Yen Shows Short-Term Appreciation Potential

Fundamental Analysis USDJPY Key Takeaways

Beware of Japanese government intervention: Japan’s finance minister and Japan’s top foreign exchange diplomat said in separate media briefings that officials are concerned about “excessive” exchange rate fluctuations and are ready to take “appropriate action.” BOJ is still waiting: Bank of Japan Governor Ueda said in a speech at a business conference in Tokyo last Wednesday that “the timing and pace of adjusting monetary easing will depend on economic activity and prices, as well as the development of future financial conditions.”

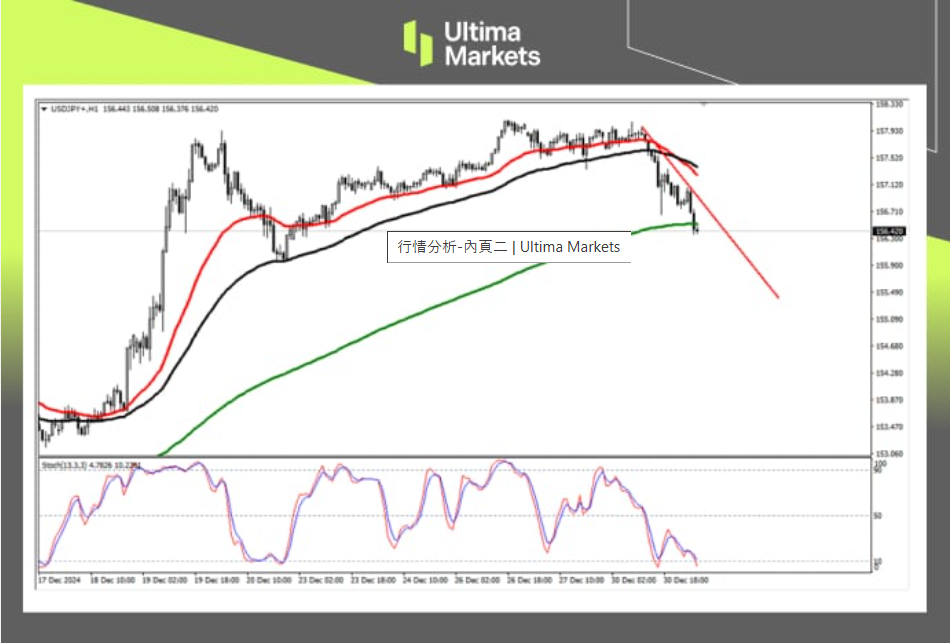

Technical Analysis USDJPY Daily Chart Insights

(USDJPY Daily Price Chart, Source: Ultima Markets MT4)

Stochastic oscillator: The indicator has entered the overbought area and is about to cross below to send a short signal. The yen has the momentum to appreciate in the short term, and wait for the short signal to be clear before paying attention to short opportunities. Resistance line: The USD/JPY price fell below the key resistance price of 157.34 yesterday, and the upward trend may end. Currently, it is blocked by the support line of 156.390 below, and the exchange rate is likely to break through this resistance and look at the purple 13-day MA below. USDJPY 1-hour Chart Analysis

(USDJPY H1 Price Chart, Source: Ultima Markets MT4)

Stochastic oscillator: The fast line enters the oversold area, followed by the slow line, which shows that the exchange rate is still in a downward trend. Before the indicator shows a bottom divergence pattern, the bearish trend is still dominant. MA support: USD/JPY price currently fell below the green 200-period MA during the Asian session, and there is a probability of consolidation in the short term. After the exchange rate returns to the downward trend line, pay attention to whether the downward trend will continue. USDJPY Pivot Indicator

(USDJPY M30 Price Chart, Source: Ultima Markets APP)

According to the trading central in Ultima Markets APP, the central price of the day is established at 157.10, Bullish Scenario: Bullish sentiment prevails above 157.10, first target 157.35, second target 157.65; Bearish Outlook: In a bearish scenario below 157.10, first target 155.95, second target 155.50.

Conclusion

To navigate the complex world of trading successfully, it’s imperative to stay informed and make data-driven decisions. Ultima Markets remains dedicated to providing you with valuable insights to empower your financial journey.

For personalized guidance tailored to your specific financial situation, please do not hesitate to contact Ultima Markets.

Join Ultima Markets today and access a comprehensive trading ecosystem equipped with the tools and knowledge needed to thrive in the financial markets.

Stay tuned for more updates and analyses from our team of experts at Ultima Markets.

—–

Legal Documents

Ultima Markets, a trading name of Ultima Markets Ltd, is authorized and regulated by the Financial Services Commission “FSC” of Mauritius as an Investment Dealer (Full-Service Dealer, excluding Underwriting) (license No. GB 23201593). The registered office address: 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.