US and China restore trade truce but markets subdued ahead of US CPI

US and China agree to ease export curbs

Two days of trade talks between the United States and China appear to have reached a positive conclusion with the two sides agreeing on a framework for implementing last month’s Geneva deal. After both Washington and Beijing accused each other of violating the terms of the Geneva truce, negotiators seemed to have worked out a way forward for easing export curbs.

Few details have been revealed about the deal struck at midnight in London, but US Commerce Secretary Howard Lutnick has indicated that China has agreed to ship more rare earths and magnets to the US, while the Trump administration will allow more exports of sensitive technology such as advanced chips.

Equities modestly upbeat

The market reaction has been muted, however, as all this deal does is put the original trade truce back on track. Moreover, both US President Trump and Chinese President Xi will have to approve what’s been agreed in London.

Essentially, this is the minimum that was expected from these talks and although breaking the deadlock may now speed up the negotiations to reach a more permanent deal on lowering the tariffs, investors have probably realised that that’s going to be a long process.

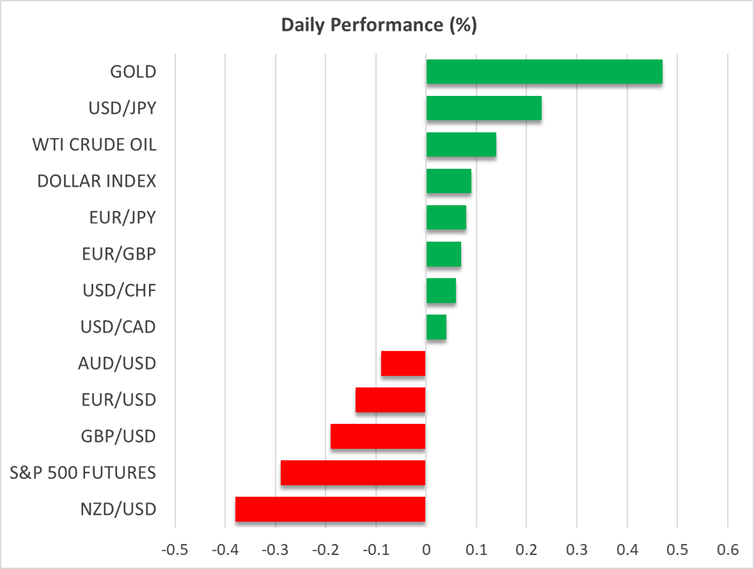

China-listed shares in Hong Kong once again rallied the most from the headlines, and other Asian indices such as the Nikkei 225 notched up decent gains on Wednesday. But stocks in Europe were mixed and US futures reversed some of yesterday’s gains on Wall Street.

On the whole, trade optimism remains alive and this has been leading the MSCI All-Country World index to record highs, even though the positive momentum is not particularly convincing either on Wall Street or in the rest of the world.

Dollar eyes CPI data and Treasury auctions

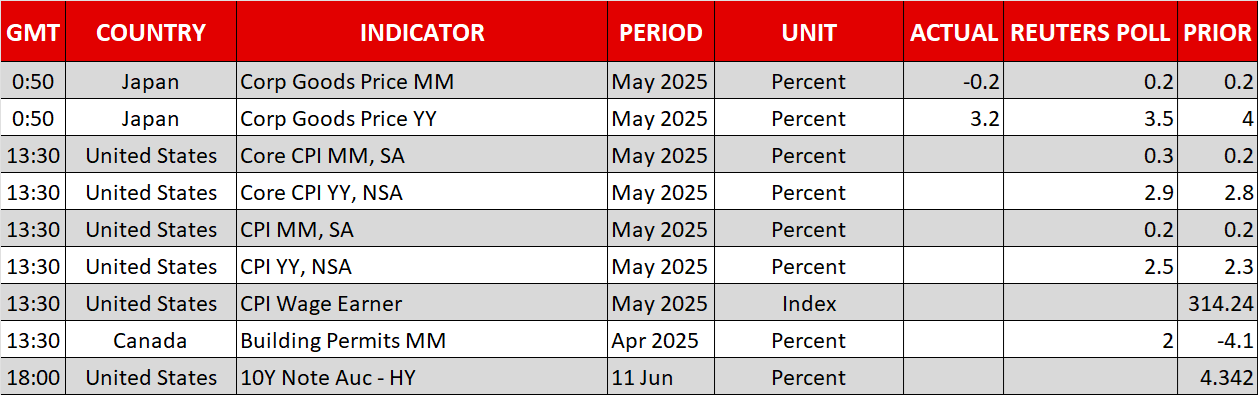

There is still a lot of uncertainty surrounding the outlook, with a major worry being the tariff impact on US inflation. The CPI report for May is due later today (12:30 GMT) and is expected to show both headline and core inflation accelerating as the higher import duties begin to feed into prices.

A more recent uncertainty is the lawsuit by small American businesses against Trump’s tariffs. The US Court of Appeals yesterday ruled that its earlier reversal of the International Trade Court’s blocking of reciprocal tariffs can stay in effect until July 31 when it will hear fresh arguments, after which, the case may head to the Supreme Court.

Investors have lately been dialling back their rate-cut expectations, with year-end odds pointing to less than two 25-basis-point cuts. But the US dollar has barely recovered, steadying at best.

A weaker Japanese yen has been propping up the dollar index against a basket of currencies amid speculation that the Japanese government will cut back on its issuance of long-term debt or even buy back some, which would push down yields. The Bank of Japan could also intervene to keep yields low by slowing down its bond tapering, potentially as early as next week when it meets.

In the meantime, investors will be watching today’s 10-year US Treasury auction, which will be followed by a 30-year auction tomorrow. The timing of the auctions isn't the best as a hotter-than-expected CPI report risks spooking markets, hurting demand for US debt and possibly exacerbating any spike in yields from the inflation data.

Pound on the backfoot, gold heads higher

Elsewhere, the pound remained under pressure following yesterday’s broadly soft labour market stats. Investors have since upped their bets of Bank of England rate cuts, fully pricing in two 25-bps reductions for 2025. The focus today, however, will be on UK finance minister Rachel Reeves’ spending review for the next three years.

Whilst any increase in investment on infrastructure, energy and defence will be welcome, any hints of further tax hikes at the next budget could weigh on sterling.

Ahead of today’s events, gold prices edged higher, approaching $3,350/oz. The safe-haven gold may be consolidating in the bigger picture but there is firm support at the moment amid the dollar’s persisting weakness, doubts about the prospect of new trade deals, and now the violent protests in Los Angeles where President Trump is trying to assert his authority.

.jpg)