Investors cautious as spotlight falls on US inflation

Dollar bolstered by Fed, inflation expectations

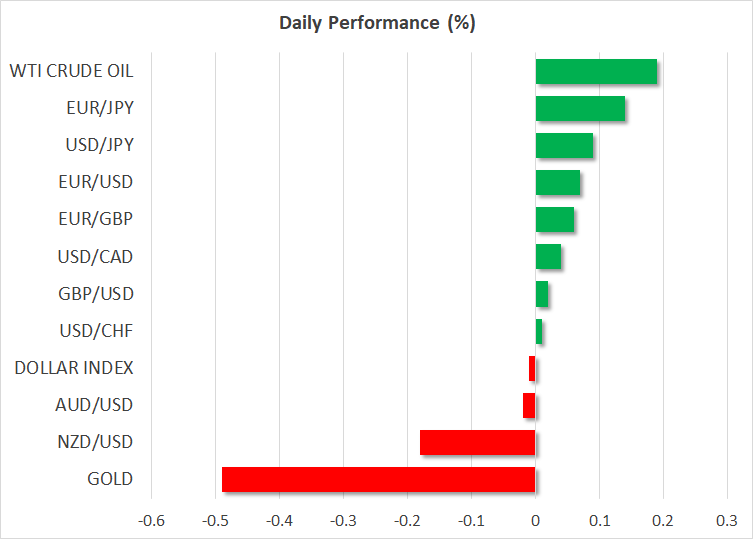

The US dollar traded slightly higher against most of its major peers on Friday, while it started the new week on a cautious note, with traders perhaps reluctant to assume large positions ahead of Wednesday’s CPI inflation numbers.

After a less hawkish-than-expected Fed decision and a softer-than-anticipated US employment report for April, market participants added several basis points worth of rate cuts back on the table.

However, remarks by a couple of Fed officials and a jump in the University of Michigan (UoM) consumer inflation expectations on Friday, prompted investors to slightly scale back their Fed rate-cut bets again. According to Fed funds futures, they are expecting around 42bps worth of reductions by the end of the year, assigning a 75% chance for the first quarter-point reduction to be delivered in September.

Following remarks by Minneapolis Fed President Neel Kashkari that monetary policy may not be tight enough, Dallas President Lorie Logan expressed a similar view on Friday, saying that there are uncertainties about how restrictive policy is and that it is too early to consider cutting rates.

Although Kashkari and Logan are not voting members this year, Atlanta Fed President Raphael Bostic, who is, said that he sees only one quarter-point reduction this year, adding to the narrative that the Fed could proceed with a higher-for-longer mentality.

Attention will now turn to the PPI and CPI data on Tuesday and Wednesday, respectively, which will reveal whether inflation remained sticky in April, or whether it resumed its downward trajectory. Another month without signs of cooling may convince market participants that two quarter-point cuts are too many for this year, and thereby prompt them to lift their implied rate path a bit more. This could further support the US dollar and Treasury yields.

Is Chinese demand recovering?Flying from the world’s largest economy to the second largest, data over the weekend showed that China’s consumer prices rose for a third straight month in April, suggesting improving domestic demand and that past policy support measures are finally bearing fruit.

The inflation data comes after the improving trade numbers for April, but with the official PMIs for the month revealing softening activity, and the wounds of the property sector not showing signs of healing, the recovery momentum may easily fade again.

With that in mind, Friday’s industrial production, retail sales and fixed asset investment numbers for April may attract special attention and if they corroborate the PMIs, concerns about the stability of the recovery may resurface, which could weigh on the aussie and kiwi, as well as on the broader market sentiment.

Wall Street awaits US CPI dataOn Wall Street, both the S&P 500 and the Dow Jones eked out some gains on Friday despite the modest strength of the US dollar and the rebound in Treasury yields, while the tech-heavy Nasdaq finished virtually unchanged.

Perhaps equity traders are content with the idea that the bar for the Fed to resume rate hikes is very high, even though rate cuts may be delayed. However, they may get more worried if this week’s inflation data suggests that rate cuts may not be warranted at all this year.

.jpg)