Market uncertainty lingers

Nervousness impacts US stocks

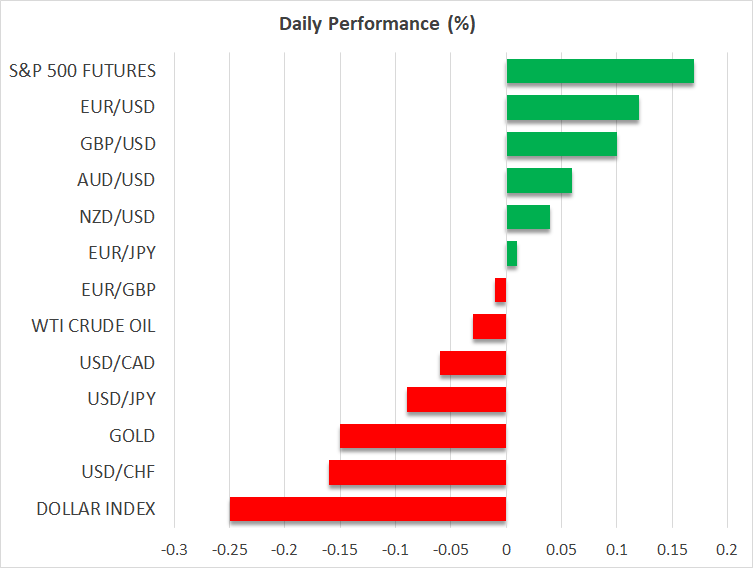

Following a rather eventful year, when most stock indices recorded sizeable double-digit gains, the start of 2025 has been surprising for the bulls. US stock indices are slightly in the red at the start of the new year, encapsulating the overall market uncertainty about the short-term outlook.

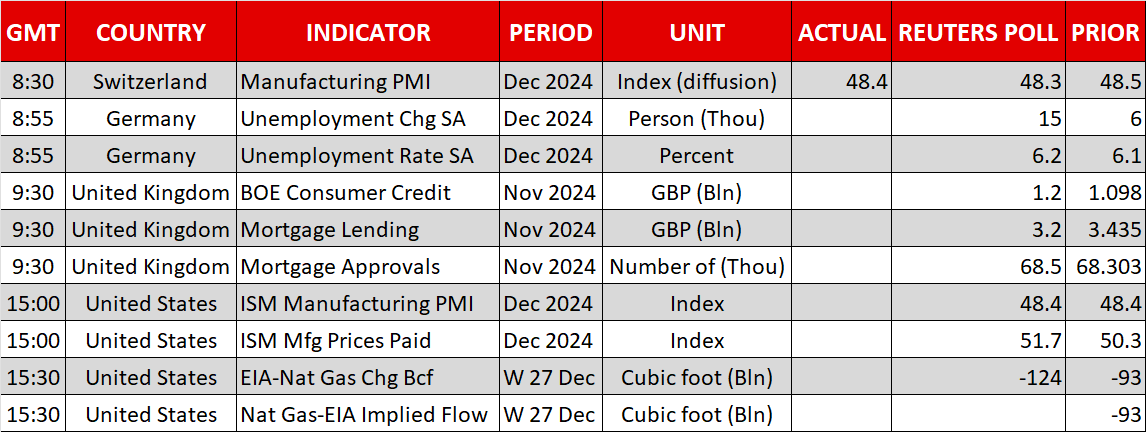

Trump’s Inauguration Day on January 20 is the next key date on the market’s radar, potentially overshadowing next week’s busy US calendar. The stronger S&P Global Manufacturing PMI survey and the jobless claims report kicked off the year on a positive note, but the Fed’s next action remains uncertain following the December 18 meeting.

Next week’s US data releases could prove a significant test of the Fed’s stance, particularly if the data proves solid, thus fueling concerns about the inflation outlook, especially when President-elect Trump is quite vocal about his administration’s strategy.

Tariffs feature in his daily commentary, scaring the market, although there is a sense among market participants that Trump is primarily a businessman. This perspective could potentially stop him from implementing the various announcements and threats made during the pre-election campaigning and his rhetoric since November 5.

The US dollar remains on the front foot

The nervousness seen in stocks has been fueling demand for both the US dollar and gold. Euro/dollar continues to trade lower, reaching 1.0222, which is the lowest level since November 21, 2022. Parity looks increasingly more likely by the day, especially as the newsflow from the eurozone remains negative.

ECB Chief Economist Lane will be on the wires today, officially opening the door to a barrage of ECB speakers next week, when the preliminary inflation report for December will be published. Regardless of the data prints, the ECB is assumed to be on a preset course to provide further accommodations and create a buffer against the Trump “typhoon” expected after January 20.

Interestingly, dollar/yen is experiencing more muted action this week, as market participants have reacted positively to both the Japanese authorities’ verbal interventions and the increased possibility of a 25bps rate hike at the January 24 BoJ meeting. A positive set of Japanese data prints could protect the yen from another round of underperformance, but at the end of the day, dollar traders hold the market reins.

Gold and bitcoin started the year positively

In this environment, following a period of mean reversion around the 50-day simple moving average (SMA), gold investors decided that it is time to make the first move, pushing gold to the highest level since December 13. This rally has taken place despite the stronger dollar and the elevated 10-year US Treasury yield level; in normal market conditions, these movements tend to be gold-negative. However, Trump’s imminent Presidency is potentially proving the strongest market force at this stage, a situation that could intensify as we approach January 20.

Meanwhile, cryptocurrencies are showing signs of life following a semi-disastrous December. Bitcoin is just 3% higher, with the other major cryptos starting 2025 more lively. Lacking a new catalyst, these movements could be seen as a “fear of missing out” reaction, following extensive discussion during festive dinners about the explosive gains recorded in 2024.

.jpg)