Not all old altcoins shine alike

Market picture

The crypto market is up 1.5% in 24 hours to $1.41 trillion. That's down from a high of $1.44 last Thursday and close to where it was a week ago. The dynamics of individual coins over the past seven days have been mixed. Bitcoin gains 0.7%, Ethereum loses 1.6%, while the top altcoins varied from -5.8% for Tron and -5% for XRP to +23% for Avalanche and +4.7% for Dogecoin.

Bitcoin is trading within an uptrend channel. In Ethereum, the trend of higher local lows over the last four weeks is noticeable.

The technical picture in the individual coins is setting up for another change of leaders in the second tier, which is typical of new markets.

Solana has been on the rise for the past month, gaining around 130% in that time, and is one of the leaders in the market's recovery. However, the price is still 77% below its peak in October 2021.

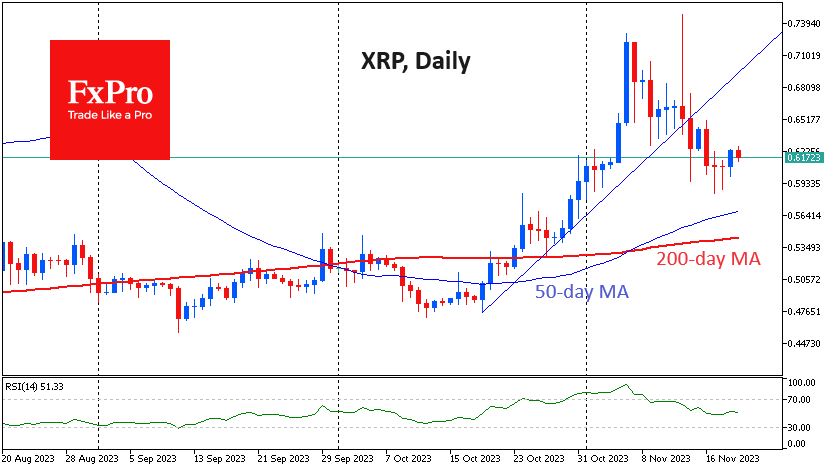

XRP and Litecoin, once some of the leading altcoins, are not yet in favour with the market. Like the coins above, they started to rise in the second half of last month but have come under more pressure in the last two weeks, reversing the upward trend. It's worth being prepared for them to underperform the market for the foreseeable future as the focus of developers and holders shifts.

News background

The crypto media is confident that the Fed's next move will be a rate cut and is debating the impact on coins. Bitfinex expects a rebound in risk appetite, triggering accelerated crypto growth. This could also coincide with next April's halving, creating a fundamental basis for buying. YouHodler suggests a later start date for policy easing.

However, we note that the Fed typically starts a cycle of rate cuts only after a significant market correction starts, on the back of damaged risk appetite. A cut in the first half of 2024 can only be triggered by severe turbulence in debt and equity markets. We saw a similar example in 2020: BTC collapsed from $10.5K to $3.77K in four weeks before rallying. Only after a new dip below the 200-week average did it find sustainable demand thanks to monetary easing and government support packages for households and businesses. In our case, this means a return below 30K before triggering another bull cycle.

According to Bloomberg Intelligence, the cryptocurrency market will continue to grow, and its capitalisation could already reach between $8 trillion and $10 trillion in this bull cycle. However, the recent growth in cryptocurrencies was not just the "hype" around the imminent launch of spot ETFs on Bitcoin.

Following BlackRock's lead, financial services firm Fidelity Investments has filed with the SEC to register a spot ETF on Ethereum.

The SEC is likely to continue to deny the launch of spot cryptocurrency ETFs, according to BitGo. The ETF filing lists Coinbase as its digital asset custody partner.

By the FxPro Analyst team

-11122024742.png)

-11122024742.png)