Powell keeps the door to a July cut open

Powell does not rule out a July rate cut

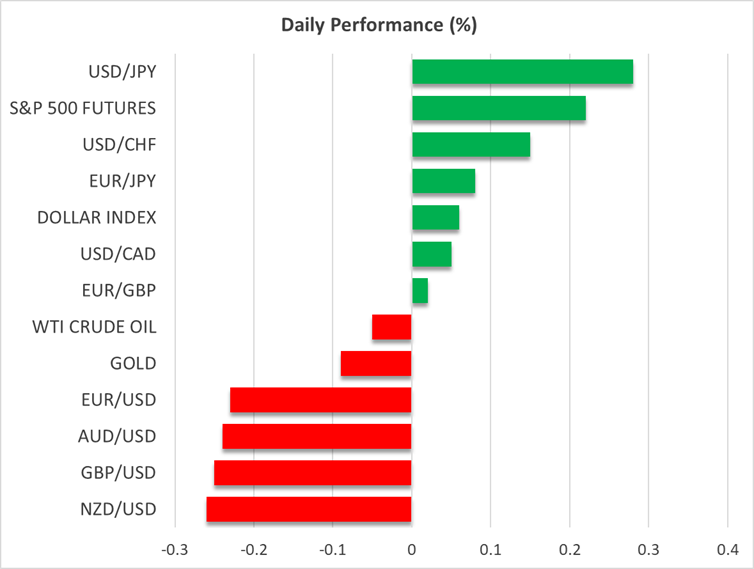

The US dollar extended its slide against all but one of its major peers on Tuesday, perhaps due to Fed Chair Powell appearing more dovish than expected at the European Central Bank’s annual conference in Sintra, Portugal.

The Fed chief reiterated the view that the Committee will maintain a patient stance when it comes to further interest rate reductions, but he did not rule out a rate cut at the July meeting, adding that the decision will depend on incoming data. This allowed investors to continue pricing in 65bps worth of rate cuts by the end of the year, with a 20% chance of the next quarter-point reduction being delivered in July.

A couple of weeks ago, that probability was at zero, but Trump’s continuous criticism of Powell about being too late in lowering borrowing costs, and remarks by a couple of policymakers that they would support a July cut, prompted market participants to reconsider their view.

Perhaps one of the reasons Trump is pushing for lower interest rates may be because it would make it easier for the government to repay its debt. Let’s not forget that Trump’s tax-cut and spending bill is estimated to add more than $3 trillion to the national debt. The bill passed through the Senate yesterday and will move back to the House for final approval.

US data show improvement, Eurozone inflation hits ECB’s target

As for yesterday’s data, the JOLTs job openings for May came in higher than expected, while the ISM manufacturing PMI for June improved somewhat, although it stayed in contractionary territory. This adds extra importance to the NFP report and the ISM non-manufacturing PMI, both due out on Thursday, as decent numbers may lower the probability of a July rate cut and perhaps allow the greenback to recover somewhat. The ADP report on private employment is scheduled to be released today.

The Eurozone’s preliminary CPI numbers were also released yesterday. The headline rate ticked up to hit the ECB’s objective of 2%, while the core HICP rate, which excludes the volatile items of food and energy, held steady at 2.4% y/y. This allowed investors to continue expecting just one more quarter-point reduction by the ECB before this easing cycle ends. However, instead of expecting it by December, they now believe that it will be delivered in February 2026.

The euro continued to take advantage of the dollar’s weakness, with euro/dollar hitting a new almost-four-year high yesterday. With the prevailing uptrend in this pair looking very strong, a pullback due to potentially strong US data tomorrow is unlikely to prove a game changer.

Stocks pull back, but uptrend remains intact; gold rebounds

On Wall Street, the Nasdaq and the S&P 500 closed yesterday’s session in the red, while the Dow Jones gained nearly 1%. However, stock futures are pointing to a rebound today and likely a new record high on the S&P 500. Perhaps the slowdown was due to trade related concerns after US President Trump said that he is not thinking of extending the July 9 deadline for countries to negotiate trade deals with the US. This means that higher levies could be imposed thereafter. In any case, for now, the prospect of lower interest rates is encouraging investors to overall maintain their risk exposure.

Gold extended its rebound yesterday. However, judging by the performance of other asset classes, this is not due to safe haven flows but rather due to a weakening dollar and expectations of lower interest rates. After all, increasing Fed rate cut bets mean lower opportunity cost for holding the non-yielding precious metal.

.jpg)