Silver is one step ahead of Gold

Silver is one step ahead of Gold

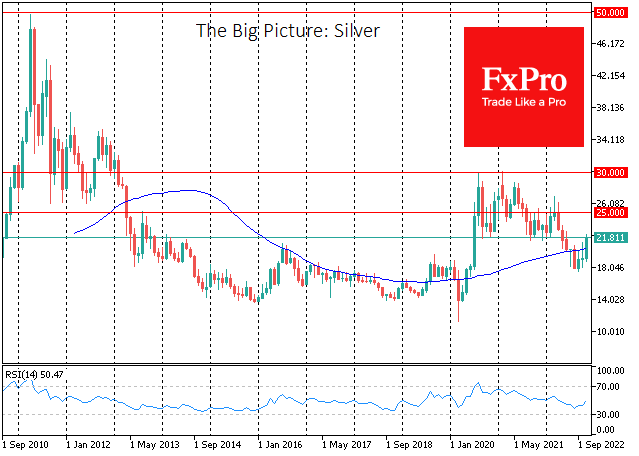

Silver is testing the $22 per ounce mark today and crossed it briefly yesterday. Although Gold marks the fifth consecutive session of back-to-back gains, Silver may have been one step ahead in this market cycle.

In early November, the price of Silver pushed up from the 50-day moving average, which had worked as a support for a week and a half before, as the metal was bought off intraday on dips under this line.

Further, while the S&P500 and stock markets, in general, were recovering from the not-so-dovish Fed comments, Silver rallied more than 7% on solid NFP data, leaving the other precious metals behind. This was a clear game-changer event for this market.

By rising in the following days, the price has reached its 200-day moving average, which Gold, S&P500 and EURUSD have yet to do. Since late last week, Silver has been gaining support on declines towards this line, confirming a change in the long-term trend.

Silver has already lingered near $22 in May and June, digesting the April collapse. There have also been repeated reversals in this area late last year and early this year. There might likely be some shake-out of market participants and partial profit-taking again.

The strong price momentum at the start of November and an even more impressive 9% rise in early October point to a demand, which might turn the market around. This bullish reversal is probably happening in Gold, but it is a more liquid and thus "noisy" instrument.

If we are correct, and after the local shake-out, silver goes further up, it could immediately target levels above $25, near the local peaks of March and April. If the strengthening does not fail again, the price may rise to $30 by August 2023.

It will be premature to talk about the possibility of reaching the highs of 2012 ($35) or 2011 ($50), but targets near $25 by the end of the year and $30 eight months later look achievable.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)