Gold could be poised for a continuation lower

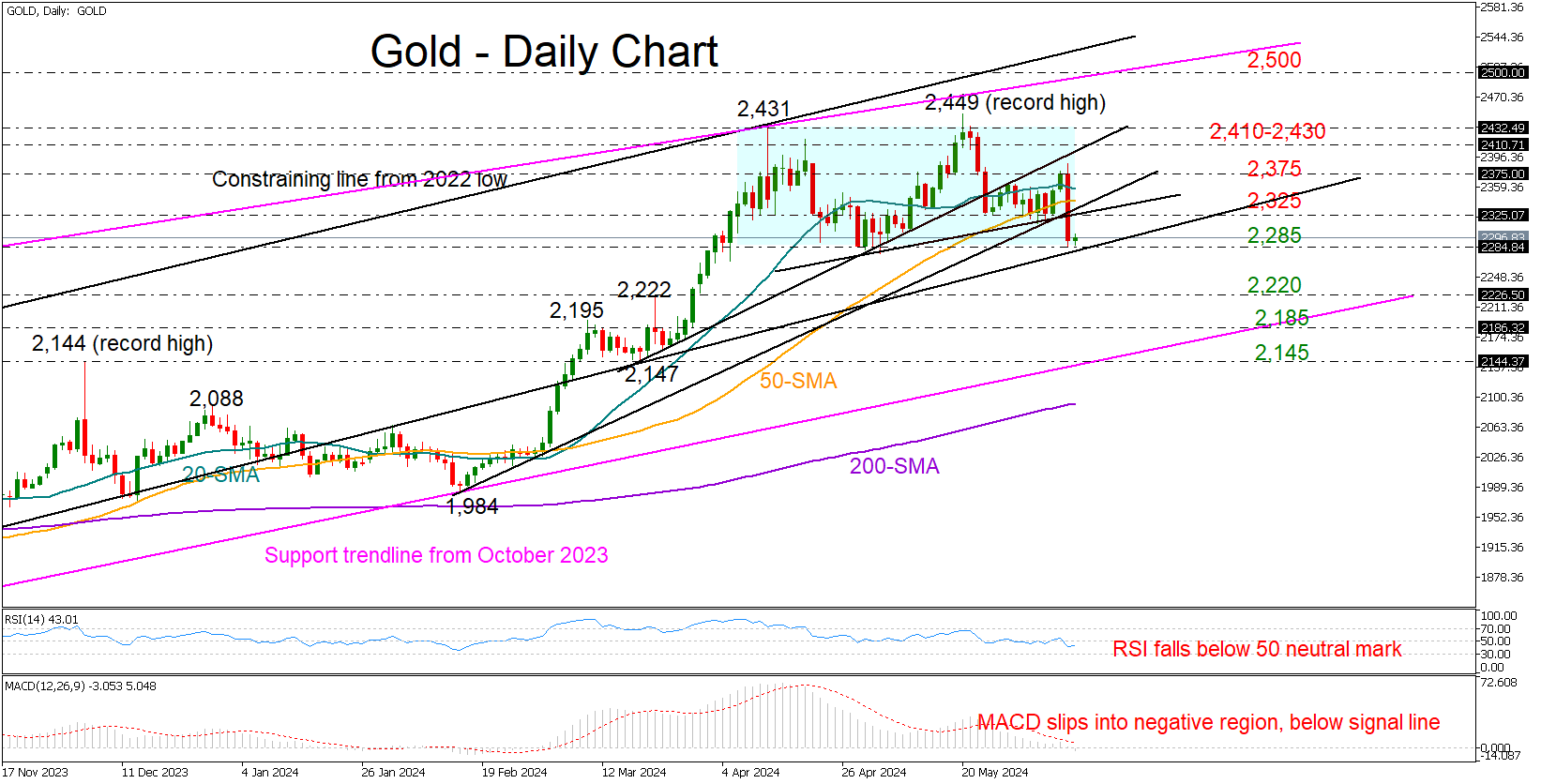

Gold has stabilized near May’s floor of 2,285 after losing more than 3.0% on Friday to mark its biggest daily loss in two years.

The price’s current lackluster performance indicates a probable bearish continuation, given its drop below the 20- and 50-day SMAs and beneath the significant trendline zone at 2,325. The technical indicators align with this narrative, as the RSI has dipped below its 50 neutral mark and the MACD has slipped below its zero line.

In the event that the 2,285 base crumbles, validating a bearish head and shoulders formation, selling momentum could escalate towards the 2,220 level. Falling lower, the price might retest the former constraining zone of 2,185 before plunging towards the ascending trendline, which connects the 2023 and 2024 lows at 2,145.

If the bulls resurface, they might encounter a new challenge in the caution zone between 2,325 and 2,375. A decisive close above this bar could be a prerequisite for a rally back to the 2,410-2,430 zone. A victory there could lift the price as high as 2,500.

Summing up, the bears seem to be t aking the lead in the gold market, with support expected to come next around the 2,220 number.

aking the lead in the gold market, with support expected to come next around the 2,220 number.

.jpg)