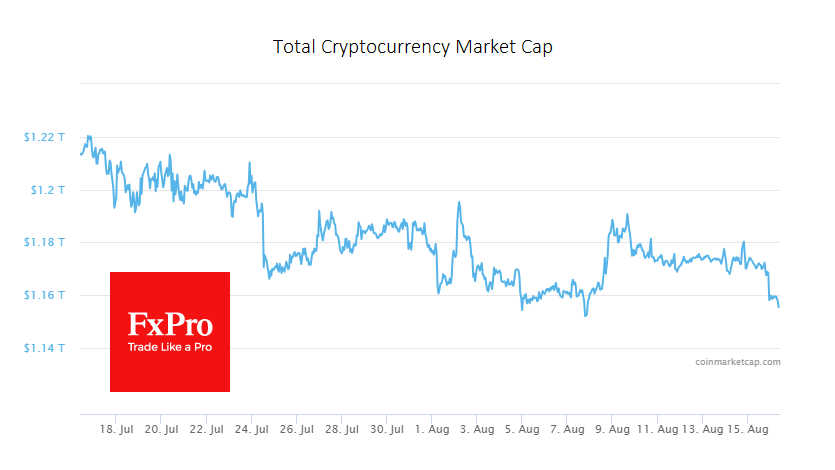

The crypto market starts moving down

Market picture

The crypto market lost 1.2% over the past 24 hours to $1.156 trillion. This is a downward move, albeit small, after a long consolidation. Larger currencies have seen less pressure than smaller altcoins. Rising US Treasury yields put pressure on riskier assets and attracted some capital. Thus, Bitcoin lost 0.7% on the day, Ethereum - 1%, and altcoins lost from 6.3% (Solana) to 1.1% (Tron).

According to The Block, bitcoin volatility fell to a record low, with BTC's 30-day volatility on an annualised basis dropping to 15.5% from 61.4% last year. Glassnode also notes the extreme level of apathy and exhaustion amid the drop in volatility.

Bitcoin approached $29.0K after a prolonged consolidation of around $29.4K. Technically, the sell-off in Bitcoin could gain momentum on a break below $28.9K. In this case, the price could quickly fall to $28.0K or even $27.2K.

News background

Kevin Kelly, Delphi Digital co-founder and head of research, sees signs of an early bull rally in the crypto market. He believes BTC could reach new all-time highs around the end of 2024, following its halving.

Crypto-related activity may pose new and complex risks to the US banking system that are difficult to assess fully. This is the conclusion of the US Federal Deposit Insurance Corporation's (FDIC) annual review.

UK-based Jacobi Asset Management has launched Europe's first spot bitcoin ETF. The instrument is listed on Euronext Amsterdam and includes a renewable energy certification solution.

New Zealand cryptocurrency exchange Dasset has closed customer access to assets and announced it will begin liquidation after six years of operation. According to media reports, users had been trying unsuccessfully to withdraw funds from the platform for months.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)