Upbeat PMIs brought buyers back into the Euro

Preliminary estimates of European business activity indices noted an overall acceleration in the Eurozone economy better than expected, helping the Euro find temporary support as it approaches 1.08.

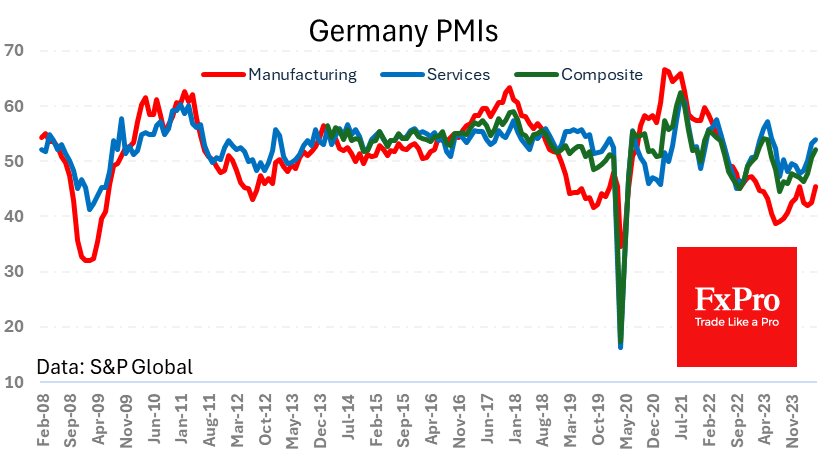

Germany provided the biggest upside to expectations this time around after months of negative surprises. The manufacturing PMI rose from 42.5 to 45.4 vs. the forecast of 43.2. This is still in contraction territory (below 50), but the trend is clearly positive.

Germany's service sector is strengthening its expansion, as reflected in the rise in the corresponding PMI to 53.9, the highest since last June. This is a territory of healthy growth and where the index was from 2013 to 2019.

Germany's composite PMI is only on the cusp of normal levels due to weakness in manufacturing, but the positive trend is building optimism.

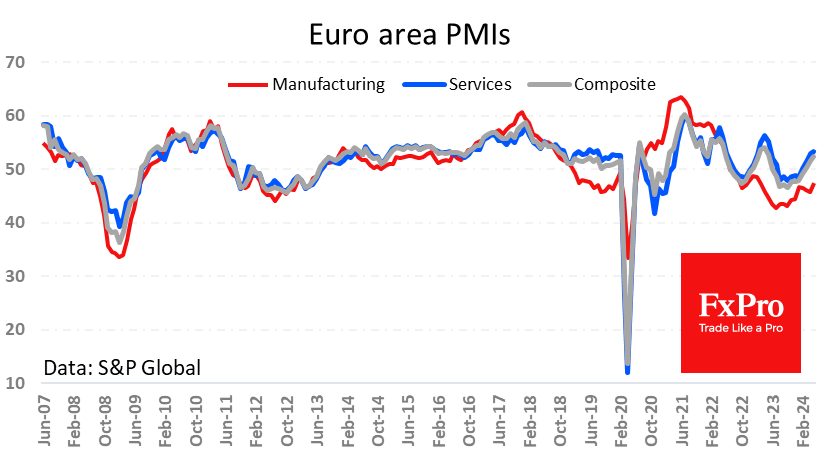

For the eurozone, the positive trend in PMIs is also unambiguous. All three indices reached multi-month highs and came out stronger than expected. As in Germany, the dynamics of the services sector are close to what we have seen during 2014-2019, relatively quiet years for the euro area.

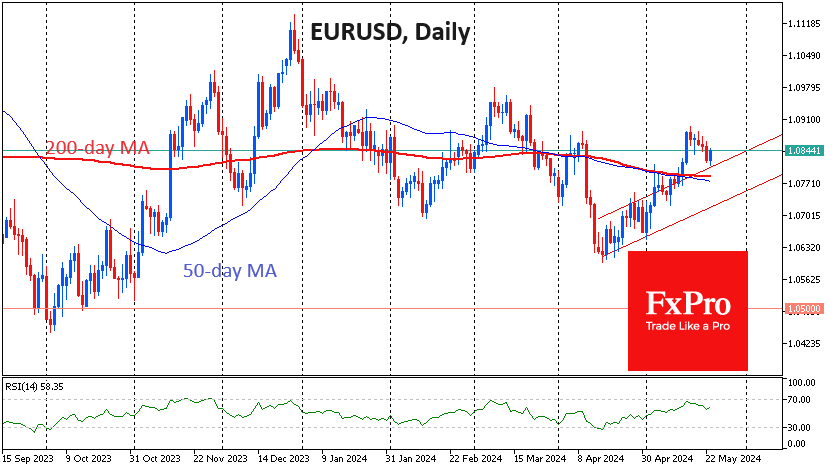

It is not unusual for PMI releases to have a meaningful impact on the performance of the Euro or the region's stock indices. Today's release was no exception, and EURUSD reversed to the upside after drifting downward for a week. However, the pair's loss of about a hundred points during this time looks like a correction after the acceleration since the beginning of the month.

Whether this is the case will be clear in case of consolidation above 1.09. A rise above the previous peaks will confirm the bullish trend, opening the way to 1.11 or higher.

We see an additional positive signal in the fact that EURUSD has received active support from buyers above the 1.0770-1.0780 area, where the 50- and 200-day moving average, as well as the former resistance line of the ascending channel, are located.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)