Two drivers of crypto growth

Market picture

Crypto market capitalisation rose 5% in 24 hours to $2.44 trillion, driven by extreme greed. The crypto market had a higher capitalisation for a few days in May and October-December 2021, but that was in an ageing bull market compared to a relatively young one now.

The current growth wave can be broken down into two drivers. The first is the demand for Bitcoin and Ethereum. They are favoured by large investors concerned about a new wave of problems at US regional banks. This buying interest also applies to gold. Almost exactly a year ago, we saw a similar move that saw the price of BTC rise by a third in a week.

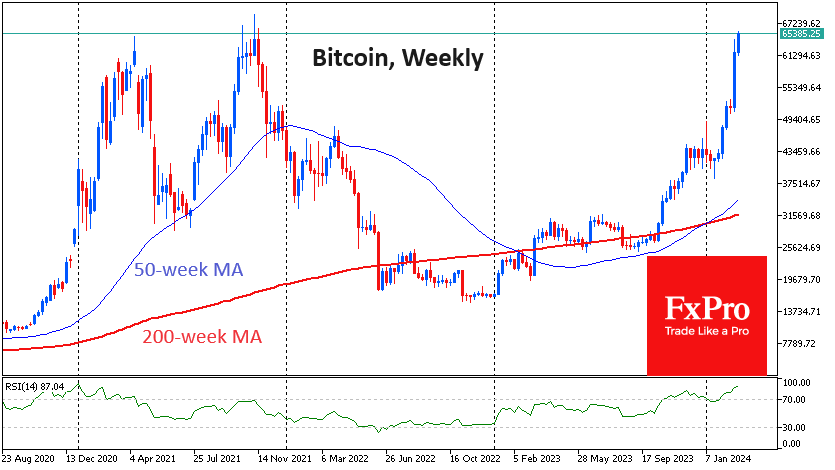

In early trading on Monday, the price of bitcoin was above $65K. That's about 5% off the all-time high, but the cryptocurrency has only been above that level for a few hours, and we've only seen three daily closes above that level.

The other half of the rise is the demand for meme coins, which goes hand in hand with FOMO. Despite the meteoric rise, the market has not yet reached the absurd highs to start talking about reversal risks.

News background

Influential logger and analyst PlanB has declared the beginning of a FOMO bull market period according to his Stock-to-Flow model. According to him, "The accumulation phase is over. There are no more easy buying opportunities in orderly and slow-growing markets". The crypto market has been in FOMO for about ten months: "extreme price spikes combined with multiple 30% drops," PlanB believes.

The Solana-based meme token dogwifhat (WIF) is up 390% in a week, a record high among the top 100 cryptocurrencies. With a capitalisation of nearly $1.7 billion, it ranks 62nd on CoinMarketCap.

According to Lookonchain, an unidentified crypto investor sold all PEPE's accumulated 1.97 trillion meme tokens for $6.07 million and bought other altcoins - netting $3.49 million. PEPE rose 310% in one week. Lookonchain has a whale wallet that is classed as 'smart', meaning that most of the trades on the address are profitable.

Macroeconomic factors could prove to be the main obstacles to further BTC growth in the short term, according to Grayscale. If inflation remains stubbornly high, the Fed may delay a rate cut. A higher interest rate is likely to be positive for the dollar and negative for Bitcoin.

The Bank for International Settlements has issued recommendations on the regulation, supervision and oversight of global stablecoins (GSCs) to address the financial stability risks posed by GSCs both domestically and internationally.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)