US Fed expected to pause rate hikes

OVERNIGHT

Asian equity markets are mostly up this morning following a rise in the US market yesterday. An in line with expectations US inflation report yesterday helped boost sentiment as it confirmed the likelihood that he US Federal Reserve will pause its interest rate hikes today. Markets may also have been lifted by hopes of further Chinese stimulus measures following up on Monday’s interest rate cut.

THE DAY AHEAD

Just released UK GDP data for April showed a 0.2% monthly rise in activity. This was due to a 0.3% increase in services output despite continued negative impacts from strike activity. In contrast, both construction output and industrial production recorded declines on the month. Along with yesterday’s labour market data, they will be important inputs into next week’s Bank of England decision whether to raise interest rates again.

This evening’s announcement from the US Fed is the first of two very important monetary policy updates this week with the European Central Bank set to follow on Thursday. Ever since the Fed signalled the possibility at its last update in May, it has been expected that it would pause its rate hikes today. The data since then have been mixed but probably not strong enough to change the Fed’s mind. That includes yesterday’s report which posted a big fall in annual headline inflation but a much smaller fall in the core rate. The Fed has been reluctant to surprise markets with its decisions in the past and, so with markets now seeing a hike today as having a less than 30% probability, it seems that a pause is likely.

Both Fed Chair Powell’s remarks at the post-meeting press conference and the updated ‘dot plot’ of policymakers’ interest rate projections will be closely watched for indications whether this is likely to be just a case of ‘skipping a meeting”. and that more policy tightening may lie ahead. As last week’s surprise hikes by the central banks of Canada and Australia underlined. a ‘pause’ does not necessarily equate to a peak in rates. We expect the Fed’s accompanying message to be that further action may be necessary and that an upward revision to the dot plot to show the potential for a further 25-50bp of rate rises by the end of the year will further emphasise that.

Ahead of the Fed, the rest of today’s data calendar is light but US May producer price data will provide a further update on inflationary pressures. Early Thursday, retail sales and industrial production data will provide clues on whether China’s economic rebound is fading.

MARKETS

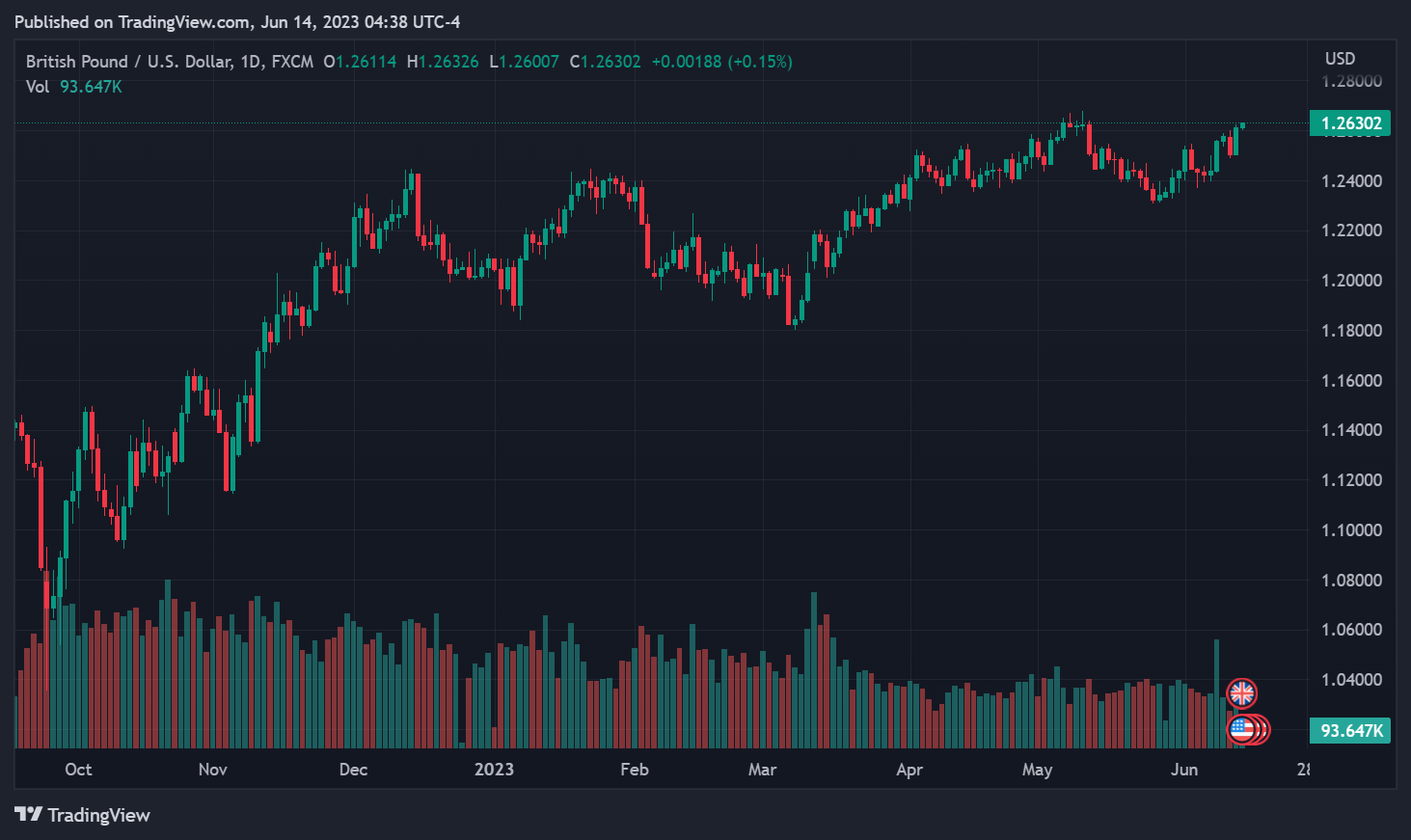

US Treasury yields initially fell after yesterday’s inflation data but eventually ended a volatile day up as today’s Fed announcement was awaited. US gilt yields also rose after stronger than expected wage news. That data also helped lift sterling yesterday as markets continue to anticipate further UK interest rate rises.