Gold and equities shine after disappointing US data

Dollar retreats on softer data

A wave of euphoria swept through global markets last week after a disappointing US manufacturing survey rekindled hopes that lower interest rates are on the horizon, sending investors rushing to buy real assets.

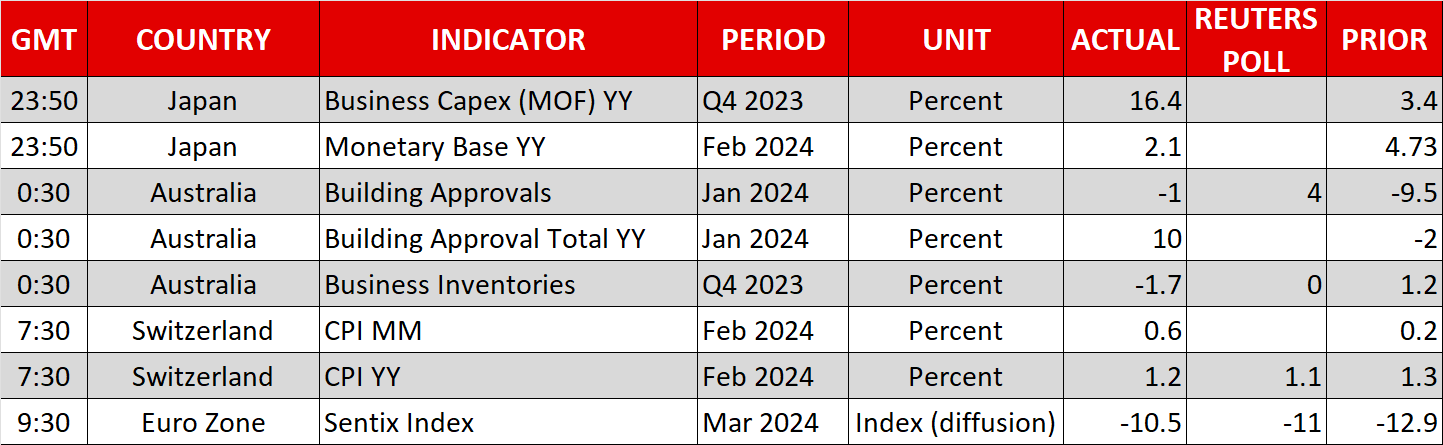

The US manufacturing sector fell deeper into contraction in February according to the latest ISM survey, with new business orders and employment conditions deteriorating significantly. Monthly readings on construction spending were equally disappointing, fueling concerns that the US economic engine might be losing momentum.

Reflecting such concerns, the Atlanta Fed slashed its estimate of GDP growth for this quarter to 2.1% in the aftermath of these releases, down from 3.0% previously. Hence, the US economy is still expanding at a faster pace than most other regions, especially Europe, but its growth advantage seems to be diminishing.

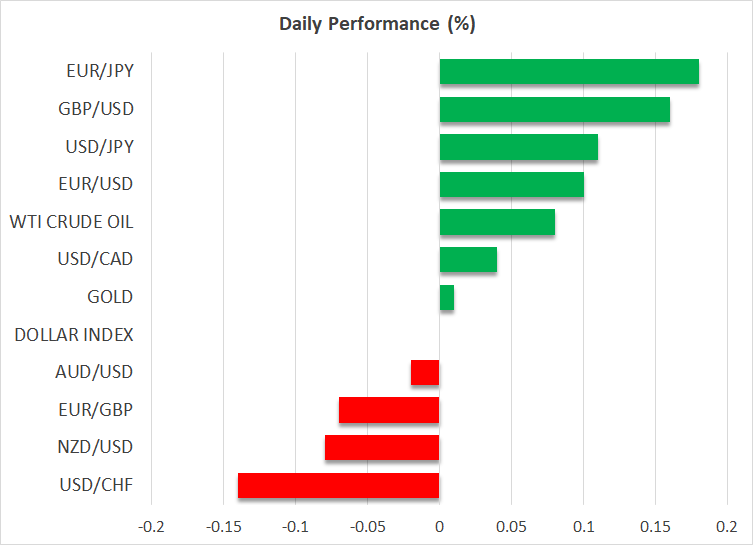

Traders responded by selling the dollar, as the slowing economic data pulse raises the chances that the Fed will deliver deeper rate cuts this year. Of course, there are several events this week that can challenge this narrative, so it’s too early to draw any conclusions. The ISM services index tomorrow, testimonies by the Fed chief before Congress, and a nonfarm payrolls report may have the final say.

Gold and equities shine bright

Gold prices enjoyed a huge boost as the dollar and real yields retreated on Friday, with the precious metal gaining nearly 2% to close at its highest level on record. A surge of this magnitude, however, suggests that there were other forces at play beyond interest rate expectations, such as direct purchases by central banks or covering of short positions.

Either way, bullion now stands less than 3% away from its all-time record of $2,135, which it briefly reached in December. If the yellow metal surpasses the $2,088 region, there isn’t much standing in the way of that record peak from a chart perspective. That said, the direction of travel will be decided by how this week’s economic events play out.

Shares on Wall Street joined the party as well. The S&P 500 raced higher to close at a new record, with Nvidia (+4%) leading the charge once again. In a surprising twist, Apple was the main drag on the market, with its shares losing ground last week following reports that it will cancel its plans to build electric cars.

Overall, there’s a sense of euphoria in the air across every asset class - from equities to bonds to precious metals to cryptocurrencies. Animal spirits have been reawakened, sending investors on a massive buying spree as the hope of lower interest rates has joined forces with the fear of missing out.

It’s a classic case of the ‘Fed put’. Markets can live with interest rates staying high for a few more months if the economy is still in good shape, shielding corporate profits. And if the economy turns, traders know the Fed will respond with deeper rate cuts, putting a floor under any selloff. Understandably, many investors view this as a win-win situation.

Oil rides supply cuts higher

In the energy space, oil prices received a boost after OPEC+ producers said they will extend their voluntary supply cuts for another quarter. The fact that a ceasefire between Israel and Hamas has not been reached yet might have contributed to the move in oil prices.

Looking ahead, it’s going to be a busy week in global markets, featuring central bank decisions in the Eurozone and Canada, alongside a couple of testimonies by Fed Chairman Powell before Congress and the latest edition of nonfarm payrolls, not to mention a budget announcement in the United Kingdom.

.jpg)