The crypto market tries to buck negative

Market Picture

Cryptocurrency market capitalisation fell 1.2% overnight to $1.07 trillion. This level has been the focus of attention since Sunday, reflecting the consolidation of the participant’s strengths. The cryptocurrency fear and greed index is back in the 50s. Since January, periods of greed are alternating with a neutral sentiment, not fear.

Bitcoin continues to find support as it falls to 23k, an impressive result amid falling markets and a stronger dollar. The first cryptocurrency remains virtually unchanged, effectively fighting off the strong headwinds that pushed the Nasdaq100 back five weeks ago.

Significant signal levels on the way down for Bitcoin appear to be around $22.7K, where the 50-day moving average and the local lows from late last week are concentrated. If this support fails to hold, the next major stop is not expected until $21.5K, negating February’s bullish momentum.

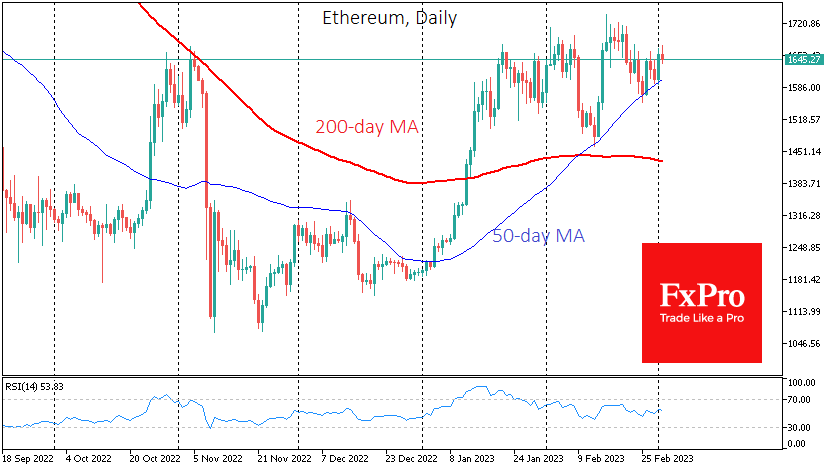

Ethereum is sandwiched between resistance in the 50-week average (near $1690) and the 50-day average (near $1600). A bearish victory in this local battle could trigger a quick pullback to $1400.

Background news

France is set to tighten licensing rules for cryptocurrency companies. The country’s lower house of parliament has approved a set of new regulations for the licensing and registration of cryptocurrency companies. If the bill is passed, the changes will take effect from July 2023.

Major stablecoin issuers, united in the Stablecoin Standard group, have announced work to create a common set of standards to increase consumer confidence in digital assets.

The Gamium blockchain project’s GMM token surged 650% after it announced a partnership with Meta and Telefonica as part of the Metaverse Activation Programme initiative. The joint programme between the giants aims to empower and scale startups in the Metaverse and Web3 space.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)