Higher US inflation will not stop the Fed from cutting rates

US consumer inflation was in line with analysts' average forecasts, but it still triggered a weakening of the dollar and increased interest in buying stocks. This reaction suggests that traders were expecting a higher number and that there is now a slight shift towards a more dovish Fed for the coming months.

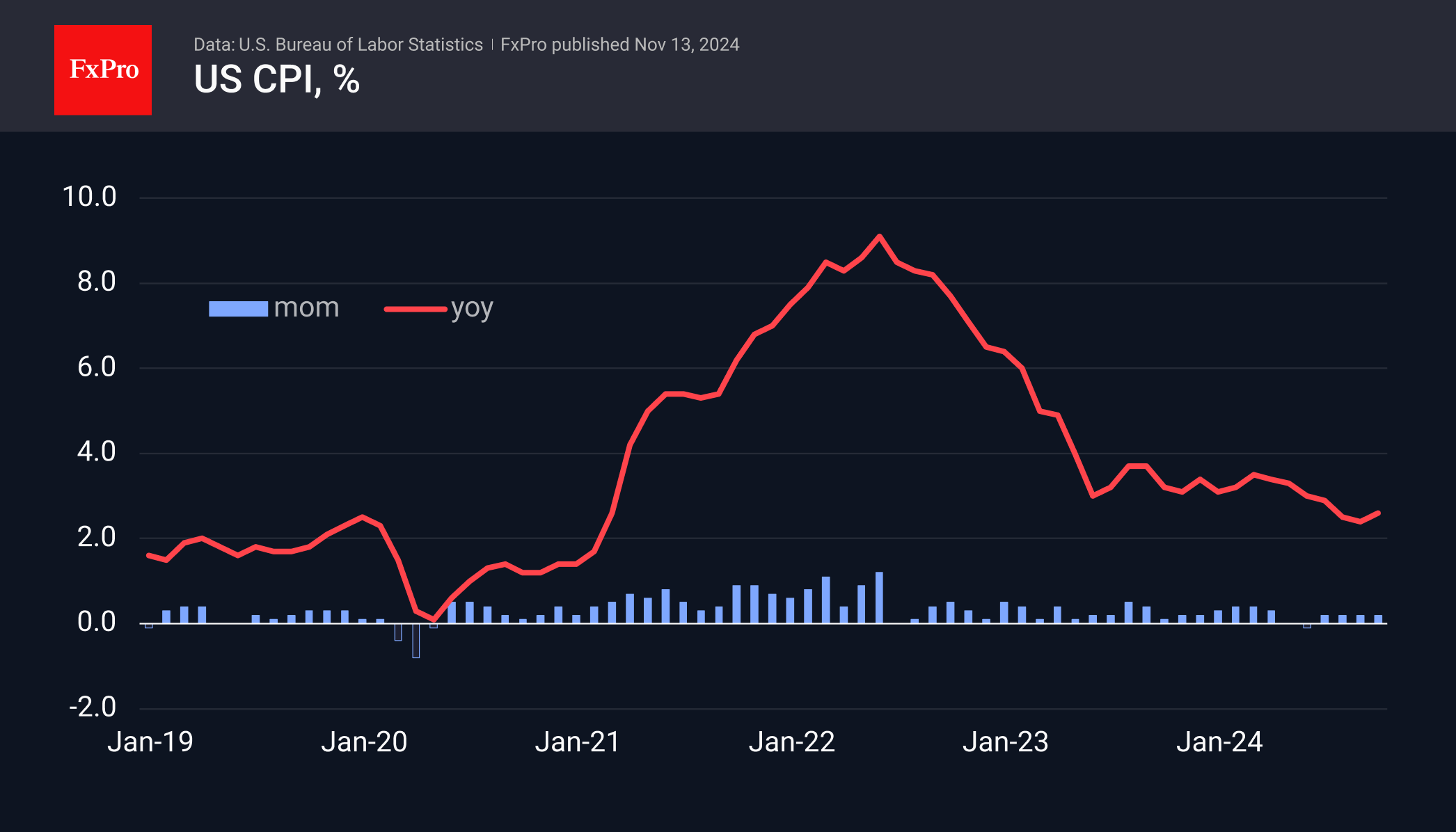

Headline CPI rose 0.2% for the fourth month in a row, and the annual rate climbed from 2.4% to 2.6%. While this is above the 2% target, it shouldn't prevent the central bank from cutting rates in December and continuing to do so.

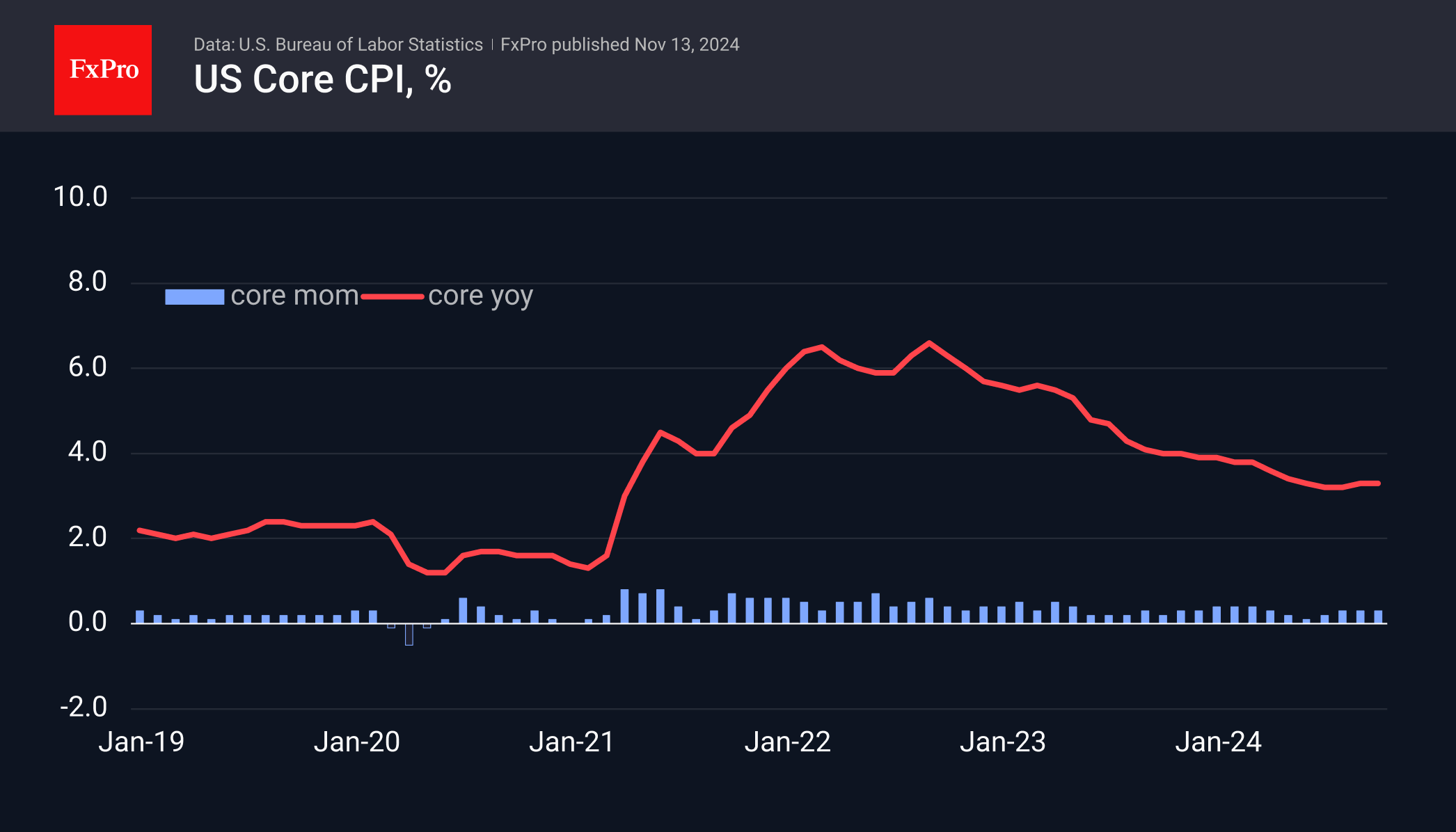

The core price index, which excludes food and energy, rose 0.3% for the third month in a row, and the annual growth rate was 3.3%.

Coincidentally, the start of the Fed's taper in September coincided with a stabilisation of the rate of price increases at elevated levels. Nevertheless, current levels do not worry markets and observers. The odds of a rate cut in December have risen to 79% from 59% the day before, as the Fed Funds rate in the 4.50%-4.75% range creates rather tight monetary conditions, impressively above the inflation rate.

Technically, this is bearish news for the dollar and positive for the equity and commodity markets, as it reignites speculation about the next rate cut. However, traders should bear in mind that attitudes towards the dollar have been influenced by news of potential trade tariffs since the beginning of October and probably over the next few weeks, with the focus returning to monetary policy by December.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)