Dollar steadies as risk appetite eases on data and key deadlines

New month, old habits for the dollar?

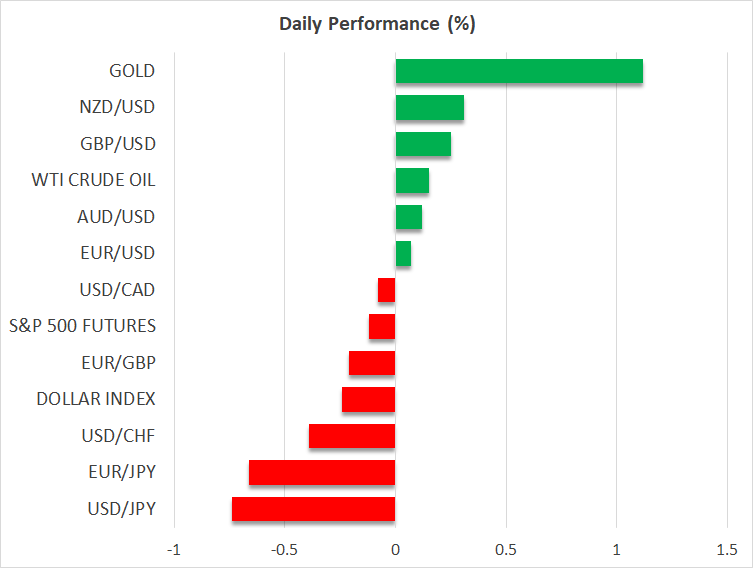

The US dollar is trying to start the new month on the front foot, following its recent underperformance. In June, the mighty greenback lost 4% against the euro, and around 2% versus both the pound and Antipodean currencies. These figures are even more striking on a year-to-date basis, with euro/dollar climbing 14% in the first half of 2025, cable rallying by 10%, and dollar/yen dropping by 8%.

The US President might view this dollar weakness as a significant boost for US exports. However, a growing number of market participants are voicing concerns that this move reflects deeper issues, as investors remain extremely skeptical about the short-term outlook, particularly regarding trade tensions and the US budget bill.

These unresolved issues and the continued dollar underperformance are casting a heavy shadow on the US stock market, despite the booming AI market. The S&P 500 and Nasdaq 100 indices are up 5.5% and 7.9% this year, respectively, significantly underperforming the DAX 40 index that has climbed by 20% in 2025.

July could be a ‘beautiful month’

The countdown to both the unofficial July 4 and the much-advertised July 9 deadlines - for the budget bill and reciprocal tariffs, respectively - is underway. The Senate is still debating several amendments to the budget bill, but the Republicans are thought to be able to secure the 50 votes needed to approve this bill and send it back to the House for the final vote. Republicans also have a majority in the House, but there is discontent within their ranks.

Meanwhile, while US officials are advertising the progress made on the trade negotiations, deals remain elusive. Most countries are unwilling to accept tariffs hitting their critical industries – for example the Japanese PM appears adamant that car industry tariffs are simply not acceptable. Similarly, the EU appears ready to accept the 10% universal tariff, but it is seeking exemptions for a number of key sectors.

Notably, there seems to be a shift in the US administration's trade strategy. Trump’s advisers are now targeting framework or baseline agreements instead of fully-fledged trade deals. In practice, this means that any trade agreements announced will not be final or complete, with discussions continuing during the summer – similar to the US-China trade developments. However, Trump will have the chance to advertise his success, despite their relative lack of substance.

Data galore this week

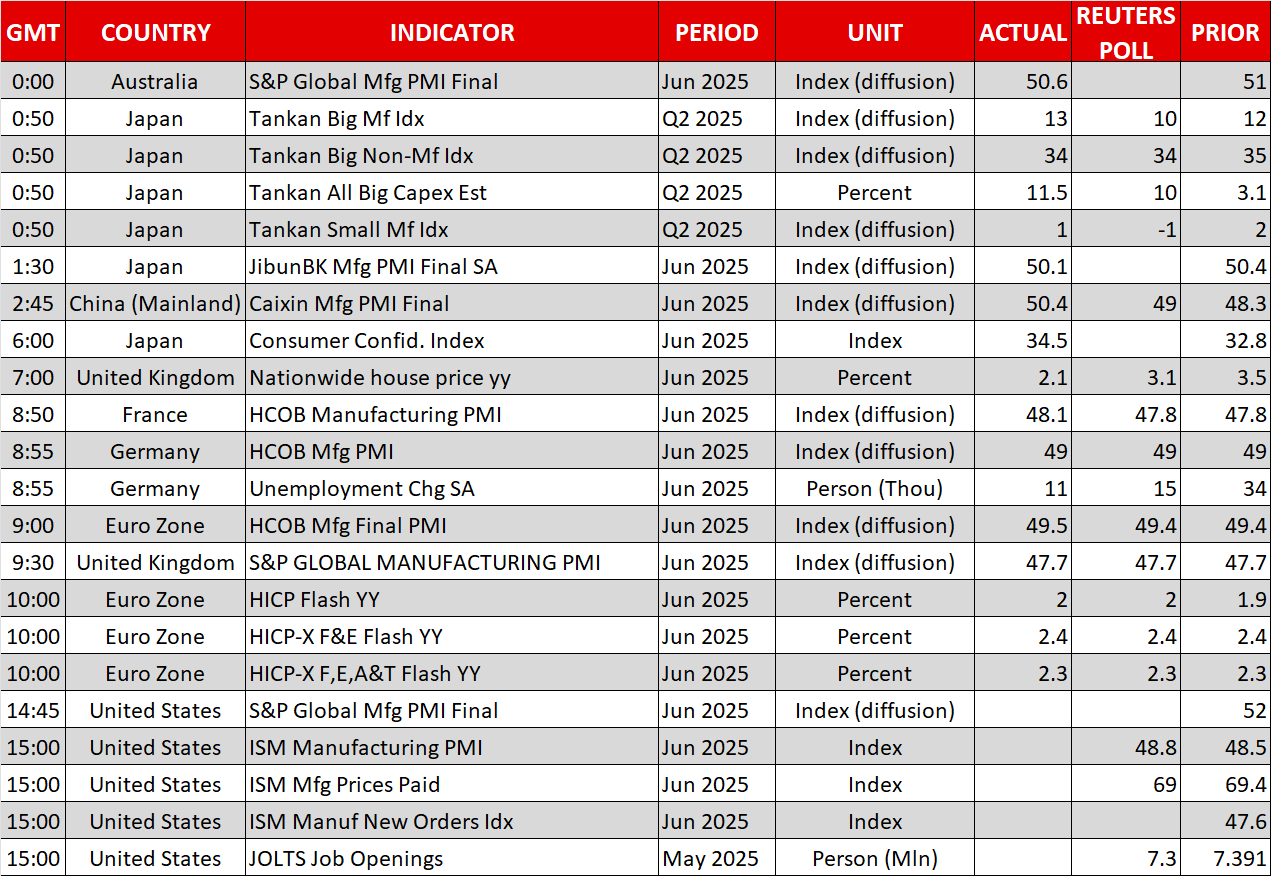

The Fed is preparing for this week’s busy data schedule. Both the S&P Global Manufacturing PMI and ISM Manufacturing PMI surveys will be published today, with the market paying extra attention to the employment and prices paid subcomponents of the latter, along with the May JOLTS job openings figure. It will be interesting to see how the dollar reacts to any potentially softer prints today.

While it could be a crucial week for Fed rate cut expectations, Fed members will probably have to keep one eye on Trump's rhetoric. The personal attacks and name-calling against Fed Chair Powell continue, with the latest episode in this saga being that Trump reportedly sent a note to Powell asking him to lower rates.

The Fed Chair is attending the three-day ECB forum on central banking in Sintra, Portugal, where he will probably feel more at home compared to Washington, DC. Notably, he is scheduled to participate in a panel discussion at 13:30 GMT alongside BoE Governor Bailey, ECB President Lagarde, and BoJ Governor Ueda.

Oil is range-bound, gold rallies

After substantial volatility in June, oil prices appear to have found a balance in the $66 area. This week’s data might beautify the oil demand picture, but investors will also have to take into account the continued output hikes by the OPEC+ alliance. There seems to be an effort by Saudi Arabia and its partners for a market share grab at the expense of lower revenue.

Finally, gold seems to be in a better mood today, climbing above a key trendline and easing fears of a protracted correction. The next two weeks, marked by a busy data calendar and various deadlines, might offer strong support for another upleg in gold.

.jpg)