Risk sentiment remains weak ahead of key US data

Trump rhetoric creates nervousness

While the world is preparing for the January 20 Inauguration Day, when Trump will officially take over, market participants are trying hard to digest the latest set of commentary from the President-elect. Trump has been quite vocal about his second favorite topic, after the trade tariffs, namely the territorial demands on neighboring countries. Canada and Mexico have always been on his radar for various reasons, but Panama and Greenland have recently risen to the top of the list.

Especially the latter appears to be of paramount importance to the incoming President. Greenland is part of the Danish Kingdom, but this does not seem to bother Trump, who has warned about imposing significant tariffs on Denmark in order to essentially hand over Greenland. This is an interesting approach, catching the markets off guard, as most market participants were just expecting a tariffs-induced Armageddon.

US stocks suffer from uncertainty

These developments are fueling uncertainty and keeping US stock indices in the red this week, led by technology shares. It is fair to say that it has been a rather weak start to the new year with the S&P 500 index being barely in the green. Interestingly, European stock indices are faring much better, with the DAX 40 being 2.2% up in 2025, despite the severely negative newsflow about the eurozone.

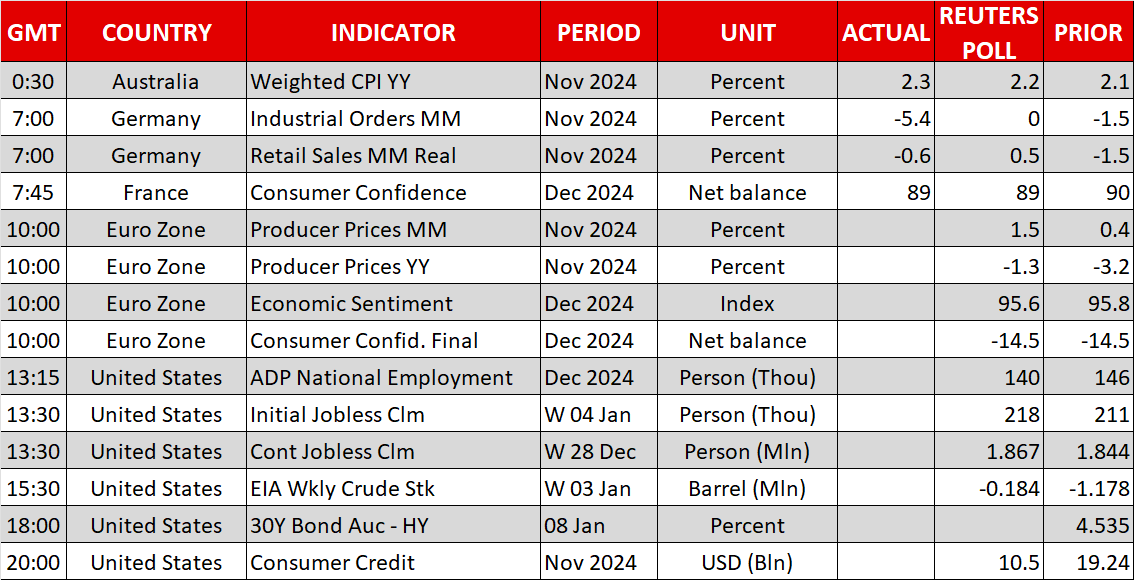

One of the main reasons for this weak performance of US stock indices is the heightened US Treasury yields. The 10-year US yield is hovering north of 4.6%, a level which is more consistent with a strong economy facing an inflation threat, rather than reflecting a weakening economy in need of further monetary policy accommodation. In this context, the US data calendar remains busy, with the release of the ADP employment report and the Fed minutes from the December meeting later today.

US data and Fed minutes in the spotlight

Following the December 19 Fed gathering, the focus has shifted from the labour market to the inflation outlook. Having said that, jobs data remain extremely important, especially if they produce surprises. After the stronger ISM Services report, which showed a significant pickup in price pressures, the market is forecasting a 140k increase in private employment for December.

But the focus will be on the Fed minutes. More specifically, it would be interesting to see how concerned Fed members really are about the inflation outlook, potentially justifying the significant revisions in the December PCE inflation projections, and whether the December rate cut was a compromise between the hawks and doves ahead of Trump’s second presidency. The market is looking for dovish hints, which increases the possibility of disappointment later today.

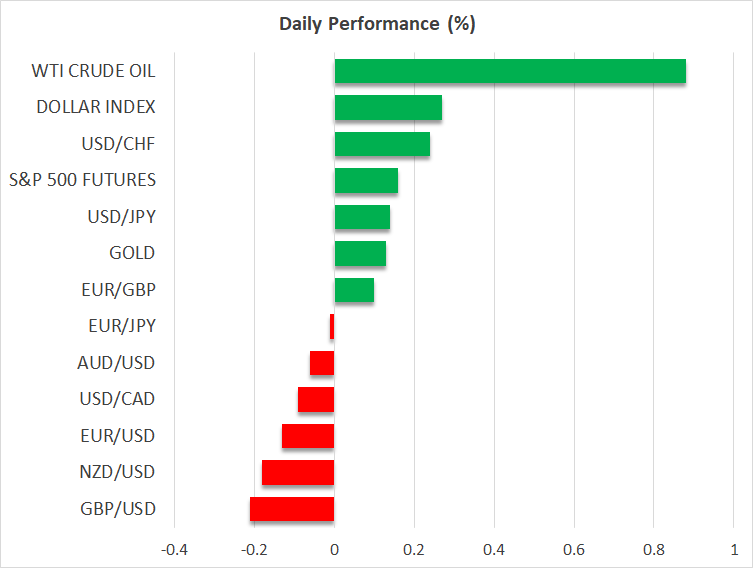

The US dollar continues to gain

Meanwhile, mixed movements in the FX space persist. Euro/dollar is edging lower again today, as the dollar is trying to recover from this week’s underperformance, while dollar/yen is hovering just below the 158 level. Despite the increased chances of a BoJ rate hike on January 24 and hawkish comments from former BoJ Governor Kuroda, the yen remains under pressure. Interestingly, in April 2024 the intervention took place when dollar/yen traded aggressively above the 158 level.

Finally, gold is hovering around its 50-day simple moving average, just north of $2,650, while bitcoin is suffering from the loss of positive momentum in US equities. The king of cryptos quickly shed its early 2025 gains, trading well below the key $100k level.