XRP soars, while Ethereum faces selling pressure

Market Picture

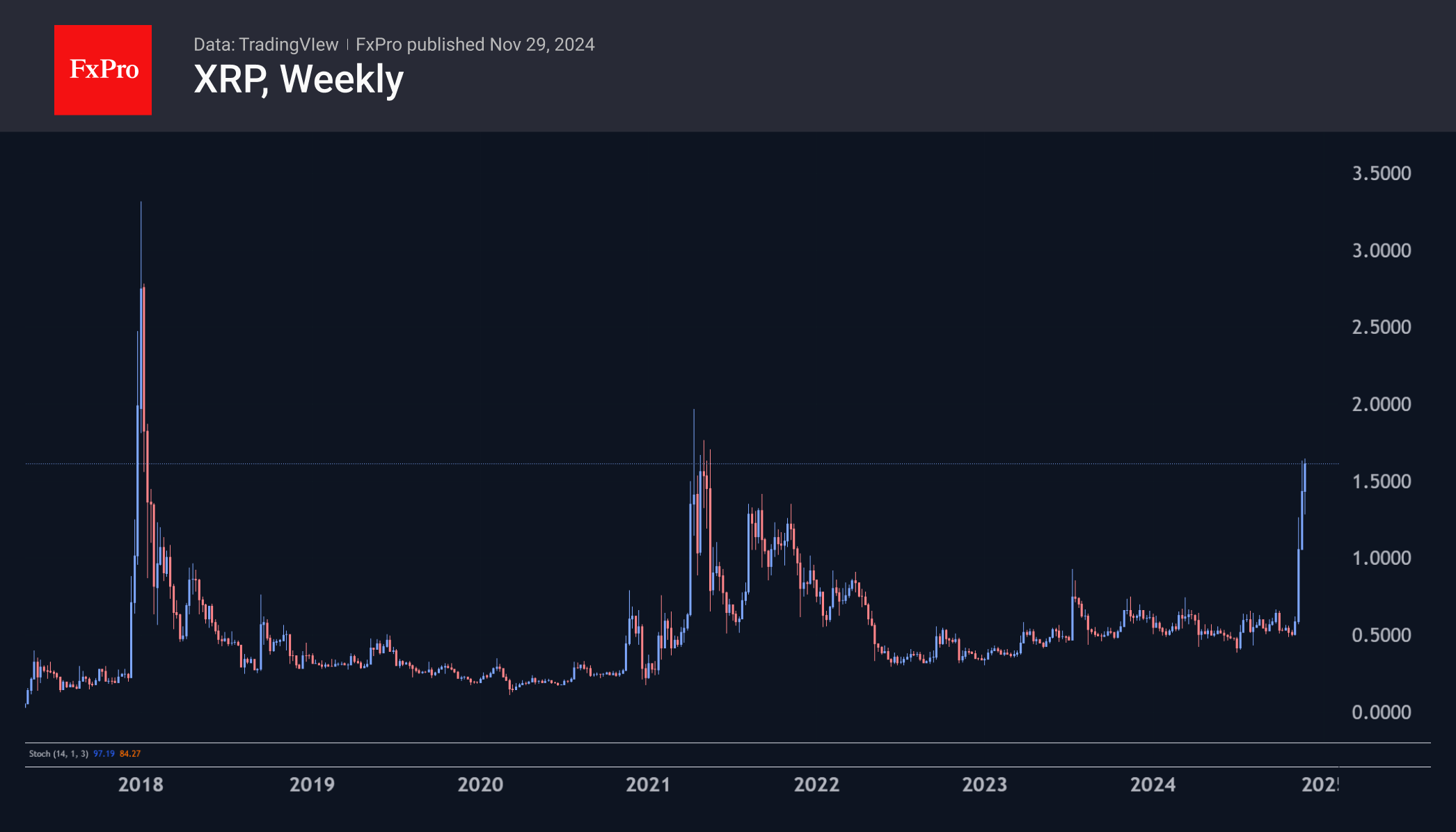

The crypto market is showing overall growth, with a total cap of $3.32 trillion (+0.5% in 24 hours). However, bitcoin is barely rising, with Ethereum down 3% from Thursday's peak, while XRP is up around 9% after hitting 2021 highs at the peak of the day's momentum.

At the start of trading on Friday, bitcoin was back near $97K, where it last stood on Wednesday. Reduced liquidity due to the US holiday curbed volatility, leaving BTCUSD in the middle of the $92-100K trading range. Only a move out of this range will spark volatility and signal the market's medium-term direction.

XRP climbed above $1.64 in the morning, its highest level since 2021. But even then, one of the oldest coins in the crypto market failed to close the week and month above $1.60. The historical maximum monthly close was just under $2 in December 2017. It's possible that expectations of an SEC rate change will allow the coin to test those levels later this year, but it will take more than that to move to historic highs above $3.3.

News Background

After the correction, some bitcoin indicators point to a continuation of the market's bullish phase with a target of $146K, CryptoQuant believes.

Ethereum has approached $3,700, outpacing Bitcoin's growth rate. QCP Capital sees signs of capital flowing from BTC to altcoins. This change in sentiment is reflected in the 9.7% growth in ETH/BTC since the beginning of the week.

Bloomberg notes that the total capitalisation of stablecoins reached a record $191.5 billion, renewing ATH after the collapse of Terra's UST in May 2022. Stablecoin's role in global trade as a tool for cross-border payments is also growing.

MARA Holdings, the largest publicly traded mining company, bought 6,474 BTCs for ~$618 million following a $1 billion convertible bond offering. The average purchase price was $95.395 per coin. The company's bitcoin reserves reached 34,794 BTC, worth approximately $3.3 billion.

The mayor of Vancouver, Canada, unveiled a plan to use BTC to diversify the city's coffers and become a "bitcoin-friendly" city.

Ethereum developer and co-founder Jeffrey Wilke sent 20,000 ETH (~$72.5 million) to the Kraken exchange, Spot On Chain notes. This is the programmer's fourth large sale of ether since the beginning of the year, dampening the spirits of potential buyers.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)