Mood sours as ECB pushes back on rate cuts; will Fed follow suit?

Rate cut bets pared back after ECB intervention

Dovish expectations for the major central banks suffered a setback on Tuesday after ECB Governing Council member Robert Holzmann cast doubt on the prospect of any rate cuts in 2024. Speaking at the World Economic Forum in Davos, Holzmann cited the heightened geopolitical risks in the Middle East as posing a significant threat to inflation. Holzmann sounded downbeat on the likelihood of the disruptions to shipping in the Red Sea ending quickly, prompting him to warn that “We should not bank on the rate cut at all in 2024”.

Other ECB officials also pushed back on the idea of a rate cut as early as spring, but were not quite as hawkish. The Bundesbank’s Nagel echoed remarks from the ECB’s chief economist Philip Lane over the weekend by arguing against cutting rates too soon.

France’s Villeroy, meanwhile, avoided giving a timeline of when the ECB might begin to lower rates, pointing to some divisions within the Governing Council. Yet, it’s hard to ignore the coordinated move by the European Central Bank to cool investors’ aggressive rate cut bets.

Unconvinced markets await Waller for more rate clues

The question now is whether the Fed will follow a similar tactic to rein in the markets’ excessive pricing for policy easing over the coming months. Fed Governor Christopher Waller is due to make remarks at 16:00 GMT and there is a lot of speculation on whether he will backtrack on some of his recent dovish language that had taken markets by surprise.

Government bond yields spiked higher globally on the back of the ECB’s pushback, with US yields also edging higher today as trading resumes after yesterday’s break when markets were shut for Martin Luther King Day. However, the moves were relatively modest when considering the extent to which Treasury yields slumped after last week’s CPI and PPI reports.

There was no dramatic repricing in money markets either, as Fed rate cut expectations were scaled back from around 165 basis points to nearer 159 basis points, suggesting that traders still overwhelmingly think that central banks will slash rates later this year. If investors are heeding any message from policymakers it is that the first cut is more likely to come in late spring or the summer than in March.

Dollar crushes rivals as euro, pound and aussie slump

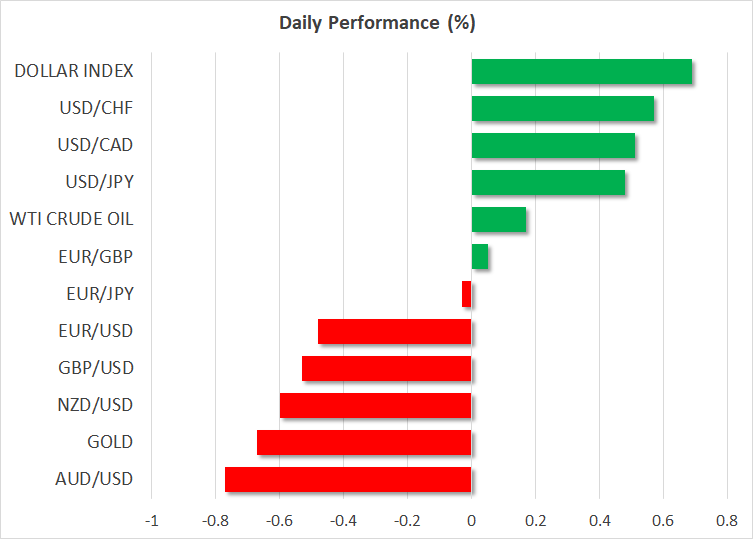

What’s also striking is that the US dollar has been powering ahead overnight, with the euro struggling to make any gains from the hawkish soundbites coming from the ECB. Against a basket of currencies, the dollar is trading at a one-month high today, defying those traders still betting for at least six rate cuts by the Fed this year.

It’s possible that the ECB doubling down on its higher for longer message has revived concerns about overtightening, weighing on the euro. Moreover, tensions in the Red Sea as well as the prospect of Donald Trump winning the nomination to lead the Republicans in November’s presidential election are spurring some safe haven demand for the greenback. Trump won the Iowa caucuses on Monday, boosting his campaign to get re-elected.

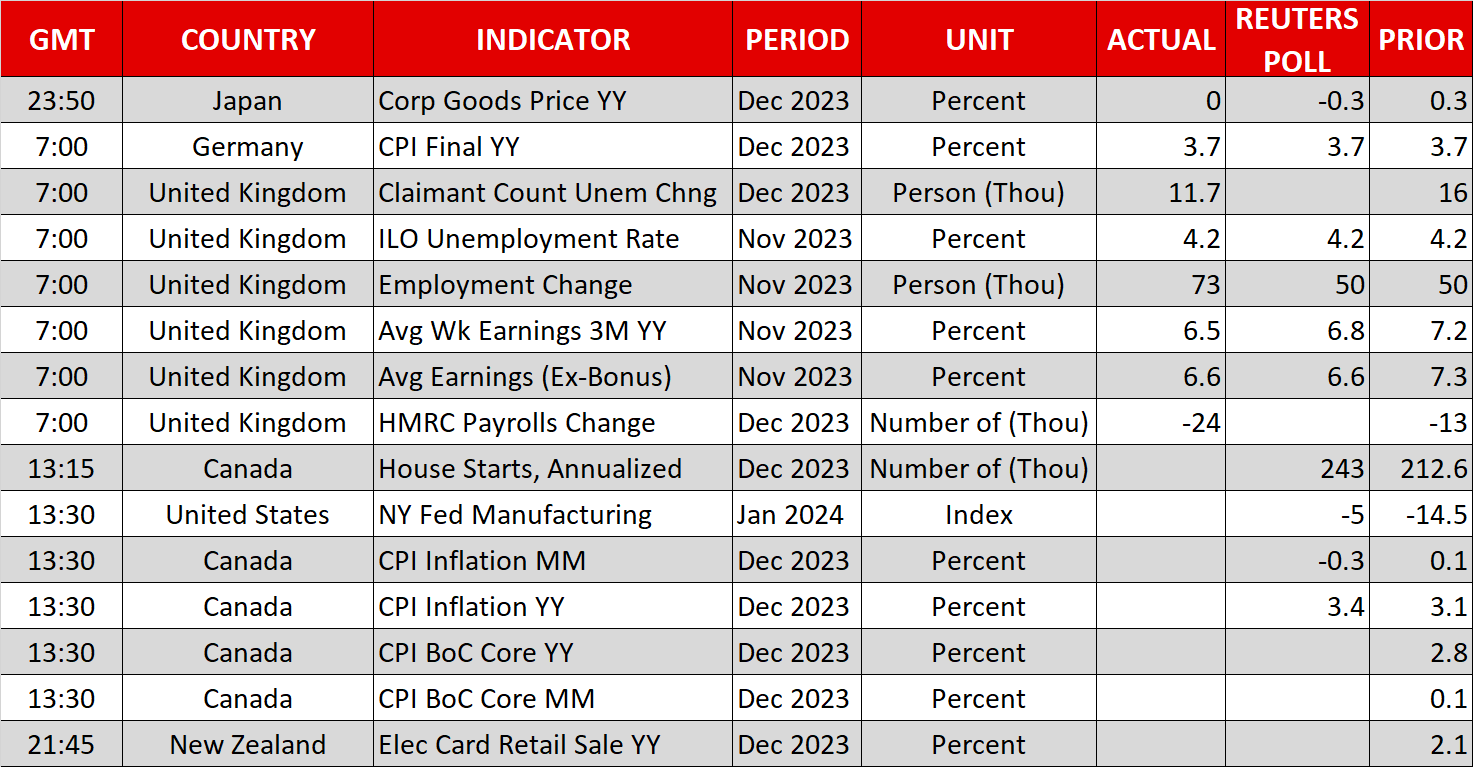

Meanwhile, the pound and Australian dollar battled their own woes on Tuesday. The aussie came under pressure from a weak consumer sentiment survey in Australia and sterling slipped below $1.27 after UK wage growth eased more sharply than expected in the three months to November.

No easy ride for gold and oil traders amid uncertainties

Overall, there seems to be quite a bit of uncertainty building up in the markets and this couldn’t be better reflected in oil and gold prices. Oil futures recently broke above their descending trendline, only to head sideways as the supply constraints sparked by the crisis in the Middle East and production issues elsewhere are being offset by growing worries about the economic outlook, particularly in China. Investors are anxious to see whether the Q4 GDP data due out of China early on Wednesday will allay or fuel those concerns.

As for gold, the dollar’s constant upswings are slowing its advance even as rate cut bets remain elevated. This week could prove decisive for the precious metal if Fed officials ratchet up their pushback attempts against big rate cuts.