Strong NFP could deepen correction in stocks & support the dollar

The monthly jobs report has enough potential for the market to set the trend for the coming weeks. However, there is also a risk that the extensive list of indicators, from employment change and unemployment rate to the pace of wage growth, will feed both the dove and hawk camps.

In our view, the slowdown in US job creation is unlikely to be a game changer. Perhaps the only thing that could affect the markets would be a drop in employment. But this would be an unexpected turn of events, as the preliminary figures are more likely to show growth above the expected 200-210k for March.

Much more volatility is likely to come from the wage growth rate. The recent increase in the minimum wage and ADP's announcement of a 5% acceleration in wage growth make the release cautious.

An acceleration in wage growth could negatively impact risk demand in two ways. Firstly, it will dramatically increase the chances that the Fed will push back even further on plans to start cutting rates and reduce the expected number of cuts this year. That's good news for the dollar but bad news for the stock market, much of whose rally was based on easing forecasts.

Second, wage increases and staff build-ups translate into higher costs and drag down profits. And that's bad news for stocks.

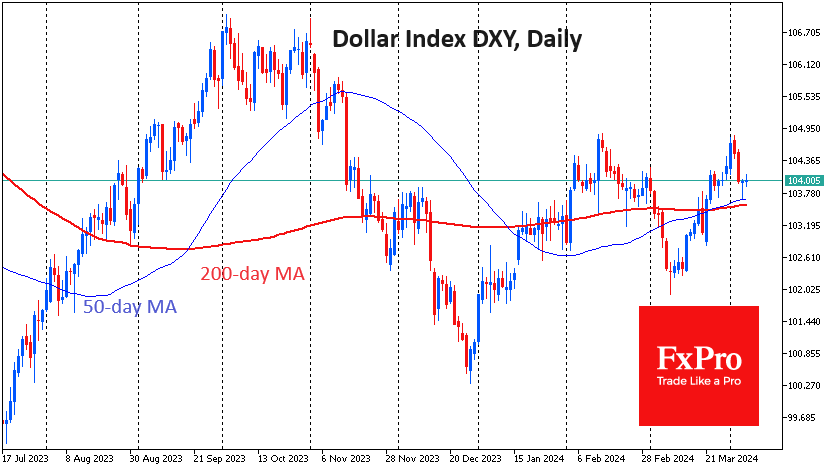

It could be a verdict for key US indices, which have been clinging to the lower boundary of the uptrend of recent months after Thursday's sell-off. A failure under the 50-day average promises to accelerate the sell-off in equities, putting the 200-day as the bears' next target. For the Nasdaq100 index, this opens up the potential for a 10% decline, while the Dow Jones 30 could fall 6.7%. News positive for the dollar has a chance to breathe new life into the DXY rally, which started on last month's NFP but lost momentum at the start of April.

However, it is well worth being prepared for a continuation of the trend towards more moderate wage growth at a rate of job creation just below 200k per month, which is in line with the long-term trend of healthy economic expansion.

We also can't rule out cooling surprises in wages. In theory, this would be a major relief for the stock market, which would have a chance to cling to established growth trends and return to storming highs in the next couple of weeks. In such an outcome, the Dollar Index may pull back from the current 104 below 103.5 and then head towards 102.3, the area of the lows of the last three months.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)