Oil on the Rise: growth drivers and risks

Oil on the Rise: growth drivers and risks

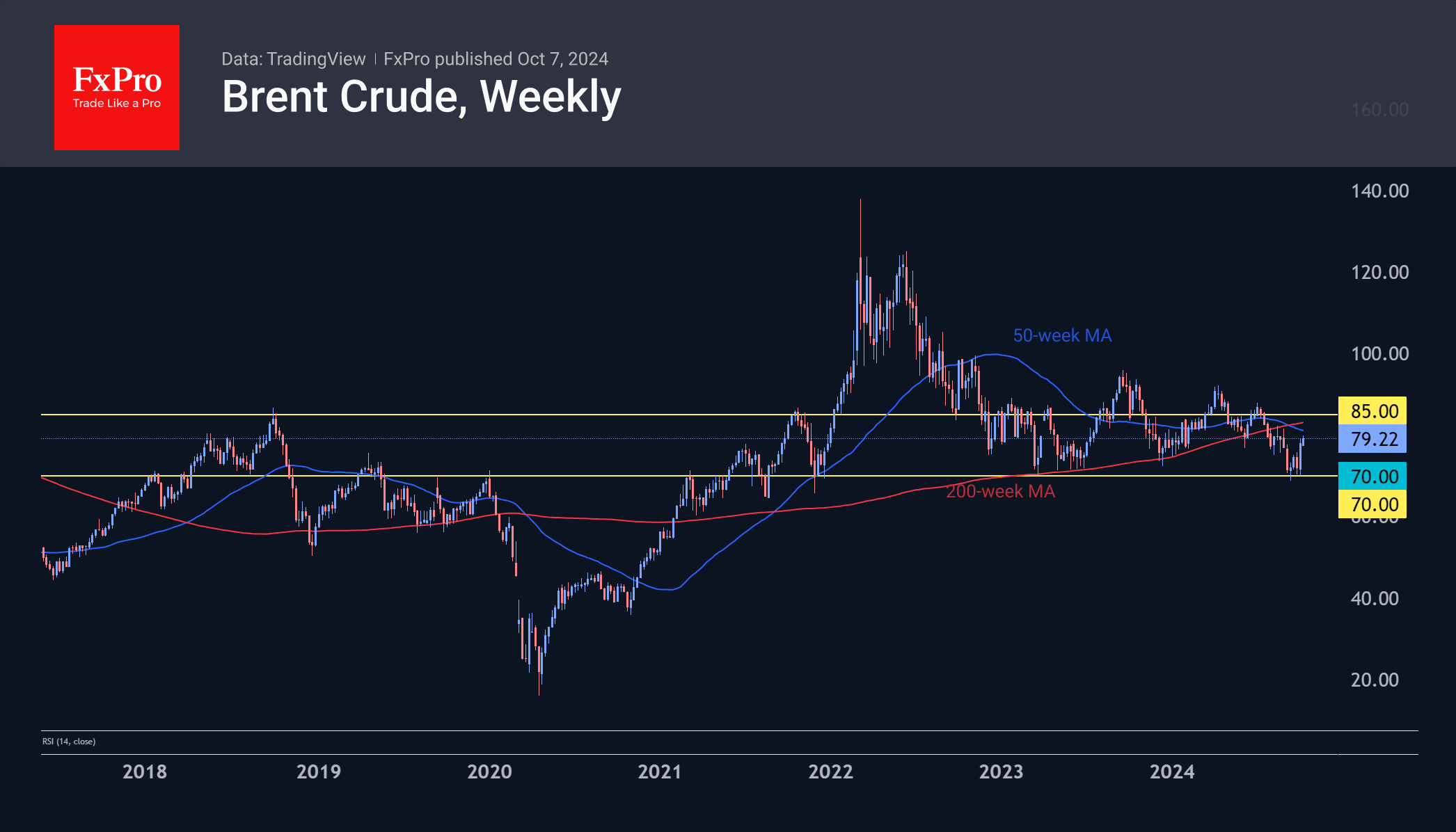

Market picture: Oil is on the rise, having turned upwards after a brief dip below $70/bbl Brent. The bullish influence of technical factors, such as a significant round level and accumulated oversold conditions, can only be discussed when we are completely disconnected from the news.

Among the economic factors, the Chinese stimulus package, which finally convinced investors of the seriousness of its intentions to stimulate the economy, was the main driver of the turnaround in oil. Markets also began to actively price in the risks of an Israeli attack on Iran's oil infrastructure. Saudi Arabia's tough stance at the last OPEC meeting, which enforced strict compliance with quotas, probably also played a role.

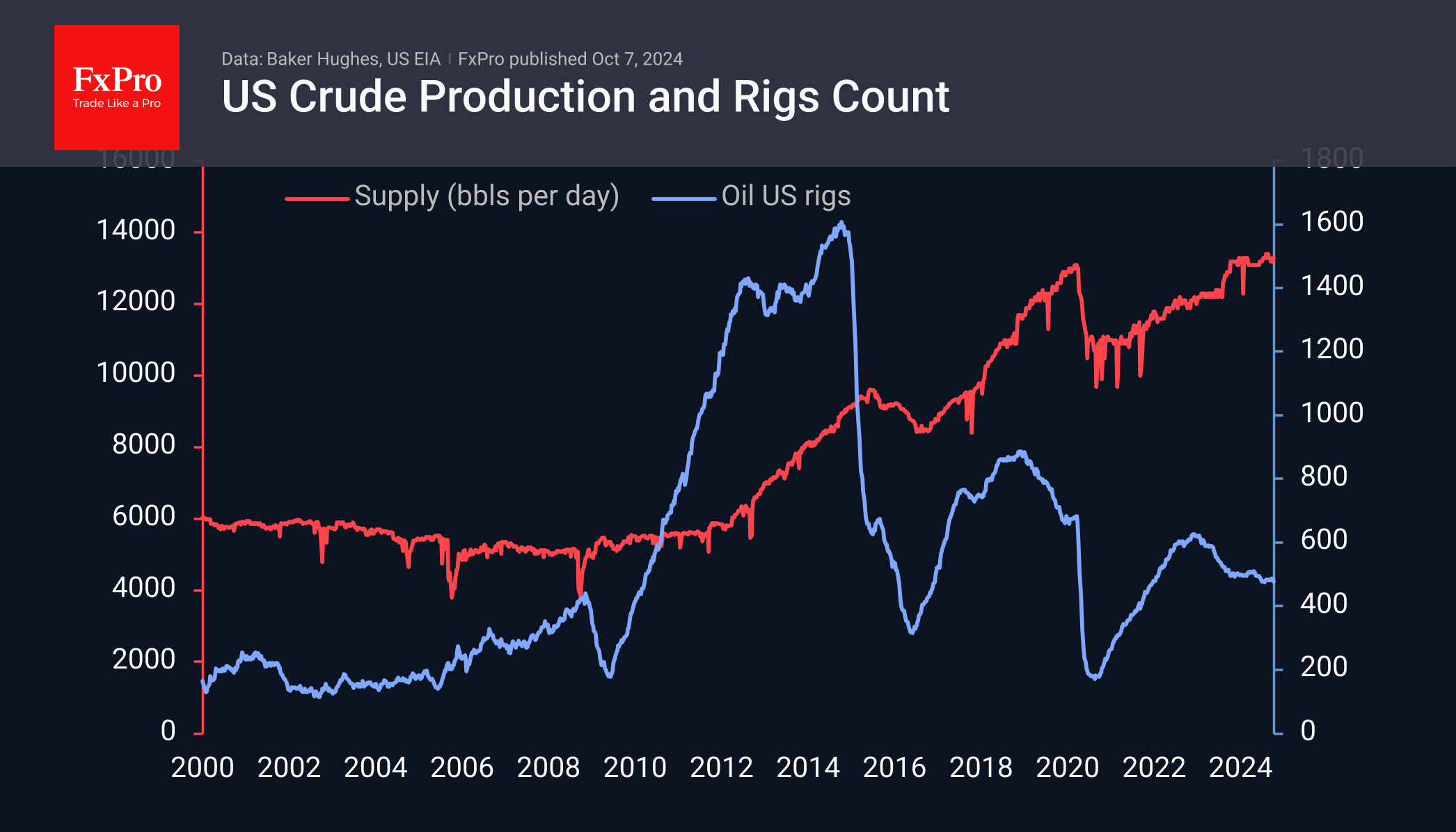

Among the high-frequency macro indicators, we focus on a new round of declines in US drilling activity. The number of oil rigs fell to 479 (-9 in three weeks), reversing the upward attempts we saw in the summer when Brent (and briefly WTI) exceeded $80/bbl.

For US producers, a drop below $70 per barrel for Brent (approximately $66 for WTI) typically triggers a reduction in activity. The primary price target for US oil producers appears to be above $85. However, this price range also attracts significant interest from OPEC+; sustained prices in this range often lead to discussions about increasing production.

In terms of the oil price, the $70-85 area represents a balance zone with increasing fundamental pressure as the price rises above the upper boundary and the threat of supply cuts as the price falls towards the lower boundary. With some disruptions, this range has been 'working' since early 2023, and recent developments in September have shown that the lower boundary remains an important support.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)