A hawkish RBA could be a role model for other G10 banks

A hawkish RBA could be a role model for other G10 banks

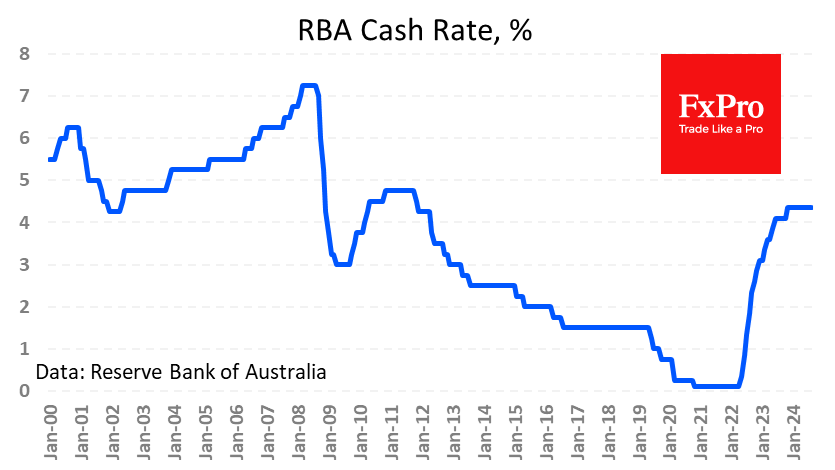

The Reserve Bank of Australia kept its cash rate on hold at a 12-year high of 4.35%, as widely expected by markets. In a statement along with the decision, the RBA noted that inflation is still well above its target range of 2-3%. Price growth has stabilised in the 3.5-4.0% range since December last year, most recently at 3.8%, with some acceleration in the second quarter. The latest producer price indices (+4.8% y/y) and a surprise in import prices (+1% q/q vs. -0.9% expected) pose upside risks to final prices.

The RBA remains focused on fighting inflation, a sentiment supported by an acceleration in consumer credit and relatively stable retail sales to push aside a slowdown in construction.

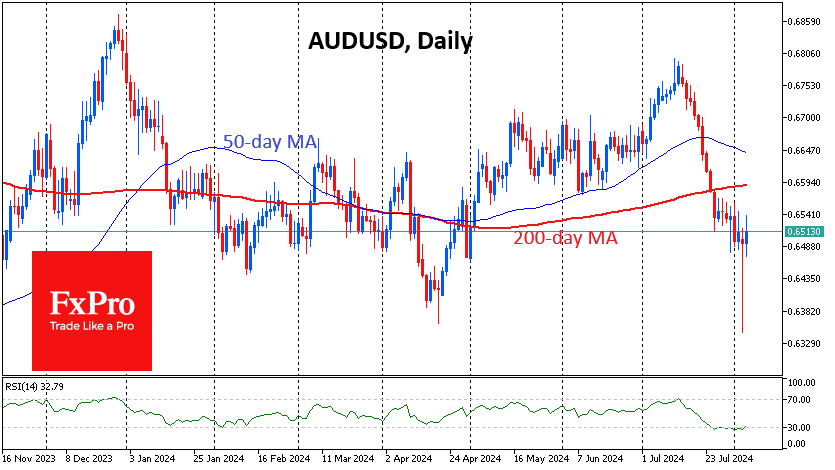

The RBA does not appear spooked by the recent sell-off and is not prepared to ease monetary conditions. This is positive news for the Aussie and is helping AUDUSD continue to fight for support at 0.6500, having overcome Monday's more than 2% drop with a margin of safety. There is also a smooth RSI over-sold exit forming on the daily timeframe, signalling the potential for a bounce or reversal to the upside.

However, the pair is reluctant to gain strength without support from the global markets, where broad but multidirectional movements prevail.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)