Raving Sentiment in the U.S. Stock Markets

- Upbeat Nvidia earnings report stirs up the U.S. stock markets.

- Improved U.S. Initial Jobless Claims fail to provide a catalyst for the dollar.

- Geopolitical tension continues to influence commodity prices, especially oil prices.

Market Summary

The U.S. stock markets, particularly the Nasdaq, have experienced a significant surge, reaching record high levels, largely driven by Nvidia's impressive earnings report, which signals a positive outlook for the technology sector. The Nasdaq, known for its tech-heavy composition, closed with a 3% gain, surpassing the 18,000 mark. This bullish sentiment in the tech sector reflects broader investor optimism regarding growth prospects and financial performance within this industry. Simultaneously, China's stock markets are showing signs of revival, with both the China A50 and Hang Seng Index recording continuous weekly gains in February.

On the currency front, the dollar index has continued to trade below the $104 mark following the release of the FOMC meeting minutes. Despite positive job data, the market perceives that the Federal Reserve is less likely to further raise interest rates and may start to consider rate cuts within the year. This anticipation has somewhat dampened the strength of the dollar, as investors adjust their expectations regarding the Fed's monetary policy direction.

In the commodities market, oil prices have seen a modest increase of 0.4%, supported by upbeat U.S. crude inventories data. However, geopolitical tensions in the Middle East, particularly involving rebel groups in the Red Sea using ballistic missiles and drones, have escalated, contributing to the ongoing uncertainty and volatility in oil prices.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (89.5%) VS -25 bps (10.5%)

Market Movements

DOLLAR_INDX, H4

DOLLAR_INDX, H4

The Dollar Index initially retreated on technical correction but rebounded robustly after the release of exceptionally positive US economic data, including a decline in Initial Jobless Claims and better-than-expected S&P Global US Manufacturing PMI and US Existing Home Sales figures. The optimistic readings fueled market confidence in the US economic trajectory, although gains were tempered by a less favourable S&P Global Services PMI.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 45, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 104.60, 105.70

Support level: 103.85, 103.05

XAU/USD, H4

Gold prices experienced a retreat as the market anticipated a potential delay in Fed rate cut policies following better-than-expected US economic data. The rise in US Treasury yields, impacting non-yield assets like gold, contributed to the decline. However, persistent geopolitical tensions in the Middle East provided a counterbalance, supporting the safe-haven demand. The mixed sentiment suggests continued consolidation in the gold market, with investors advised to monitor geopolitical developments and US economic data.

Gold prices are trading flat while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 54, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 2035.00, 2060.00

Support level: 2015.00, 1985.00

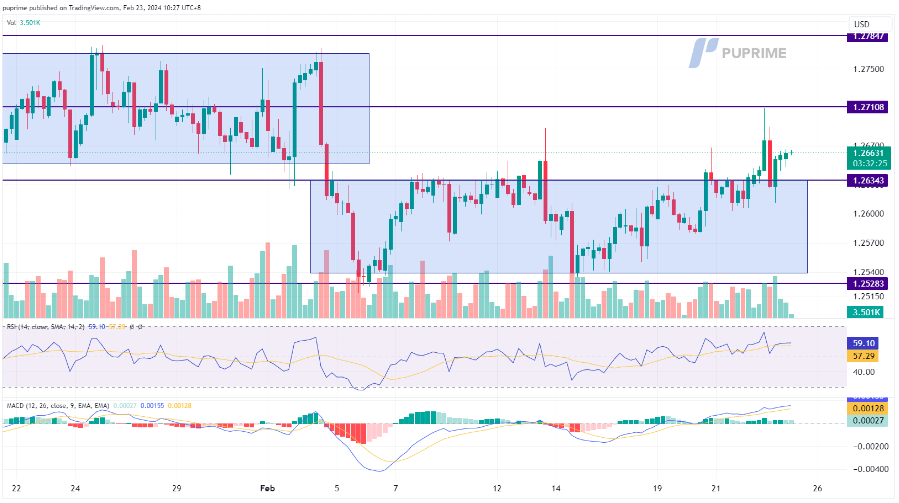

GBP/USD,H4

The GBP/USD pair has shown resilience, managing to hold its ground at the previously established resistance level of 1.2634. Initially, the pair faced downward pressure from a strengthened U.S. dollar, buoyed by positive job data from the U.S. that hinted at a robust economic performance. However, as market participants processed and adjusted to the sentiment, the impact of the strong dollar was mitigated, allowing the pound to defend its position effectively. The slight improvement in the U.K. Manufacturing Purchasing Managers' Index (PMI) compared to prior readings has also contributed to supporting the pound.

GBP/USD found support at its previous resistance level at 1.2634, suggesting a positive outlook for the pair. The RSI remains flowing at elevated levels while the MACD continues to surge, suggesting the bullish momentum remains strong.

Resistance level: 1.2710, 1.2785

Support level:1.2635, 1.2530

EUR/USD,H4

The EUR/USD currency pair has charted a bullish course, recovering from its prior nadir at the 1.0700 mark. The stabilisation of the Eurozone's Consumer Price Index (CPI) aligns with market forecasts, hinting at a tempered inflationary landscape within the region. Concurrently, an uptick in the Purchasing Managers' Index (PMI) readings signals a robust economic performance surpassing initial expectations. This confluence of factors is propelling the euro to ascend against its major counterparts, underscoring a newfound investor confidence in the currency bloc's economic resilience and growth prospects.

EUR/USD rebounded from its recent low and recorded a higher high price pattern suggesting a bullish bias for the pair. The MACD flow flat above the zero line while the RSI hovering near to the overbought zone suggests the bullish momentum remains intact with the pair.

Resistance level: 1.0865, 1.0954

Support level: 1.0775, 1.0770

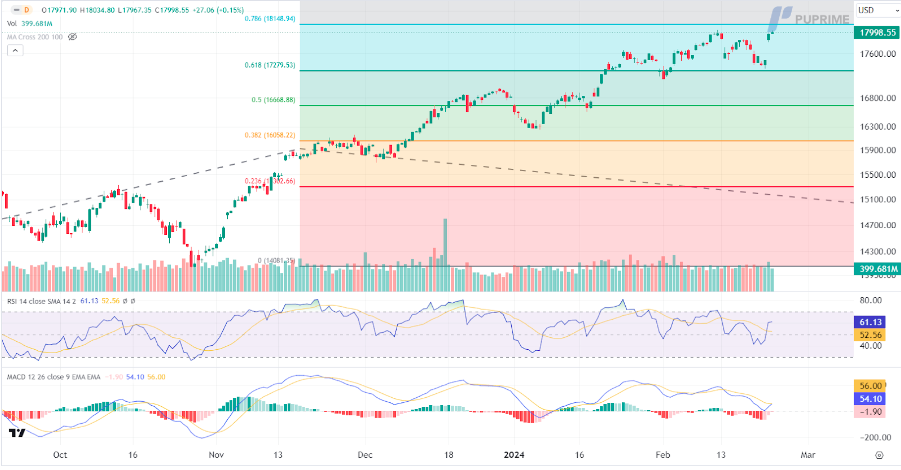

Nasdaq,H4

Nvidia's stock surged over 16%, reaching record highs, following the chipmaker's stronger-than-expected fourth-quarter earnings and an optimistic first-quarter revenue forecast of about $24 billion. Nvidia's success in the AI sector has positioned it as a key player, potentially influencing a positive spillover effect on other US tech companies and bolstering the performance of tech-heavy indexes like Nasdaq.

Nasdaq is trading higher while currently near the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 61, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 18150.00, 19255.00

Support level: 17280.00, 16670.00

NZD/USD, H4

The bullish momentum of the New Zealand Dollar (Kiwi) exhibited a minor slowdown in the last session, influenced by a convergence of bearish factors applying pressure on the currency. The robust job data in the U.S. bolstered the U.S. dollar, contributing to the Kiwi's retreat. Additionally, the recently released New Zealand Retail Sales figure fell short of expectations at -1.9%, further impeding the strength of the Kiwi. Market participants are now closely monitoring the Reserve Bank of New Zealand's (RBNZ) upcoming interest rate decision next week for insights into the future trajectory of the New Zealand Dollar.

The NZD/USD faced strong resistance levels at near 0.6202. However, the momentum indicators suggest the bullish momentum remains intact with the pair with the RSI remaining elevated and MACD flowing above the zero line.

Resistance level: 0.6205, 0.6250

Support level: 0.6150, 0.6094

USD/JPY, H4

The Japanese Yen is currently one of the weakest among the major currency pairs, primarily due to disappointing economic indicators. The recent decline in U.S. Initial Jobless Claims, compared to prior readings, underscores the resilience of the U.S. labour market, further bolstering the strength of the dollar. Market attention is now increasingly focused on the forthcoming release of Japan's National Core CPI data next week, a key metric anticipated to influence the Bank of Japan's (BoJ) future monetary policy decisions.

The USD/JPY pair has broken above its descending triangle pattern suggesting a potential bullish trend for the pair. The RSI is hovering closely to the overbought zone while the MACD has signs of rebounding from above the zero line, suggesting a fresh bullish momentum is forming.

Resistance level: 151.85, 154.80

Support level:149.50, 147.60

CL OIL, H4

Crude oil prices experienced a significant surge after an upbeat Energy Information Administration (EIA) inventory report revealed a substantial decline in US crude oil inventories. The data, showing a decline from 12.018M to 3.514M, surpassed market expectations. Simultaneously, rising geopolitical tensions in the Middle East, with Yemen's Houthis threatening escalated attacks and introducing "submarine weapons," raised concerns about potential supply disruptions.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 78.65, 81.20

Support level: 75.20, 71.35