USD/JPY on the rise: Is the rally sustainable?

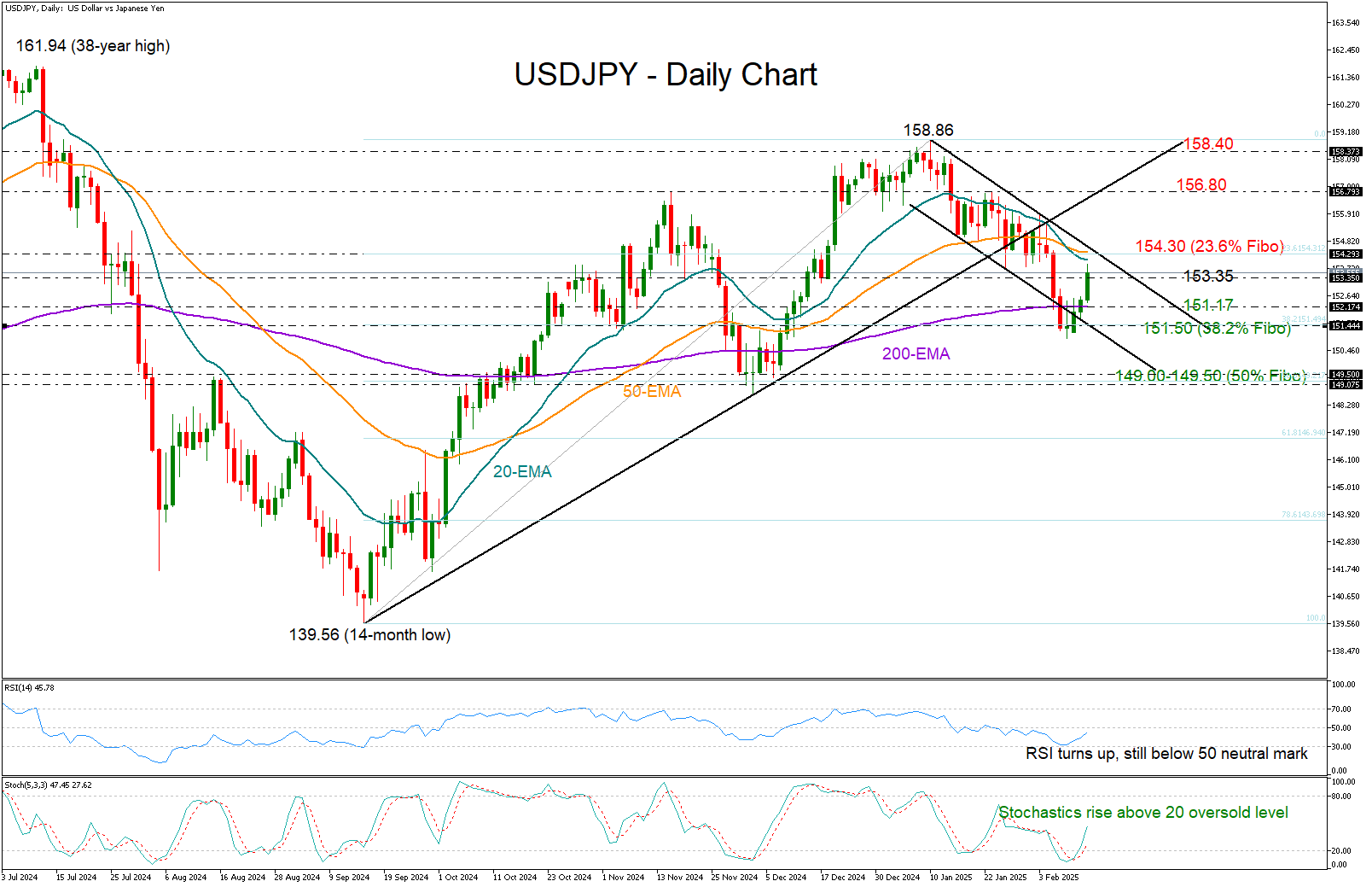

USD/JPY drifted up to 153.72 after confirming a bullish morning star candlestick pattern above its constraining 200-day exponential moving average (EMA). This marks the start of a potential new bullish cycle—at least for now.

The positive reversal in the RSI and the stochastic oscillator is reflecting improving buying appetite, though the former is still some distance below its 50 neutral mark, suggesting the market is still waiting for confirmation.

Perhaps, some patience is necessary until the price clears the crucial resistance of 154.30. This is where the 23.6% Fibonacci retracement of the September-January upleg, the upper band of short-term bearish channel, as well as the 20- and 50-day EMAs are sitting. If the pair can break through this wall, a faster rally could follow towards the 156.80 region, while higher the focus could turn to the 158.40 barrier.

Yet, the bearish cross between the 20- and 50-day EMAs is casting doubt about whether the pair will return to an uptrend soon, particularly if it fails to close above 153.35. In this case, the price could flip backwards to retest the flat 200-day EMA near 151.17 and the 38.2% Fibonacci of 151.50. Additional losses from there could set the stage for a deeper pullback into the 149.00-149.50 territory, where the 50% Fibonacci number lurks.

In summary, USDJPY is enjoying some recovery at the moment, though it's not out of the woods yet. A decisive break above 154.30 would likely eliminate downside risks, but until then, traders may stay on their toes.

.jpg)