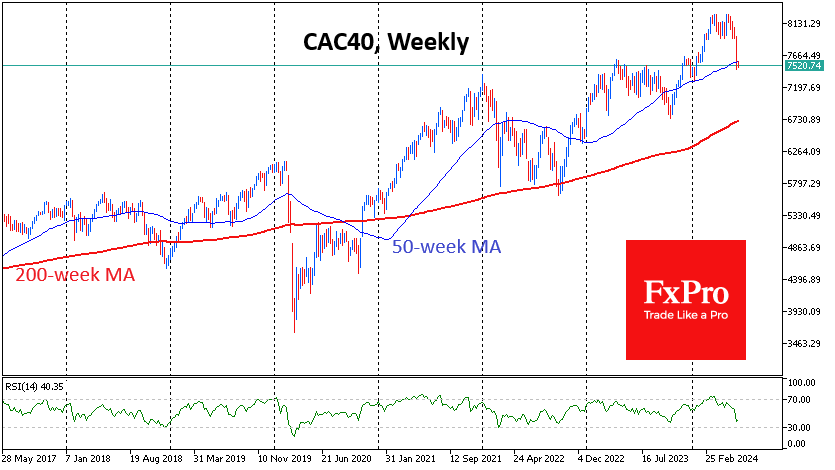

CAC40 could lose another 9%, breaking the upward trend

French stocks were under intense pressure last week due to political fears. Although paused on Monday, that sell-off has probably already undermined index gains.

France’s CAC40 lost 6.2% last week, the sharpest decline in two years, and the sell-off only gained momentum on Friday. The new Monday started with a rise after reassuring words from Marine Le Pen about respect for European institutions. Recovering from last week’s sell-off, the CAC40 is adding 0.6 per cent to Friday’s closing level - half of what it was shortly after the start of trading. However, technical analysis is setting up further declines.

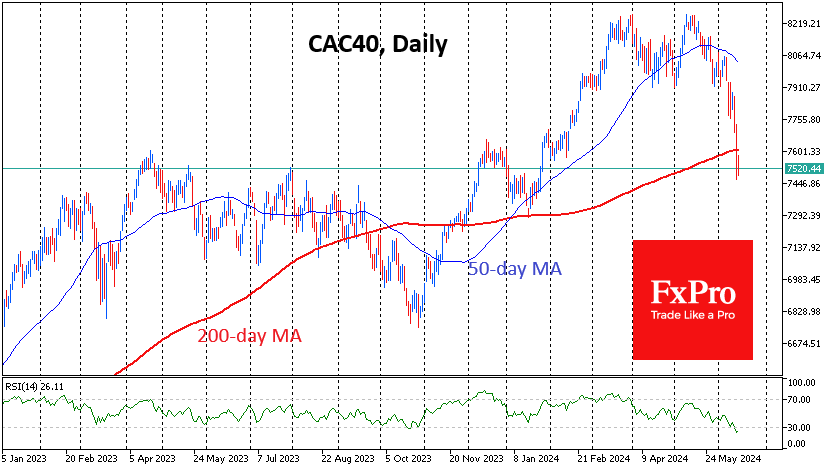

On daily timeframes, the CAC40 accelerated its decline late last month with a dip under its 50-day moving average. Late last week, it broke and consolidated below the 200-day in a sharp move. Thus, the medium- and long-term uptrend broke down over three weeks. The RSI fell below 25 on Friday - the oversold area.

However, the last time the index was this low was in February-March 2020, and after the RSI first touched this level, the CAC40 fell 35% before reversing. Clearly, the current degree of oversold French equities is not a buy signal. It is prudent to wait for a recovery to the area above 30 on the RSI.

It is also worth being prepared that the French equity index is heading towards the area of the lows of October and March last year at 6800 from the current 7527.

An alternative optimistic scenario suggests that the French equity market will get support on the dip to the 7320-7520 area if last year’s April-September resistance area becomes support.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)