Markets threatened by dollar’s dominance

US stock indices continue to suffer

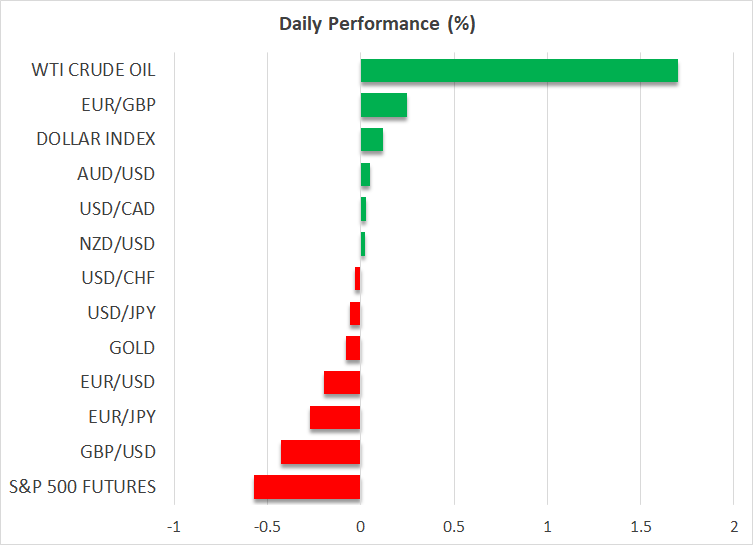

One week is left until President-elect Trump takes office, and the markets appear to be in shambles. US equities had a horrible week, led by the Russell 2000 index, which has completely given back its post-US presidential election gains, with the US 500 index suffering the least.

While uncertainty regarding Trump’s second presidency lingers, with markets preparing for an array of scenarios ranging from the US annexing Canada and Greenland to announcing a new round of harsh sanctions on Iran, the Fed remains the key factor driving market movements.

One Fed rate cut priced in by the market for 2025

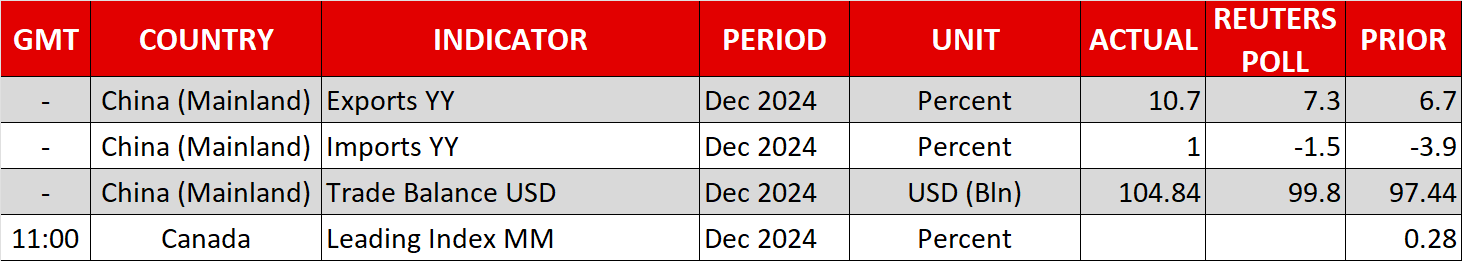

Friday’s solid labour market data confirmed that the US economy is growing strongly, clearly outperforming the rest of the world. The next big test for the Fed will be Wednesday, when the December US inflation report will be published, with a rising probability of another upside surprise.

These developments have forced the market to price in only one Fed rate cut in 2025, at the December meeting. Another round of revisions to Fed rate expectations from key investment houses has followed since. While most firms still expect rate cuts in 2025, there are some dissenters that believe that the Fed’s next step could be a rate hike. This sounds somewhat extreme considering the two active conflicts in both the Middle East and Ukraine, and the ongoing economic trouble in China, with no easy solution in sight.

The 10-year US yield is edging higher

However, it is undeniable that the 10-year US yield is trading at the highest level since July 2007, and it could thus prove very damaging for the global economy, especially for emerging markets. As a reminder, the Great Financial Crisis, ignited by the US subprime mortgage market, started in the summer of 2007 and was the catalyst of the eurozone sovereign debt crisis in 2010.

The result of the strong US economy, heightened US yields and reduced Fed rate cut chances are clearly reflected in the US dollar. It is outperforming its main competitors, with euro/dollar trading just above the 1.02 level. The majority of market participants expect this pair to hit parity during the first quarter of 2025, especially if the ECB maintains a dovish stance.

Markets remain negative for the UK

Not all market movements are dollar-driven though, as in the case of the pound, the domestic situation is potentially the root of the problem. Putting aside the possibility of the UK being caught in the web of US-imposed tariffs, the recent UK budget, which introduced significant public spending funded by tax increases and a solid increase in bond sales, appears to be backfiring.

UK yields are climbing aggressively higher, and the pound keeps losing ground against both the dollar and the ailing euro. The current situation is bringing back memories of the Truss budget crisis in 2022, which ended with a BoE bond support programme and the appointment of a new Chancellor of the Exchequer. Until either event happens, both the pound and bond markets are probably in for more pain.

Gold supported, oil rally continues

Gold is trading slightly below $2,700, benefiting from the wider dented risk appetite but surviving, up to now, the continued dollar rally. On the flip side, the oil market is alive again, capitalizing on the new US sanctions on Russia’s vast oil industry. While the effectiveness of these sanctions remains highly questionable, WTI oil is testing the early October 2024 highs. A move above 78.96 could potentially unlock another rally towards the July 2024 highs.

.jpg)