What is ahead for the markets

What is ahead for the markets

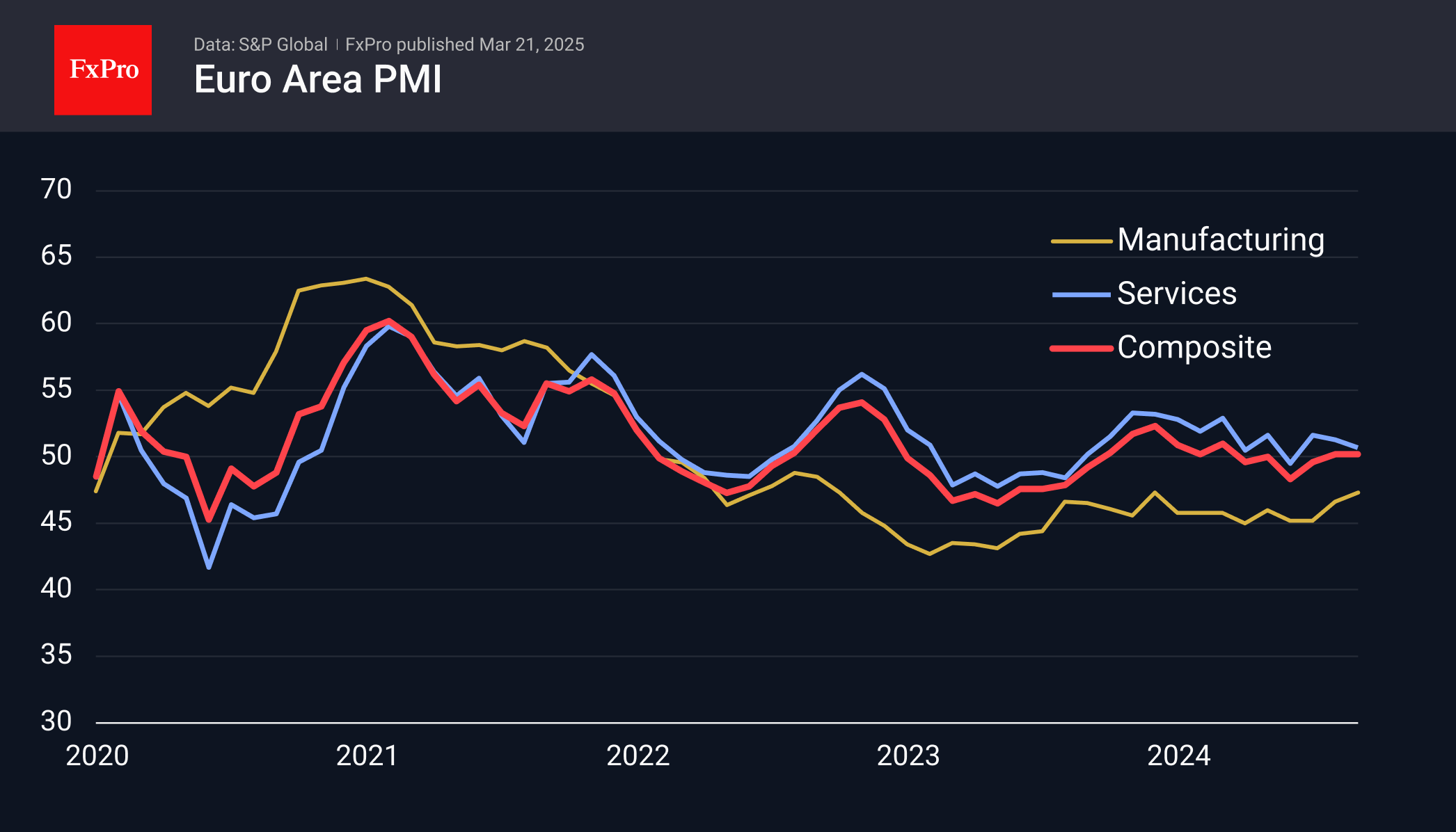

The new week will start with the first estimate of the PMI business activity indexes for March, which will be influential for the single European currency. In recent months, this indicator has picked up considerably, which has helped equities and the euro. There are growing expectations that not only the service sector but also manufacturing activity will return to growth territory after many months of contraction.

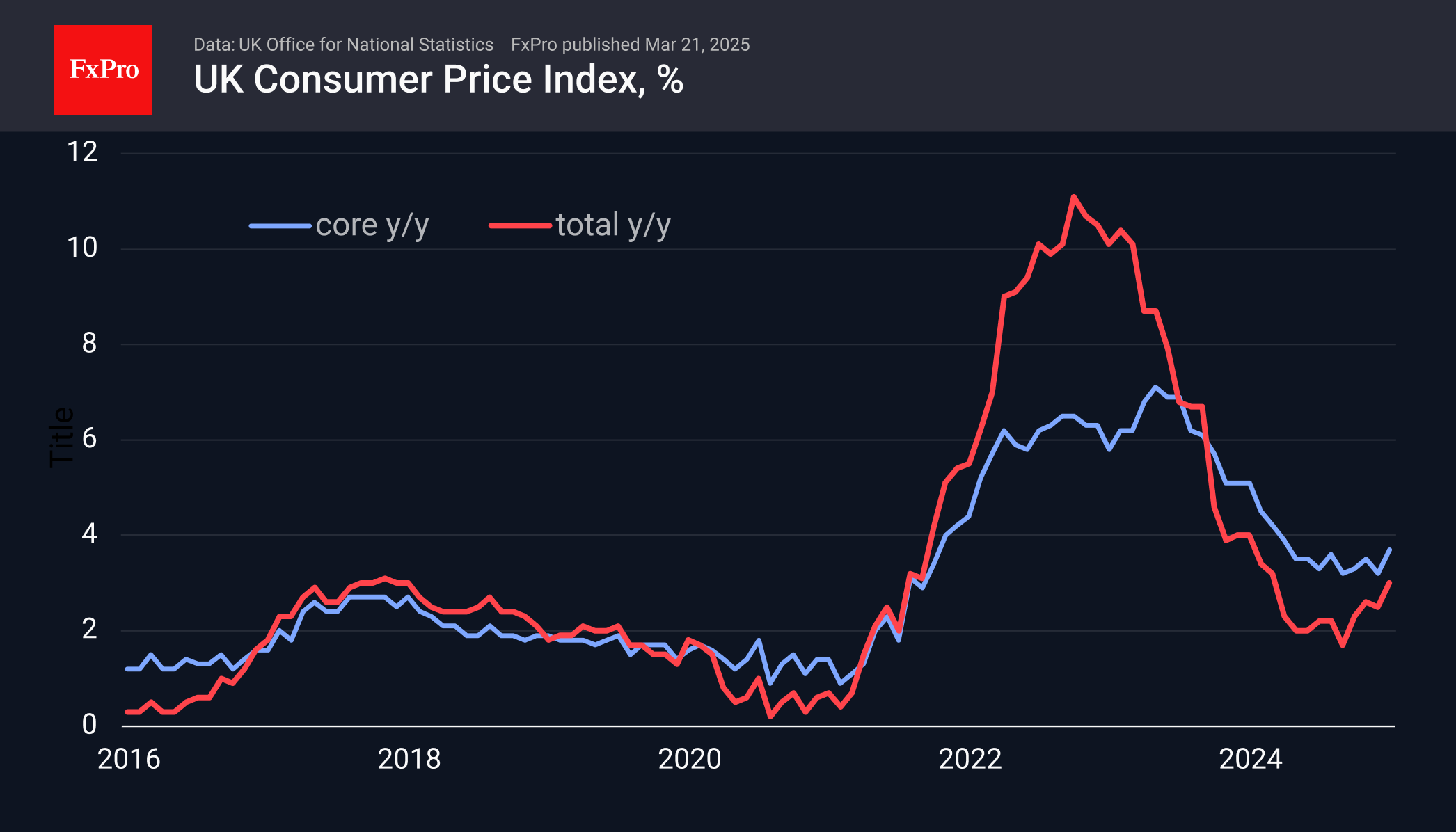

On Wednesday, it is worth paying attention to the UK inflation figures, where we see an acceleration since October. This is an important reason why the Bank of England is not cutting rates. Analysts, on average, forecast a slowdown from 3.0% to 2.9%. Deviations from forecasts will drive the pound.

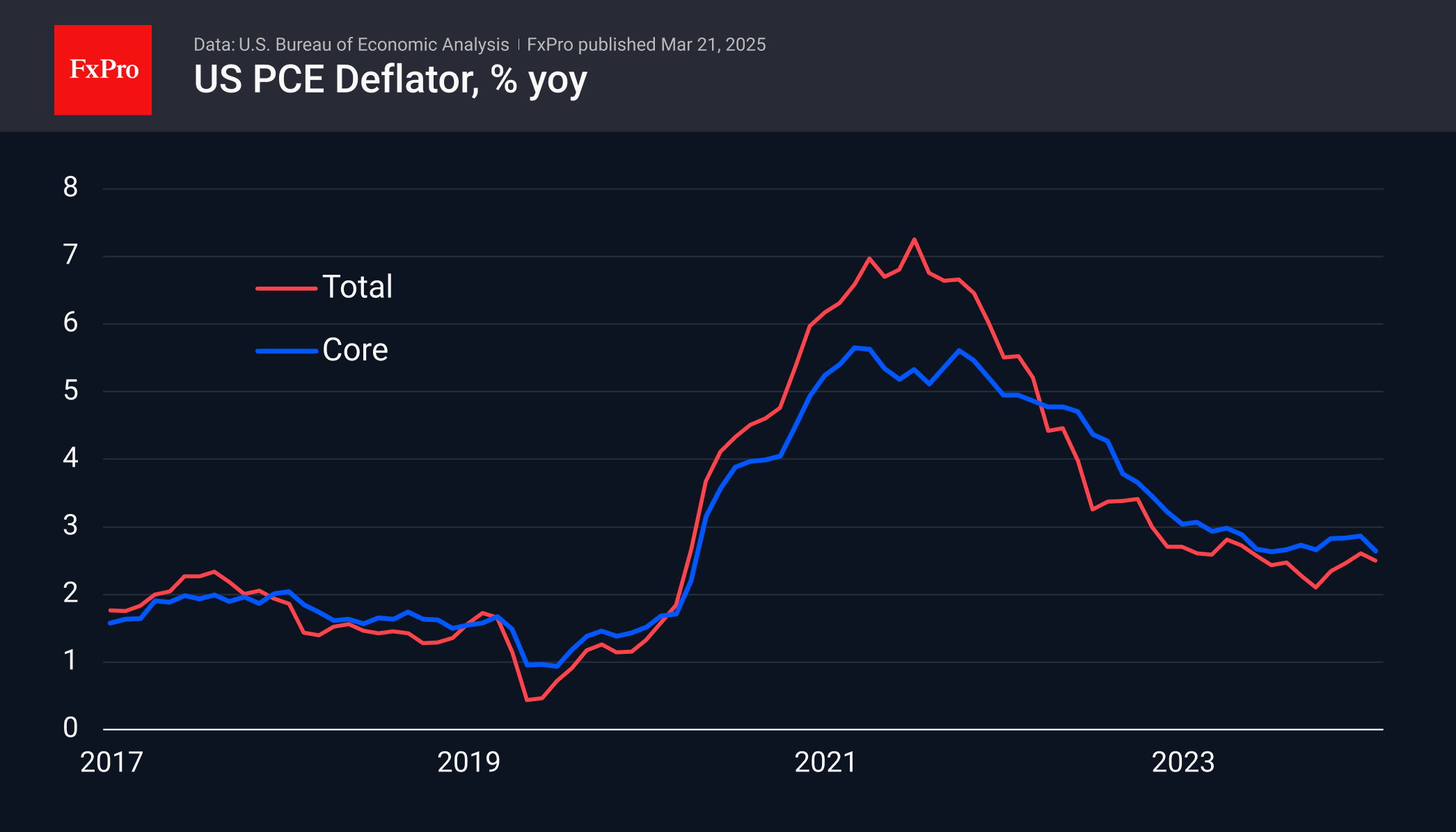

Friday sees the release of personal income and household spending statistics and the Fed's preferred measure of inflation. There was a slowdown here in January, will it persist in February? It won't be easy for the dollar to continue strengthening if that's the case.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)