pressures, and so it will be difficult for the two currencies to get back on the front foot against the dollar.

But there may be a chance of a near-term bounce if Thursday’s flash PMIs are positive.

The Canadian dollar, meanwhile, has weakened past the 1.3800 level versus its US counterpart, reversing last week’s brief recovery as investors are almost certain the Bank of Canada will slash rates by 50 basis points on Wednesday.

Earnings the focal point for stocks

Equity markets were mixed on Monday as traders await direction from US earnings, with Tesla and Amazon.com being the mega caps that will report this week. Before those earnings, however, investors will be watching the latest quarterly results from Texas Instruments tomorrow to gauge the strength of demand in the chip market.

The S&P 500 closed at a fresh record on Friday as the indications of a still solid US economy have bolstered the earnings outlook. Apple also boosted the market as its share price closed at a new all-time high on reports of strong demand for its new iPhones in China.

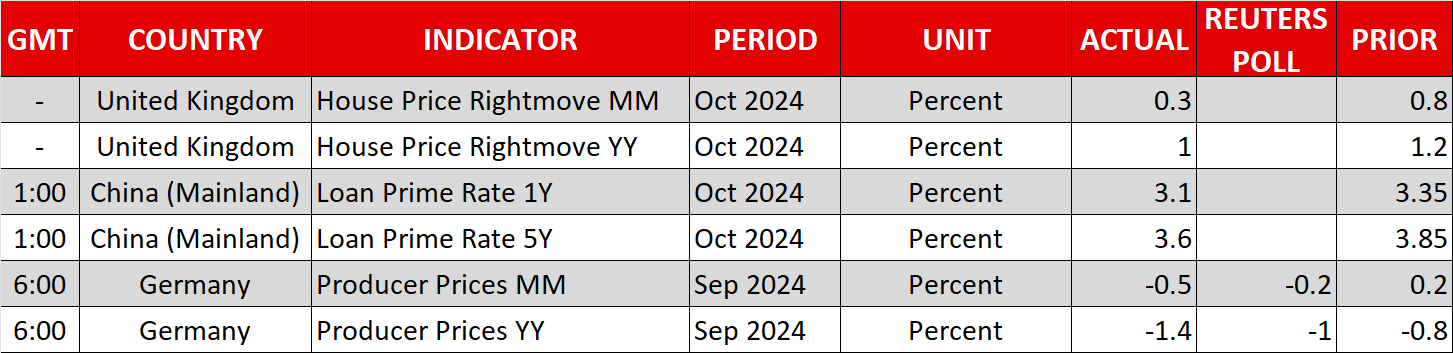

Sticking to China, the PBOC cut rates today, as had been widely expected, adding to the mostly positive sentiment. The focus later today will turn to Fed speakers, which include Kashkari and Daly, while the IMF’s annual meeting in Washington this week will attract some attention too as a number of central bankers are scheduled to speak.

.jpg)