Platinum and Palladium are ready to go up

Precious metals are gaining on Monday in the second day of growth after last week's heavy sell-off. Platinum is recovering the most, jumping 2.9%. Palladium is gaining about 2%, also noting the recovery of buyers' appetite after the recent drawdown.

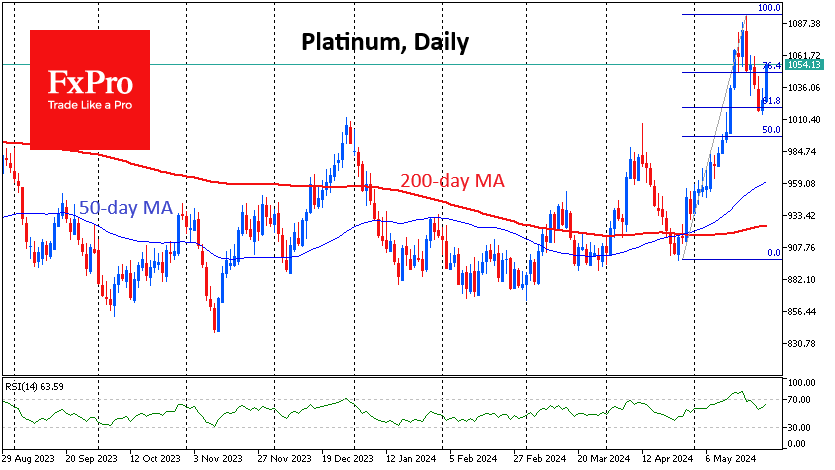

Exactly one week ago, Platinum reached a local peak at $1095, a two-year high. The subsequent 7% pullback was a classic 61.8% Fibonacci retracement of the initial rally from $897 in late April. According to this pattern, overcoming the last peak would allow us to consider the $1210-1220 area as the next potential target.

We also note that the price did not fall below the $1000 level, which effectively acted as resistance in December and April but has now turned into support. The platinum price may be ready to move a notch higher in the coming weeks, settling in the $1200-1400 area.

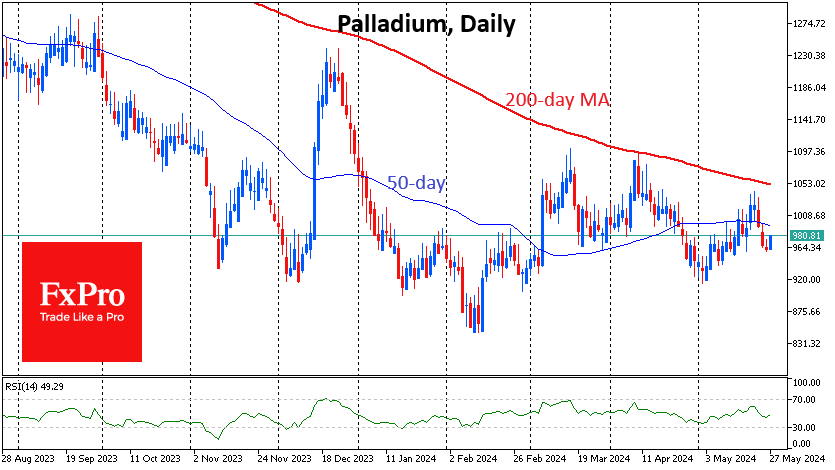

Last week's downward reversal pushed Palladium below the 200-day moving average, where it has been hovering since October 2022. Perhaps this downtrend is reaching its last days, as Palladium has formed very strong horizontal support in the $910-950 area since November. The combination of these forms the price movement within a triangle.

Classically, such a triangle should be resolved by a failure of the support and further price decline. But we believe that this is the case when we should expect an upward breakout.

Raw materials have a boundary below which exploration and mining are not interesting for companies. Palladium seems to have reached or strongly approached this boundary in the last six months. On the other hand, China's stimulation of its own economy is driving up commodity prices. Palladium should not be left behind, as it is actively used in the production of electric cars and has the biggest upside due to its distance from historic highs above $3400.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)