Sanctions Deepen, Oil Prices Surge Against Consensus

Fundamental Analysis of WTI OIL WTI OIL Key Takeaways

- Sanctions trigger oil price increases: In the past few months, the market consensus for 2025 is that crude oil will be in large surplus, prices will be flat or even weak. But the outlook has become more complicated after the United States imposed the boldest package of sanctions on Russia’s energy industry to date. The market expects that sanctions will force buyers of Russian oil to seek other supplies.

- Three major crude oil reports: This week, the three major oil market institutions will publish their latest monthly reports to help investors sort out their thoughts. The U.S. Energy Information Administration (EIA) will release a report on Tuesday, and the Paris-based International Energy Agency and the oil-producing group OPEC will release reports on Wednesday. Currently, OPEC plans to relax its supply restrictions from April.

Technical Analysis of WTI OIL Daily and Hourly Charts WTI OIL Daily Chart Insights

(WTI OIL Daily Price Chart, Source: Ultima Markets MT4)

- Stochastic oscillator: The indicator is out of the overbought area and sent a bullish signal again yesterday. It suggests that the upward trend is strong, bulls still have the upper hand, and traders can still pay attention to short-term long opportunities.

- Strong rise: Yesterday, oil prices broke through the downward trend line since September 2023 without adjustment, suggesting that the bulls are strong. The next target is the 80 integer mark, which is also the previous long-short conversion price of 80.46.

WTI OIL 1-hour Chart Analysis

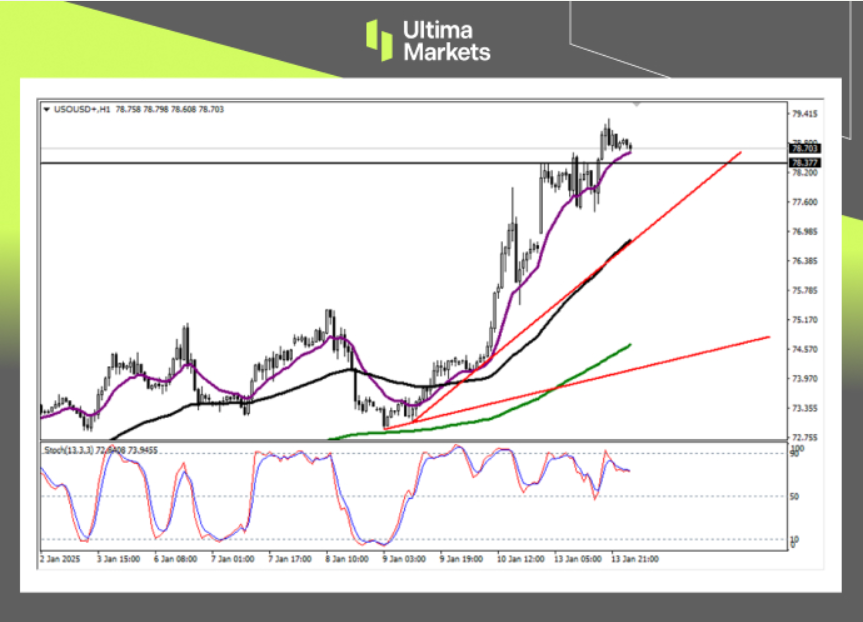

(WTI OIL H1 Price Chart, Source: Ultima Markets MT4)

- Stochastic oscillator: Focus on the divergence between the current indicator and the oil price. Since last week, the intraday trend has shown three consecutive top divergences. In theory, it is due to fundamental news that stimulated the short-term rise in the market price. Be alert to the adjustment of the indicator during today’s Asian session, or it may fall below the 50 median line.

- Adjustment target: The current upward trend of oil prices has always been supported by the 13-period MA of the color. Before the oil price falls below the MA, the oil price still has the probability of continuing to rise. However, it is necessary to be vigilant about the deep adjustment of oil prices at any time. The target below is the upward trend line, which is also the black 65-period MA.

Pivot Indicator Insights for WTI OIL

(WTI OIL M30 Price Chart, Source: Ultima Markets APP)

- According to Pivot Indicator in Ultima Markets APP, the central price of the day is established at 76.30,

- Bullish Scenario: Bullish sentiment prevails above 76.30, first target 78.00, second target 79.10;

- Bearish Outlook: In a bearish scenario below 76.30, first target 75.60, second target 74.60.

How to Navigate the Commodity Market with Ultima Markets To navigate the complex world of trading successfully, it’s imperative to stay informed and make data-driven decisions. Ultima Markets remains dedicated to providing you with valuable insights to empower your financial journey.

For personalized guidance tailored to your specific financial situation, please do not hesitate to contact Ultima Markets.

Join Ultima Markets today and access a comprehensive trading ecosystem equipped with the tools and knowledge needed to thrive in the financial markets.

Stay tuned for more updates and analyses from our team of experts at Ultima Markets.

—–

Legal Documents

Ultima Markets, a trading name of Ultima Markets Ltd, is authorized and regulated by the Financial Services Commission “FSC” of Mauritius as an Investment Dealer (Full-Service Dealer, excluding Underwriting) (license No. GB 23201593). The registered office address: 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.