The crypto market is temporarily more attractive than stocks

Market picture

Cryptocurrency market capitalisation rose 2.2% over the past 24 hours to $1.183 trillion, returning to Wednesday's highs. Cryptocurrencies came under selling pressure after the stock market at the close of the US session on Thursday but found much more support on that local dip.

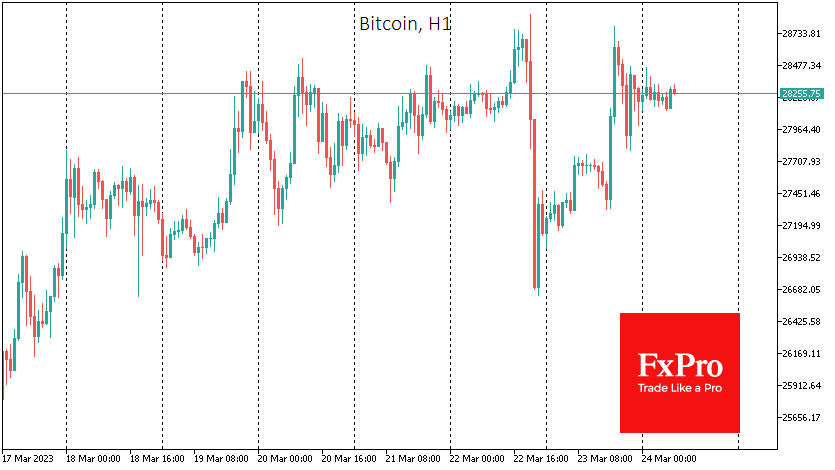

Bitcoin failed to rewrite the previous day's local highs on Thursday but found support from increasingly higher levels during the day, which looks like a short-term bullish signal. Despite entering the oversold territory on the daily chart's RSI, Bitcoin still has a good chance of testing the $30K level before a medium-term correction to $25K.

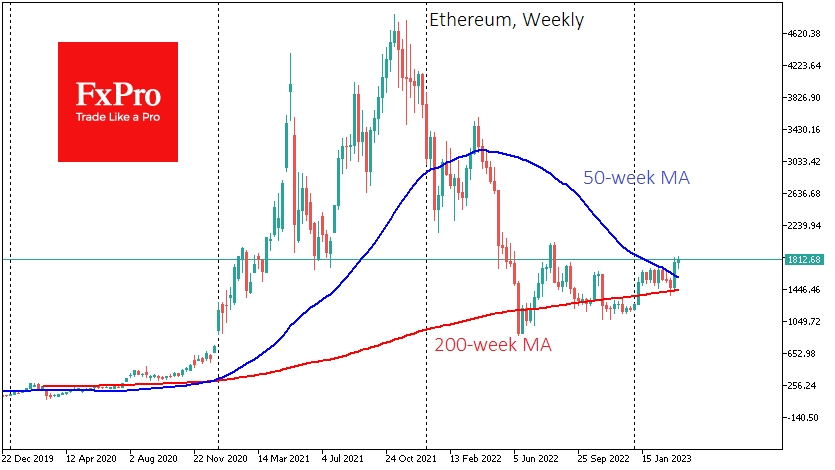

Ethereum has shown more modest momentum recently and renewed local highs yesterday before retreating to $1800. A promising bounce from the 200-week average and a consolidation above the 50-week average has been formed on the weekly timeframe. This week's momentum confirms the return of active bulls and sets up a test of $2000 in the coming weeks.

News background

Top crypto industry executives interviewed by CNBC remain bullish on the first cryptocurrency. Tether CTO Paolo Ardoino believes bitcoin could retest its previous record high of $69K. Gemini cryptocurrencies exchange strategic director Marshall Beard believes BTC could hit $100K this year.

The US Securities and Exchange Commission (SEC) has sued Tron project founder Justin Sun and three of his companies for "unregistered sales of securities in the form of cryptocurrencies" Tron (TRX) and BitTorrent (BTT). The regulator also believes that Sun manipulated the secondary market for TRX through "laundered trading".

US cryptocurrency exchange Coinbase has received a notice of investigation from the SEC regarding the listing process on the platform and its products - Coinbase Prime, Coinbase Wallet and the Coinbase Earn stacking service. The exchange has time to respond.

Ethereum can maintain its leadership position in the blockchain if its developers increase ETH's bandwidth. Otherwise, network use will decline significantly in the coming years, according to a report by Bank of America.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)