Risk sentiment strengthens, dollar slides as pivotal week gets underway

Dollar retreats after solid week

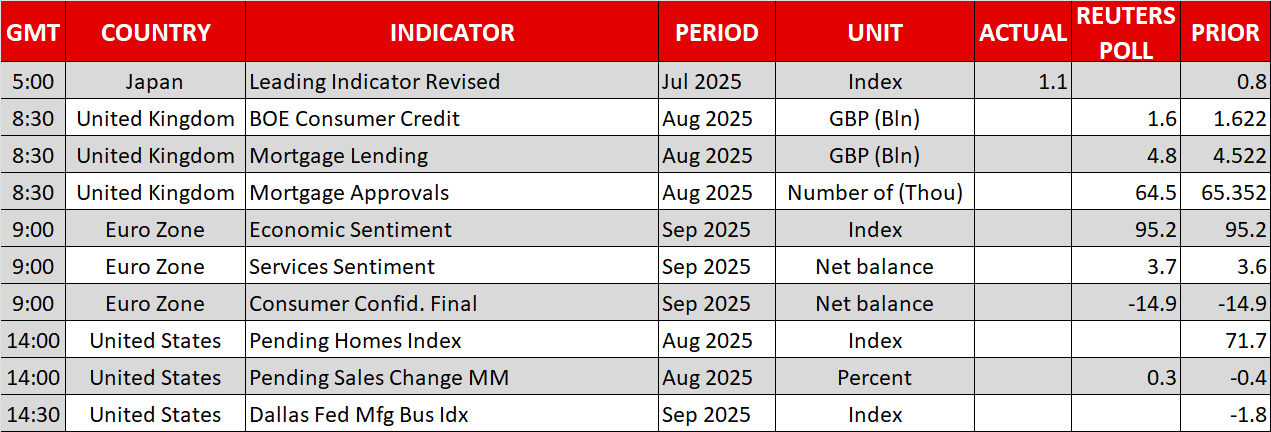

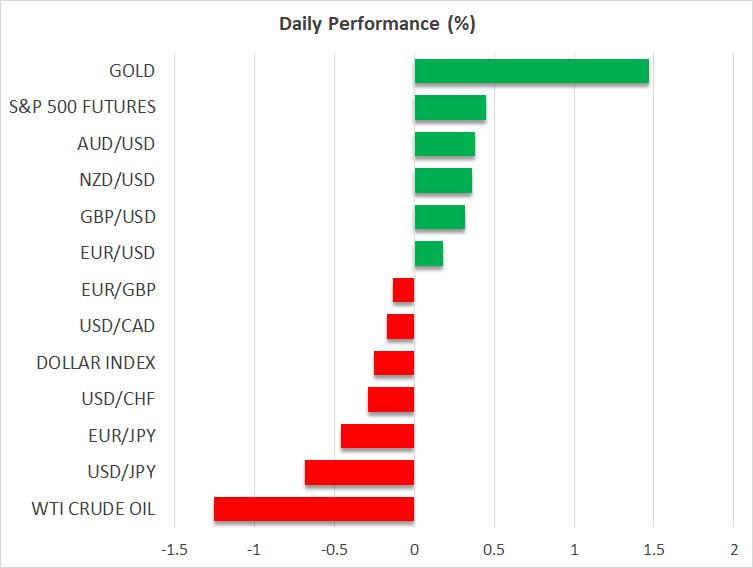

After one of its best trading weeks in a while, the US dollar is once again on the backfoot today, losing ground against most peers. The dollar index is already 0.2% down and euro/dollar is hovering around 1.1720 at the time of writing.

The greenback appears to be the victim of improved risk appetite. Following a mixed week for US indices, equities are bid today, with Asian stocks posting decent gains. More notably, after a sharp decline last week – with Ether dropping around 10% and bitcoin sliding to $108k – the cryptocurrency market is showing some signs of life.

This upbeat risk sentiment comes amidst a challenging environment and clouded outlook. In the US, economic data releases and the potential US government shutdown could prove an explosive mixture this week.

Specifically, following a solid set of data last week, with some noticeable upside surprises such as the Q2 GDP, focus now shifts to the labour market. Along with the valuable ISM surveys, the nonfarm payrolls print and the remaining jobs-related data could play a pivotal role in shaping expectations for a late October Fed rate cut.

Today’s calendar is rather light, hence Fedspeak will be in the spotlight once again. At least five speakers will be on the wires – Fed board members Waller and Williams, and regional Fed presidents Hammack, Musalem and Bostic – with a strong chance of hawkish remarks that could weigh on risk appetite.

Is a US government shutdown imminent?

In the meantime, a US government shutdown could take place this week, as Democrats and Republicans have failed to reach common ground on spending plans. The debt ceiling was raised with the “Big, Beautiful Budget” approved in July, but Congress is still debating the appropriate spending bills. Without an agreement on these bills or an approved continuing resolution (CR), which will just keep the government funded for a specific period, a shutdown could start on Wednesday, October 1.

President Trump is set to meet with the four Congressional leaders today, in a last-minute effort to bridge the gap, but chances for an agreement today are low, particularly if Trump starts blaming Democrats for the stalled progress. Notably, while both sides appear determined to pursue their objections, they worry about the political impact of another shutdown.

Meanwhile, following tariffs decisions on trucks, bathroom furniture and pharmaceutical products – targeting firms without a US presence – Trump is focusing again on chips and specifically finished products like electronic devices. If one adds reports that LDP leadership contender Takaichi might seek to renegotiate the US-Japan agreement, trade flare-ups could return with a vengeance during the last quarter of 2025.

Gold higher, oil reacts to extra production

Gold continues its aggressive climb, recording another all-time high, with the precious metal trading to $3,815 at the time of writing. Despite reports that the US President is closing in on a deal with Israel and Hamas about Gaza, the escalation seen in the Ukraine-Russia conflict is fueling demand for gold.

Following a 5% rally last week and a new two-month high of $66.75, oil prices appear to stabilize above $65 today. Investors are digesting reports that the OPEC+ alliance is going to increase its production again by a minimum of 137k bpd at its upcoming meeting, and the restart of Kurdish oil flows through the Kirkuk–Ceyhan pipeline after almost three years.