US economy about to contract

This week's PMI business activity figures were much weaker than expected, reflecting the impact of the sharpest monetary tightening in more than 40 years on the economy.

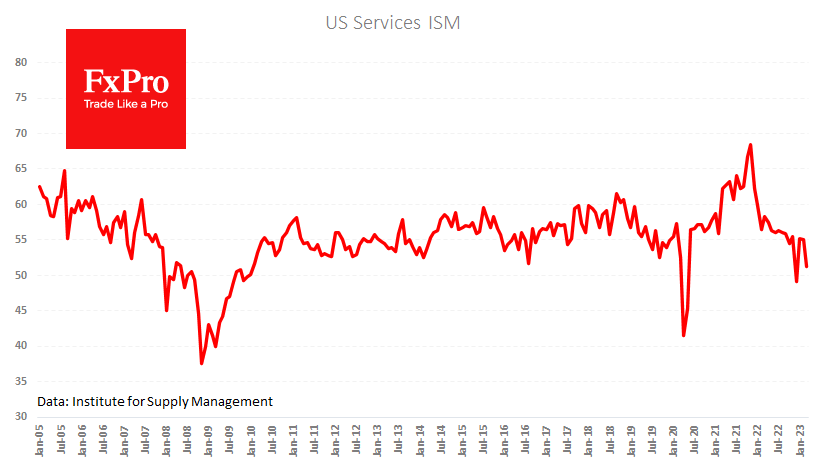

The ISM's service sector data attracts the most interest from market participants as it represents the broadest sector of the economy. The index fell from 55.1 to 51.2 in March, against expectations for a drop to 54.3. Readings above 50 reflect an overall activity increase, but the pace of expansion has slowed sharply after a rise in January and February.

The index was dragged by a sharp fall in new orders: The export orders component fell by 18 points, while the New Orders component lost 10.4 points. Only the inventories component rose, but this is a questionable positive as it could reflect overstocking in the face of falling demand. And this hypothesis is supported by a sharp fall in new orders.

Ahead of the NFP, we also look at the employment component, which at 51.3 is also scrambling for growth territory.

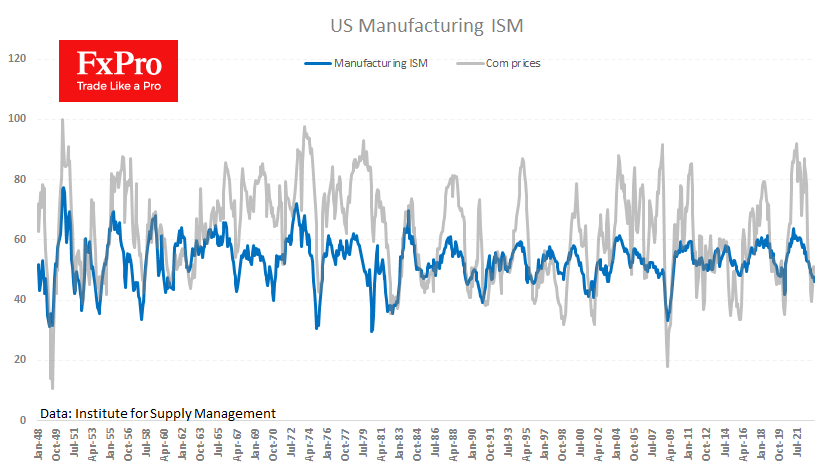

The ISM manufacturing index published earlier in the week painted an even more dramatic picture, falling to a near three-year low of 46.3, with the employment component deepening further into contraction territory.

Both indices were much weaker than expected, as were the S&P Global PMI estimates. Such data does not provide a positive signal ahead of Friday's NFP.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)