The crypto market is poised for a deeper correction

Market picture

The crypto market lost 1.8% to last week's level of $1.192 trillion, spending most of its time within the $1.190-1.210 trillion range and near its lower boundary on Monday morning. The market has found its temporary equilibrium as it awaits the decisions of three major central banks - the Fed, the ECB, and the Bank of Japan - later this week. Their actions and comments will likely complete the market consolidation and set the trend for the coming weeks.

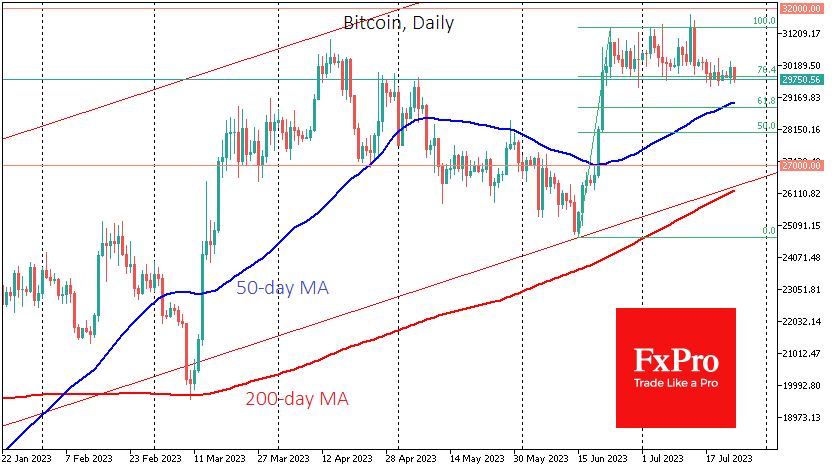

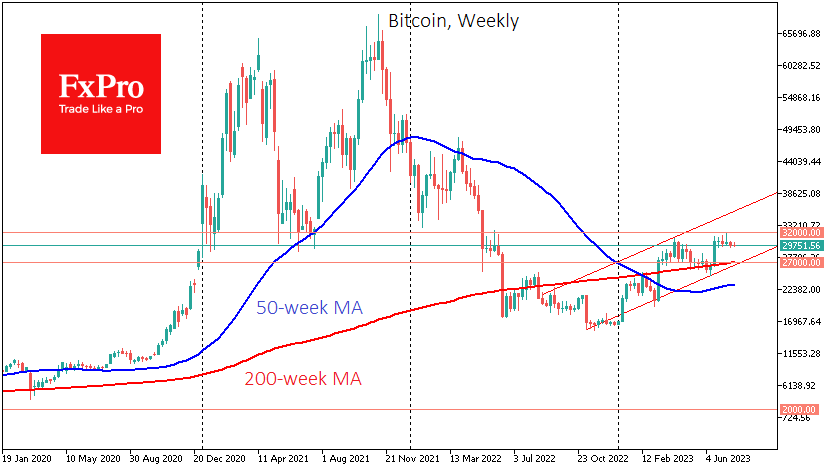

Bitcoin continues to test the lower end of the range, trading at $29.8K, but a closer look reveals a downtrend, with periods of weakness occurring at slightly lower levels. On the other hand, the bulls still manage to buy back BTCUSD on dips below $29.7K. Nevertheless, be prepared for Bitcoin to fall to $28.9K as part of a typical correction to 61.8% of the initial rise since mid-June and the 50-day MA.

If bearish pressure intensifies, the next significant support level would be $27K, the lower boundary of the rising channel from the November lows and the 200-week moving average.

News background

Bitcoin will soon fall to almost nothing, says Spencer Schiff, a former BTC backer and son of prominent crypto critic Peter Schiff. He has become disillusioned with cryptocurrency and now believes that the most attractive projects will be those based on artificial intelligence.

Republicans in the US House of Representatives released a draft bill to regulate the digital asset industry, requiring the SEC and CFTC to develop rules.

Cryptocurrency exchange Coinbase closes its Borrow lending programme. The programme allowed customers of the largest US exchange to borrow up to $1 million against crypto assets.

MicroStrategy co-founder Michael Saylor said Argentina's economy can only recover thanks to cryptocurrencies, especially Bitcoin. Argentina is leading the way in cryptocurrency adoption in Latin America amid high inflation.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)