Inflation surprise - now in Europe

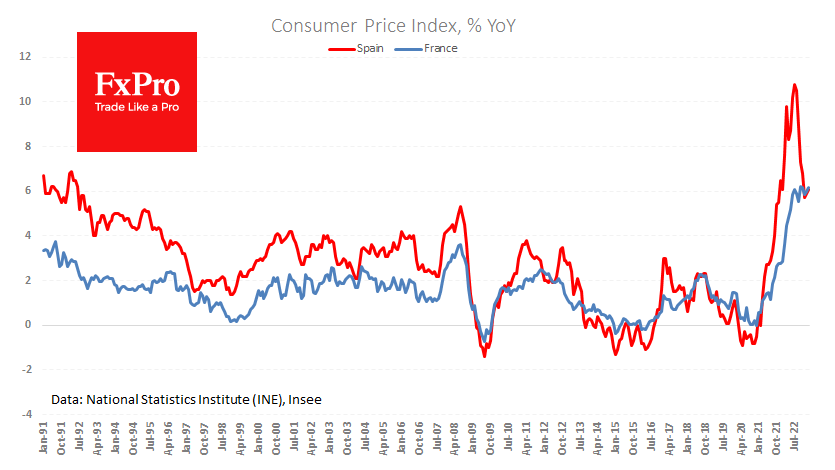

Spain's CPI rose by 1% in February, and annual inflation accelerated from 5.9% to 6.1%. In France, prices rose 0.9% m/m, accelerating to 6.2% y/y. For forex traders, it is also important to note that the figure was higher than forecast, forcing a reassessment of expectations for Thursday's release of the region's overall index.

Although inflation in France has not reached the double digits for the whole Euro region, it still shows no signs of reversing. It will not be easy for the ECB to get inflation back to its "close but below 2%" target.

The higher-than-expected inflation rate supported Euro buying on Tuesday, pushing EURUSD back above 1.06 after a long downtrend triggered by strong US inflation. This currency tug-of-war has every chance of continuing as the labour market remains strong in both cases, creating a price spiral.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)