No need to fear the death cross in BTC

No need to fear the death cross in BTC

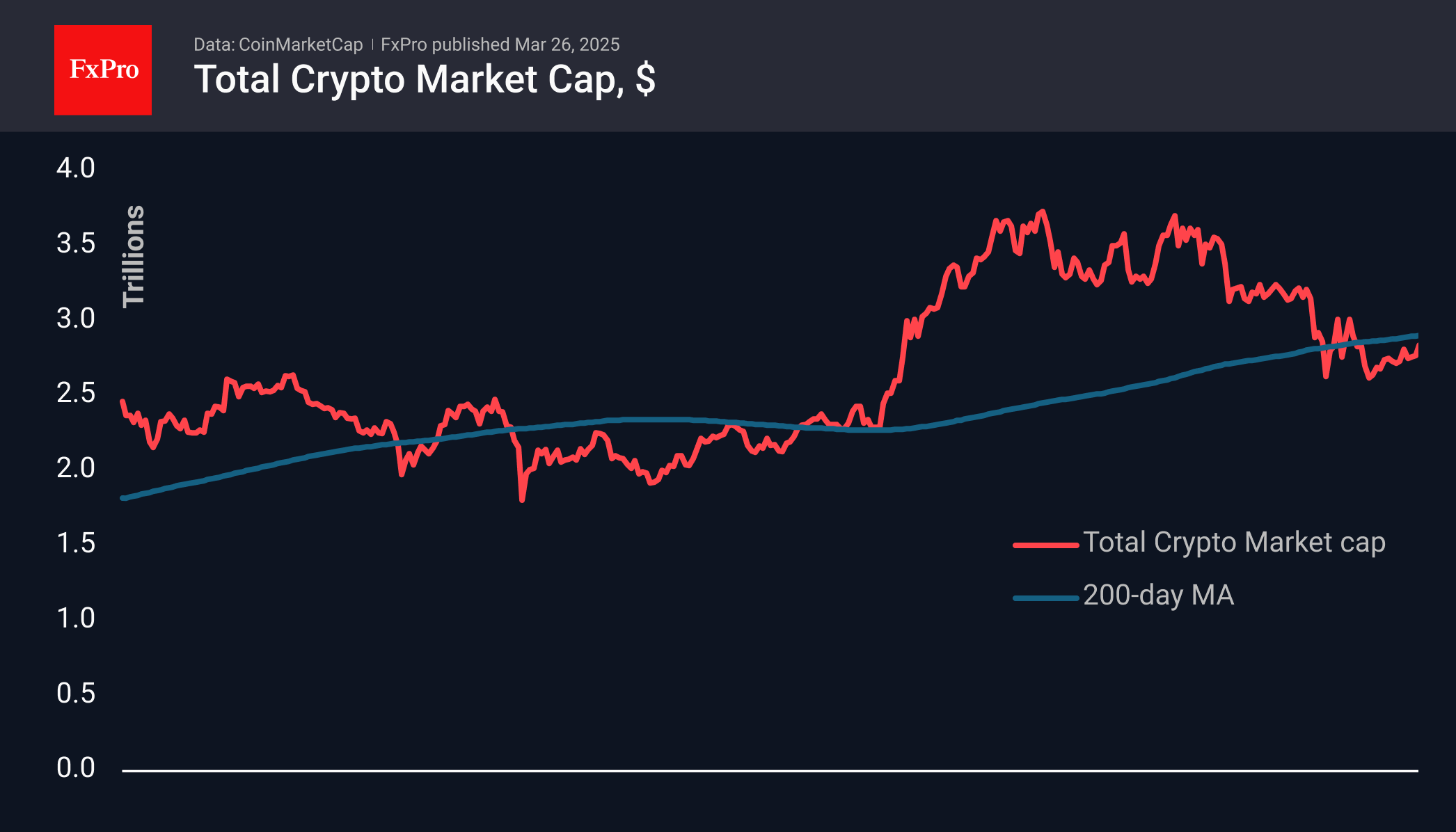

Market PictureCrypto market capitalisation rose 0.5% in the last 24 hours to $2.89 trillion, the highest since March 8, but still below the 200-day moving average. The Bulls still have to prove their strength by overcoming an important technical level. But worryingly, recent gains have come on low trading volume. This could simply be a setup to trap buyers and trigger a sharp sell-off in the next move.

Bitcoin pulled back below $87K on Wednesday, hesitant to storm the 50-day moving average and the round $90K level. This curve is pointing downwards and will soon cross the 200-day average. Technically, this would form a ‘death cross’, but we place greater importance on the upward price trend seen over the past three weeks.

News Background

Based on sentiment analysis, Santiment concluded that many community participants are confident in the continued growth of cryptocurrencies. Brickken noted that another important signal is the increase in global liquidity by about 8% this year, which creates a favourable environment for Bitcoin.

BlackRock will list its iShares bitcoin ETF on the European market. The instrument will trade under ticker IB1T on Xetra and Euronext Paris and under ticker BTCN in Amsterdam. This is the first exit of BlackRock cryptocurrency funds outside the US.

OKX explained the reasons for the lack of an altcoin season. The current bull cycle in the crypto market has lacked large-scale technological breakthroughs and hype trends like DeFi or GameFi that would have fuelled altcoin growth.

Trump's media company, Trump Media, has partnered with Crypto.com, one of the largest US crypto exchanges, to launch exchange-branded products under the Truth.Fi brand. Crypto.com’s token Cronos (CRO) jumped more than 40% on the news.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)