Rising dollar spooked bitcoin, but not the entire crypto market

Market picture

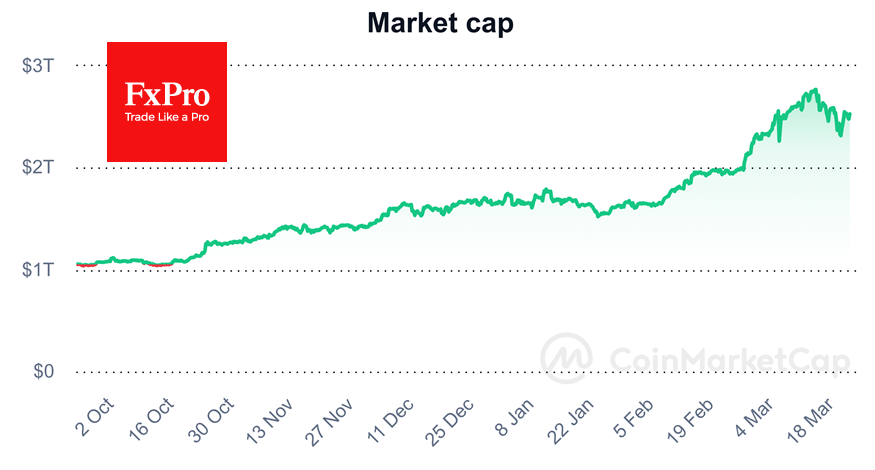

The cryptocurrency market closed lower on Thursday, but little changed from the $2.53 trillion market cap over 24 hours. However, the internal dynamics are mixed. Bitcoin loses 1.5% and retreats to $66K, while Ethereum hovers around $3500 (-0.25%), BNB and DOGE are up over 5%, and XRP is up around 4%.

It's as if the cryptocurrencies haven't chosen their shepherd: should they follow negative from the strengthening dollar or positive after new heights of US indices? We lean towards the latter, believing that the dollar strengthens against even weaker peers whose central banks are more dovish.

Overall, G10 central banks’ dovishness eases a liquidity drain, which is positive for cryptocurrencies that are sensitive to it.

News background

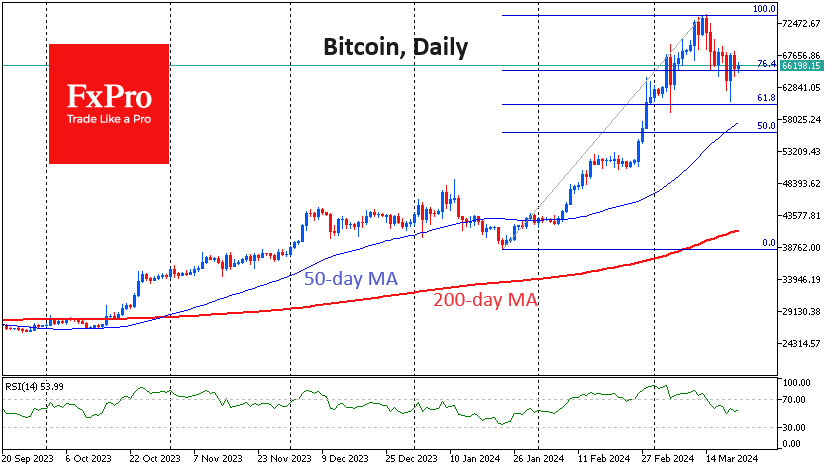

Bitcoin's current pullback is a temporary correction, according to CryptoQuant. Judging by the low level of inflows from new investors, BTC's bull cycle is far from over.

BTC could fall to $52K in the coming weeks, warned 10xResearch. However, there will be a further rise to at least $106K due to the upcoming halving in April.

The SEC has no good reason to reject applications to launch an Ethereum ETF, said Coinbase General Counsel Paul Grewal. For years, the commission has treated the world's second-largest cryptocurrency as an exchange-traded commodity rather than a security, he said.

Former US CFTC commissioner Brian Quintenz criticised the SEC's stance on Ethereum, saying the agency was creating confusion in the law.

Solana is attracting the most investor interest. Solana accounts for 49.3% of global investor interest in blockchain ecosystems in 2024, CoinGecko calculated based on internet search data. The leadership is fuelled by SOL's rise to highs from 2021, the development of ecosystem projects such as Pyth and the popularity of meme tokens such as dogwifhat.

Ethereum co-founder Vitalik Buterin said the main challenge for the network's PoS mechanism was the centralisation involved in staking services. Lido, Coinbase and Binance have gained "excessive market share", he said.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)