After Bitcoin

Market picture

The US Securities Commission (SEC) has announced the approval of the Bitcoin-ETP. The initial fake announcement of this created a spike in volatility. This is a stark reminder of how short-term traders are vulnerable to volatility from the news.

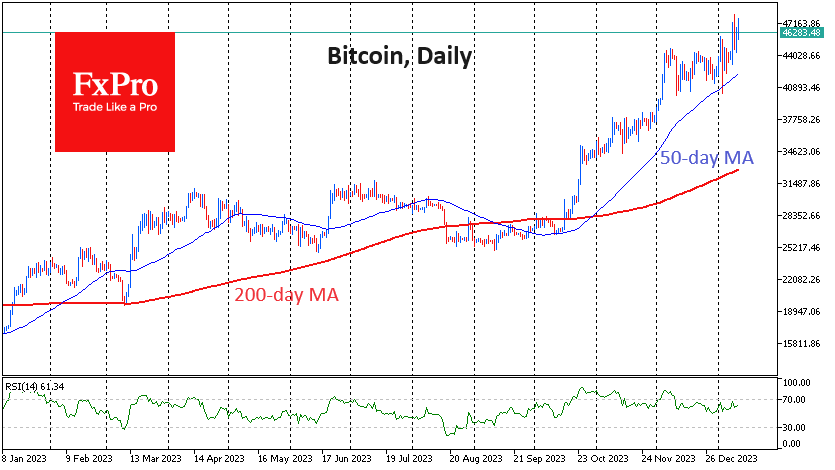

Bitcoin soared to $48K before returning below $45K. Technically, these moves fit into a trend formed back in late October last year and gained new momentum after December's sideways consolidation. It's worth preparing for a scenario where altcoins, currently appearing undervalued compared to the leading cryptocurrency, start taking centre stage. But that doesn't negate the potential for BTCUSD to reach $50-51K before a significant correction.

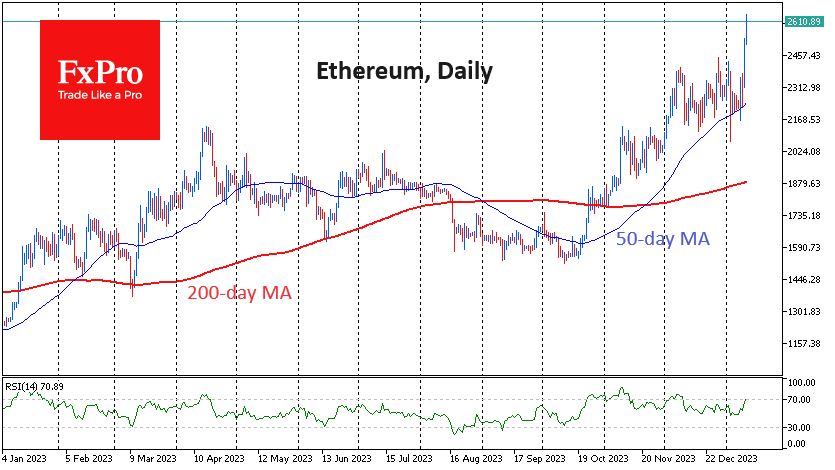

Ethereum is obviously attracting the attention of speculators, adding over 13% in less than 36 hours, as it is the next favourite for ETP approval. Potentially, these expectations could drive the price of ETH up in the next couple of months all the way to the $3500 area – the peak in April 2022.

News background

According to CoinMarketCap, traders lost nearly $1 billion due to a fake tweet about ETF approval. According to Bitfinex, the liquidation of positions in the futures market was the largest since August 2023.

About a dozen fund companies in Hong Kong are exploring the possibility of launching spot bitcoin ETFs, HashKey reported. Potential issuers include firms with Chinese capital, as well as from other Asian and European countries.

Robert Kiyosaki, author of the best-selling book "Rich Dad, Poor Dad", suggested the price of the first cryptocurrency to rise to the $150K level after the ETF was approved. According to him, he will "buy more gold, silver and bitcoin with fake dollars".

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)