Stock indices: stagflation is scarier than a war

Stock indices: stagflation is scarier than a war

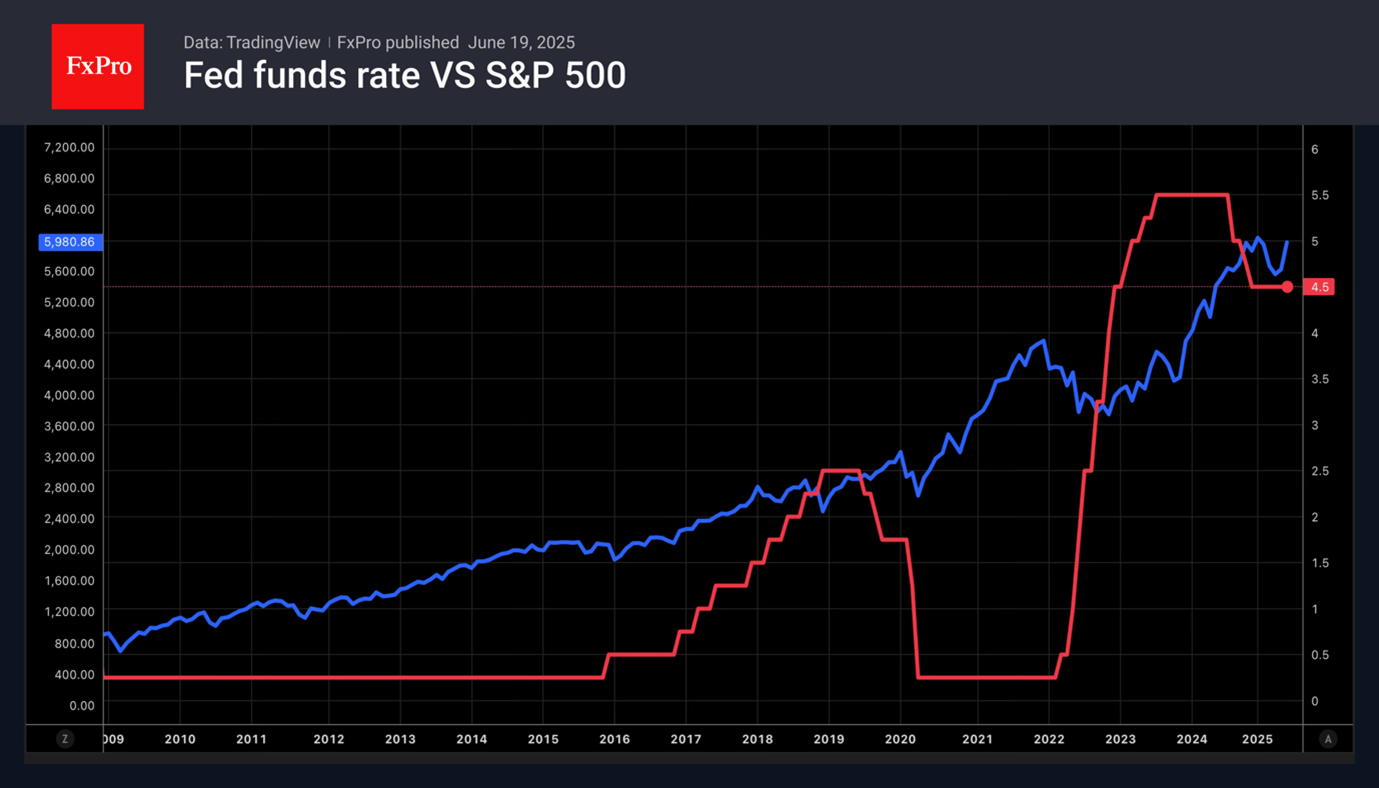

At its June meeting the Fed painted a stagflationary scenario. The central bank lowered its forecast for US GDP in 2025 from 1.7% to 1.4% and raised its inflation estimate from 2.7% to 3%. This scared the S&P 500 more than the war in the Middle East and the potential increase in tariffs after the end of the 90-day grace period. The broad stock index retreated but continues to trade close to record highs.

Donald Trump is trying to support the US stock market. He is calling on the Fed to cut the federal funds rate by 1–2.5 percentage points. The US president claims to have already collected $88 billion from tariffs while inflation remains low. However, his criticism of Jerome Powell is more likely to scare investors than inspire them to buy.

Markets are concerned about the White House's willingness to raise import duties after the 9th of July and the ongoing Israel-Iran conflict. According to RBC Capital Markets, if it drags on, the S&P 500 could fall by 20%. Deutsche Bank warns that a twofold increase in oil prices in the past has led to recessions in developed countries.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)