Wall Street extends record streak, gold joins in

US stocks brace for soft landing

Optimism that the Fed is well placed to engineer a soft landing by cutting rates soon continues to fuel risk appetite on Wall Street, even as equity markets globally struggle against the prospect of Trump 2.0. Worries that a second Trump presidency will lead to a new round of tariffs not just on Chinese but on all imported goods, not to mention the geopolitical risks from Trump’s lack of commitment to Ukraine, and now Taiwan as well, are keeping non-US investors on edge.

But for US traders, those concerns are more than offset by hopes of tax cuts and deregulation should Trump return to the White House. It’s also likely, however, that investors are so caught up in the euphoria that the Fed will soon start slashing rates, they are overlooking the possible dangers from Donald Trump winning a second term as US president.

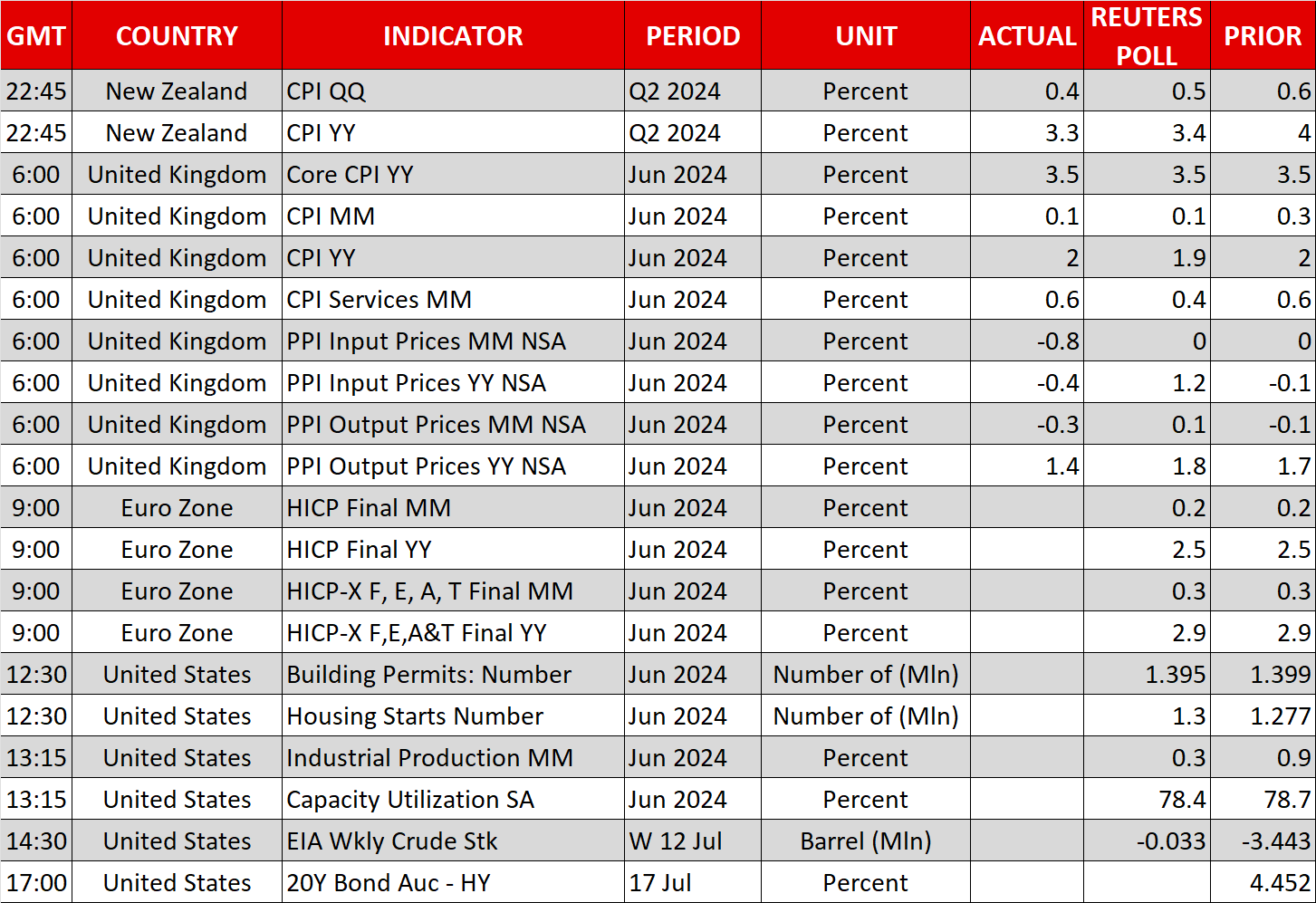

Rather unsurprisingly, it seems that Fed rate cut and earnings expectations are the bigger priority for Wall Street. US inflation is finally moving downwards in a more convincing manner, while yesterday’s better-than-expected retail sales readings for June eased fears of a sharp economic slowdown. Moreover, Fed officials appear to have toned down some of their hawkish rhetoric since that last CPI report and a September rate cut is now fully baked in.

Dow Jones shines as Big Tech lag

For equities, what’s perhaps more important is that the Fed is seen cutting rates more rapidly in 2025 and this is pulling Treasury yields lower. Add to that a so far solid earnings season, there’s little reason for investors to be bearish on US stocks.

Yet, whilst the Trump trade isn’t driving funds away from Wall Street, it does seem to be redirecting flows to small-cap and traditional stocks, with the Dow Jones and Russell 2000 being the biggest beneficiaries.

The Dow Jones soared by 1.9% on Tuesday to a new all-time high, while the Russell 2000 has skyrocketed by more than 11% over the past week. The S&P 500 also set a new record, but the Nasdaq underperformed amid the rotation away from Big Tech and on fears of fresh restrictions on chipmakers that sell to China.

Pound and kiwi in CPI boost, gold in record territory

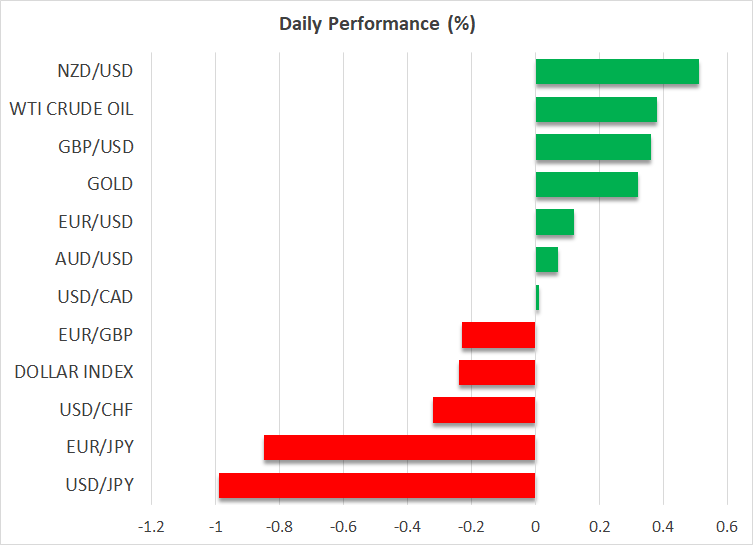

In the FX sphere, although there’s been no absence of volatility, the major pairs have been mostly directionless this week. The US dollar’s rebound from Monday faltered yesterday and continues to slide against a basket of currencies today.

The pound rose above $1.30 for the first time since July 2023 after UK CPI data cast doubt on an August rate cut. Although headline inflation held at 2.0%, services inflation, which was unchanged at 5.7% instead of declining, remains problematic for the Bank of England.

Investors are also less certain about a rate cut this year by the RBNZ. New Zealand’s CPI for the second quarter printed below forecasts at 3.3% y/y, but another measure – non-tradeable inflation – came in slightly hotter than expected. The New Zealand dollar is today’s second best-performing major after the Japanese yen, which is rallying on reports that the Bank of Japan intervened for a second day last Friday.

Gold, meanwhile, is extending its winning streak, reaching an intra-day record peak of $2,482.29/oz today as US yields retreat and Fed rate cut bets gather pace.

.jpg)